Camino Corp. (TSXV:COR)(OTC PINK:CAMZF)(WKN:A116E1) ("Camino" or the "Company") is pleased to announce that core drilling has commenced at the high-grade copper and gold Lidia Zone at its Los Chapitos copper project near the coastal town of Chala in Arequipa Department, Peru ("Los Chapitos"). On August 27, 2021, Camino received the necessary Start of Operations certificate from the Ministry of Energy and Mines in addition to the drilling permit that was received at the beginning of August. Camino is initially focusing its drilling towards new discoveries and is targeting mineralization extensions at the Lidia Zone, 4 km north from previous drill intercepts along a major controlling fault structure. The Lidia Zone is a vein system with rock chip samples of artisanal workings channel samples returning grades up to 9.3 gt gold (Au) and up to 5.1% copper (Cu) (see news release dated August 10, 2021

"We commenced our 2021 drilling campaign at Los Chapitos with a traditional Pachamama mother earth ceremony. We recognize that the copper that we use for our technologically intensive lifestyles comes from concentrated copper endowments in the earth's crust. Peru has a particularly large endowment of copper mineralization as the second largest copper producer in the world," said Jay Chmelauskas, CEO of Camino. "We are testing the geological endowment at Los Chapitos by drilling at new locations that demonstrate the potential for large new discoveries."

"Drilling has advanced to a depth of 76 metres and nearing the target mineralization zone," said Chief Geologist, Jose Bassan. "We are starting to see trace chalcopyrite in a rock assemblage of volcanic Andesitic Tuff with moderate alteration and the presence of epidote, chlorite, hematite, magnetite and carbonates, plus evidence of magnetite replacement by specularite. We are within the same metallogenic system previously drilled along the Diva Trend fault system that had significant copper intercepts at Adriana (see news release dated August 10, 2021)."

Photo 01: Alteration assemblage Chlorite + Epidote + Hematite + Feldspar-K + Magnetite

(DCH0688-75 depth 71.00 m)

(weak +, moderate ++, strong +++ alteration)

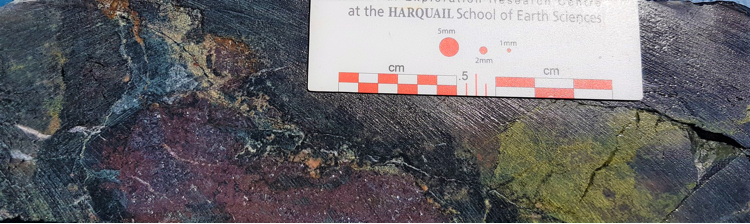

Photo 02: Andesite porphyritic, pervasive alteration Chlorite +++ Epidote ++ Magnetite

+ Chalcopyrite (trace) DCH0688-75 depth 71.50 m

Photo 03: Lidia Zone Copper & Gold Drill Targets at Los Chapitos

Options

The Company has recently granted incentive stock options to various directors, officers, employees, and consultants to purchase up to 5,500,000 common shares of the Company on or before September 1, 2026, at an exercise price of $0.18 per share in accordance with its stock option plan.

About Camino Minerals Corporation

Camino is a discovery and development stage copper exploration company. The Company is focused on advancing its high-grade Los Chapitos copper project located in Peru towards potential resource delineation and new discoveries. In addition, the company has commenced field studies at its copper and silver Plata Dorada project. Camino has also recently acquired the Maria Cecilia copper porphyry project. The Company seeks to acquire a portfolio of advanced copper assets that have the potential to deliver copper into an electrifying copper intensive global economy. For more information, please refer to Camino's website at www.caminocorp.com.

Jose Bassan MAusIMM (CP) 227922, MSc. Geologist, a Qualified Person as defined by NI 43-101, has reviewed and approved the technical contents of this document. Mr. Bassan has reviewed and verified relevant data supporting the technical disclosure, including sampling and analytical test data.'

ON BEHALF OF THE BOARD

/S/ "Jay Chmelauskas"

President and CEO

For further information, please contact:

Camino Investor Relations

info@caminocorp.com

Tel: (604) 608-4513

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: Certain disclosures in this release constitute forward-looking information. In making the forward-looking disclosures in this release, the Company has applied certain factors and assumptions that are based on the Company's current beliefs as well as assumptions made by and information currently available to the Company. Forward-looking information in the release includes the prospectivity of future exploration work on the Los Chapitos projects the ability to complete the necessary permit requirements for drilling, or that actual results of exploration and engineering activities are consistent with management's expectations. Although the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect, and the forward-looking information in this release is subject to numerous risks, uncertainties and other factors that may cause future results to differ materially from those expressed or implied in such forward-looking information. Such risk factors include, among others, that actual results of the Company's exploration activities will be different than those expected by management, that the Company will be unable to obtain or will experience delays in obtaining any required approvals and the state of equity and commodity markets. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

SOURCE: Camino Minerals Corp.

View source version on accesswire.com:

https://www.accesswire.com/662935/Camino-Commences-Discovery-Drilling-at-the-Los-Chapitos-Copper-Project-Peru