(TheNewswire)

Vancouver, B.C. TheNewswire - December 14, 2021 - Opawica Explorations Inc. (TSXV:OPW) (FSE:A2PEAD) (OTC:OPWEF) (the "Company" or "Opawica") has used the services of GoldSpot Discovery Corp. (TSXV:SPOT) (OTCQX:SPOFF) (‘GoldSpot') and applied its proprietary machine learning techniques to help identify and rank drill targets at the Bazooka Property of the Abitibi Gold Camp.

GoldSpot has been working closely with Opawica's technical team to analyze all available geological data to create high quality multivariate ranked drill targets on the Bazooka Property.

Methodology and Input Data

In collaboration with Opawica, GoldSpot has compiled and integrated various drillhole legacy datasets, including geological, structural, alteration, mineralogical and geochemical information which has provided unprecedented insight into Bazooka's geology. The interpretation of this updated drillhole database has led to a cohesive 3D model which has facilitated drill targeting for the upcoming drill program at the Bazooka Property.

New Outlook on Bazooka's Geology

Structures and hydrothermal pathways were interpreted using the co-occurrence of selected exploration criteria in drillhole data. Interpreted prospective panels trend generally E-W with a steep dip to the north. They are constrained within the northern and southern borders of the Cadillac shear zone, a 150m wide corridor of highly carbonate-chlorite-talc altered and schistosed ultramafic units, which form a Z-shape asymmetric drag fold in the area of the Bazooka historic mine.

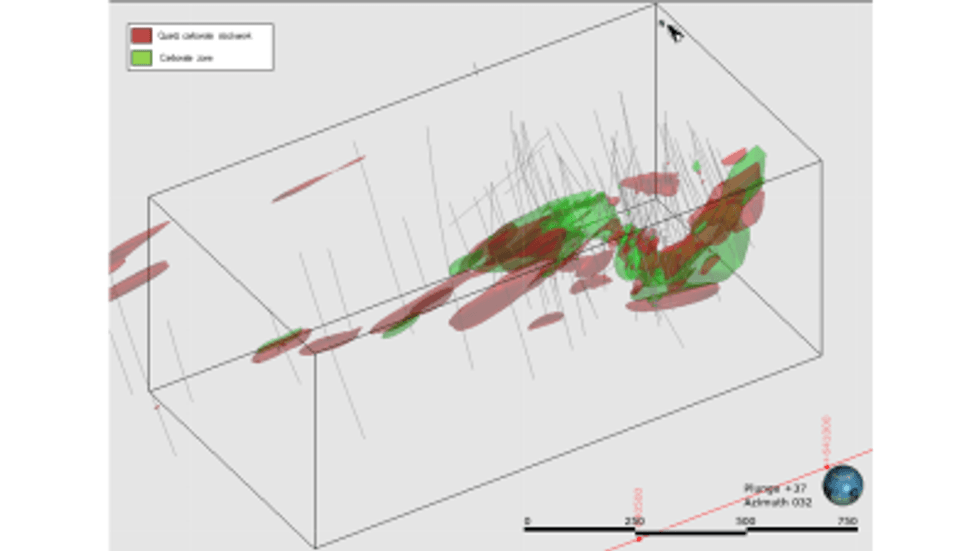

GoldSpot applied statistics on the updated Bazooka drillhole database. Conditional probabilities revealed that quartz stockwork zones and carbonate zones are the top gold prospective environments at Bazooka. These altered geological bodies were modeled (Figure 1) to provide relevant input for the targeting process.

