(TheNewswire)

Vancouver, British Columbia TheNewswire - November 1, 2021 Xander Resources Ltd. ("Xander" or the "Company") (TSXV:XND) (OTC:XNDRF) (FSX:1XI) is pleased to announce that it has entered into an option agreement (the " Option ") to acquire (the " Acquisition ") 100% interest in certain 286 mineral claims (the " Claims " and the " Property ") located in Timmins, Ontario.

The Property

The Property consists of two (2) separate mineral claim blocks and is located within the Timmins mining camp in Ontario, Canada, a highly prolific mining complex with over 100 hundred years of history well supported by major infrastructure including highways, rail, and relatively inexpensive hydroelectric power.

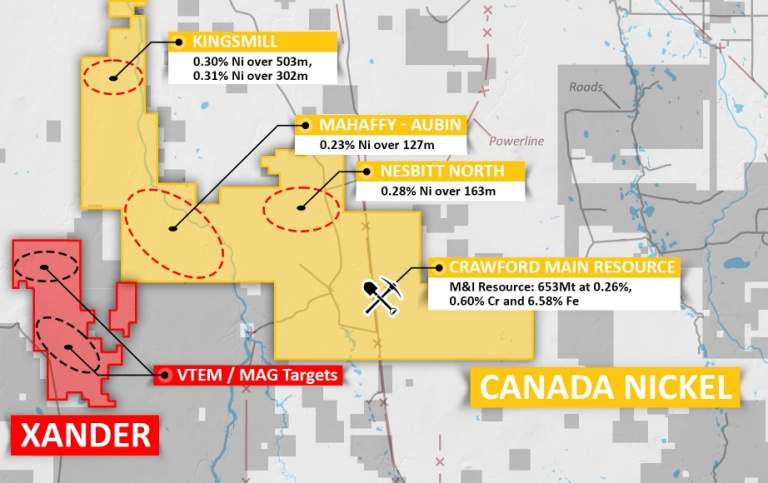

The "North Block" consists of 236 claims located approximately 21 kilometres west of Canada Nickel Company's (CNC's) Crawford Project (as shown in Figure 1 below) where CNC has completed a preliminary economic assessment only 20 months after the commencement of exploration drilling that indicates 25-year mine with an after-tax NPV 8% of 1.2 billion i . It is also situated southwest of Kingsmill, Mahaffy-Aubin, and Nesbitt North, properties acquired from Noble Mineral Exploration by Canada Nickel through option agreements earlier in 2021 ii .

Figure 1 - Location of the "North Block"

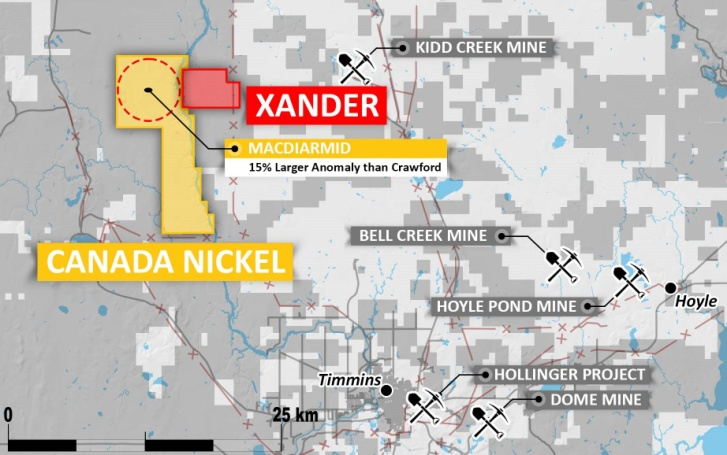

The "South Block" consists of 50 claims contiguous to Canada Nickel's MacDiarmid Project (as shown in Figure 2 below) where in May 2021, Canada Nickel announced a secondary discovery through the identification of significant intersections of mineralized dunite similar to the average mineralization initially discovered at Crawford. Geophysical surveys reveal that the MacDiarmid target to be approximately 1.8 kilometres long indicating a structural footprint averaging 400 meters in width – 15% larger than Canada Nickel's original Crawford's Main Zone discovery iii .

Figure 2 - Location of the "South Block"