Click Image To View Full Size

Figure 1: Prospective Hydrothermal Zones

Drill Targets

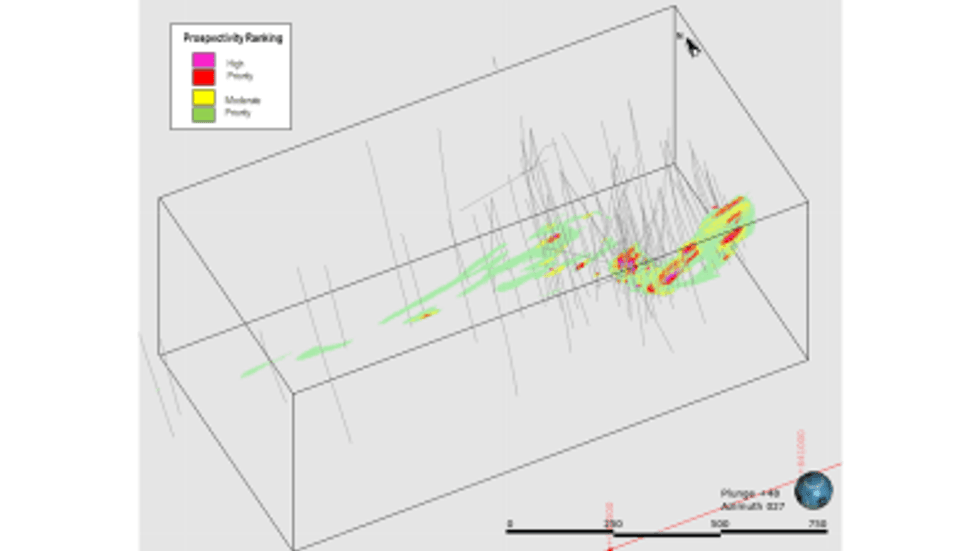

GoldSpot and Opawica generated gold targets using a "Smart Targeting" approach of knowledge- and AI data-driven methods. The AI data analysis trains machine learning algorithms to predict the presence of gold, using both numeric and interpreted layers on a 5 m x 5 m x 5m grid cell stack of layers. The results have outlined 25 zones of high priority drill-ready targets, and additional targets for general drilling exploration (Figure 2).

Click Image To View Full Size

Figure 2: Gold Targeting favourability at the Bazooka project.

Blake Morgan, Chief Executive Officer of Opawica stated, "We have added another 25 drill targets, which is excellent work from the Opawica team in conjunction with GoldSpot Discoveries Corp. Now, with a total of 39 High Priority drill targets and more coming, the team is in a great position for success."

About Opawica Explorations Inc.

Opawica Explorations Inc. is a junior Canadian exploration company with a strong portfolio of precious and base metal properties within the Rouyn-Noranda region of the Abitibi Gold Belt in Québec and in Central Newfoundland and Labrador. The Company's management has a great track record in discovering and developing successful exploration projects. The Company's objective is to increase shareholder value through the development of exploration properties using cost effective exploration practices, acquiring further exploration properties, and seeking partnerships by either joint venture or sale with industry leaders.

About GoldSpot Discoveries Corp.

GoldSpot Discoveries Corp. (TSXV: SPOT; OTCQX: SPOFF) is a technology services company in mineral exploration. GoldSpot is a leading team of expert scientists who merge geoscience and data science to deliver bespoke solutions that transform the mineral discovery process. In the race to make discoveries, GoldSpot produces Smart Targets and advanced geological modelling that saves time, reduces costs and provides accurate results.

Derrick Strickland, P.Geo. (OGQ No. 35402), is the Qualified Person for Opawica Explorations Inc. and approves the technical content of this news release.

FOR FURTHER INFORMATION CONTACT:

Blake Morgan

President and Chief Executive Officer

Telephone: 604-681-3170

Fax: 604-681-3552

Neither the TSX Venture Exchange nor its Regulation Service Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of accuracy of this news release.

Forward-Looking Statements

This news release contains certain forward-looking statements, which relate to future events or future performance and reflect management's current expectations and assumptions. Such forward-looking statements reflect management's current beliefs and are based on assumptions made by and information currently available to the Company. Readers are cautioned that these forward-looking statements are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results to differ materially from those expected including, but not limited to, market conditions, availability of financing, actual results of the Company's exploration and other activities, environmental risks, future metal prices, operating risks, accidents, labor issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry. All the forward-looking statements made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR at www.sedar.com. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by applicable law.

Copyright (c) 2021 TheNewswire - All rights reserved.