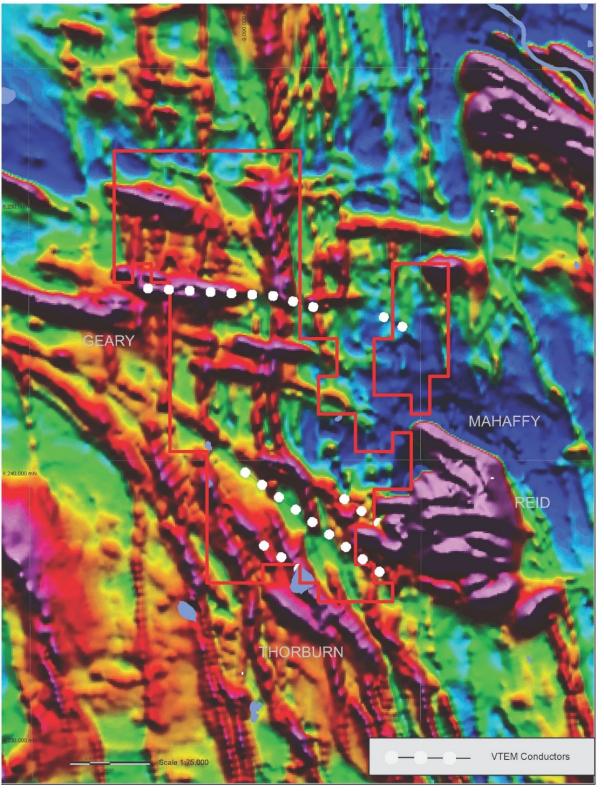

Historical work at the Property includes airborne geophysical survey work (Geotech's Helicopter Borne VTEM) which has delineated a series of high-priority electromagnetic anomalies within the Property (often indicative of sulphide mineralization), and numerous major and minor structures, which require follow-up exploration and possibly drilling as shown in Figure 3 below. The Company's plan over the coming months is to build on the geophysical work completed through further geophysical mapping and interpretation, sampling, and other techniques in order to launch a comprehensive drill program with the goal of completing a maiden resource at one or more areas.

Figure 3 - VTEM Conductors Identified on the "North Block"

Pursuant to the Agreement and in exchange for the option to purchase a 100% interest in the Property, the Company will pay the following remuneration to the Vendors:

-

- 600,000 common shares (the " Shares ") of the Company at a deemed price to be determined as of the closing market price of the Company's Shares on or before the closing date (the " Closing Date ")

- $50,000 cash payable within 90 days of the Closing Date

- 1,000,000 Shares to be issued at a deemed price to be determined within 90 days of the Closing Date

- $50,000 cash payable within one year of the Closing Date

- 1,000,000 Shares to be issued at a deemed price to be determined within one year of the Closing Date

- 900,000 Shares to be issued at a deemed price to be determined within two years of the Closing Date

- $50,000 cash payable within two years of the Closing Date

The Company has agreed to incur not less than $1,250,000 of qualified exploration expenditures, including 3,000 metres of diamond drilling on the Property within two (2) years of the Closing Date, of which not less than $500,000 and 1,500 meters of diamond drilling will be incurred within one (1) year following the Closing Date and of which not less than $120,000 ($95,000 North Block and $25,000 South Block) will be incurred within six months from the Closing Date. The Company has also agreed to grant the Optionors a 3% net smelter returns royalty.

The Acquisition and transactions contemplated, including the issuance of the Shares, are subject to the final approval of the Exchange. The Shares will be subject to the applicable hold periods in accordance with securities laws in Canada and the Exchange policies.

"We are thrilled to have acquired such a significant project at a time when the demand for nickel is increasing so dramatically," stated Deepak Varshney, CEO of the Company. "This project checks off all the boxes – a mining-friendly jurisdiction, easy year-round access, and a Property with great geophysical targets at a stage of development where we can explore and unlock shareholder value".

Qualified Person

The technical content of this news release has been reviewed and approved by Mr. Andrew Tims, P.Geo., a qualified person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects (" NI 43-101 ").

About Xander Resources Inc.

Xander Resources Ltd. is a Canadian mineral acquisition and exploration company based in Vancouver, BC, Canada focused on developing accretive gold and battery metal properties within Canada. The company currently has a focus on projects located within the Provinces of Ontario and Quebec.

Xander is exploring for commercially exploitable mineral deposits and is currently focused on deposits located in Val-d'Or, Quebec, including the Senneville Claim Group which comprises over 100 sq. km and is contiguous in the south to Probe Metals' new discovery, and contiguous in the north to Monarch Mining, in close proximity to Eldorado Gold's (formerly QMX Gold) projects, and east of the North American Lithium Deposit, Great Thunder Gold‘s Chubb Lithium property and East of the Sayona Quebec's Authier Lithium Deposit, all in the Val-d'Or Mining Camp, plus its newly acquired nickel-sulphide project in Timmins, Ontario near Canada Nickel's MacDiarmid and Crawford Projects.

We seek Safe Harbor

ON BEHALF OF THE BOARD OF DIRECTORS

Deepak Varshney, P.Geo., President and CEO

For more information, please phone Dan Samartino, Investor Relations, at 778-962-0234, email ir@xanderresources.ca , or visit www.xanderresources.ca .

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

i Preliminary Economic Assessment, titled "Crawford Nickel-Sulphide Project National Instrument 43-101 Technical Report and Preliminary Economic Assessment", Effective Date of May 21, 2021

ii https://canadanickel.com/wp-content/uploads/2021/04/20210422-Canada-Nickel-Acquires-Option-Properties-final.pdf

iii https://canadanickel.com/wp-content/uploads/2021/10/2021-10-26-East-Zone-High-Grade-vFinal2.pdf

Copyright (c) 2021 TheNewswire - All rights reserved.