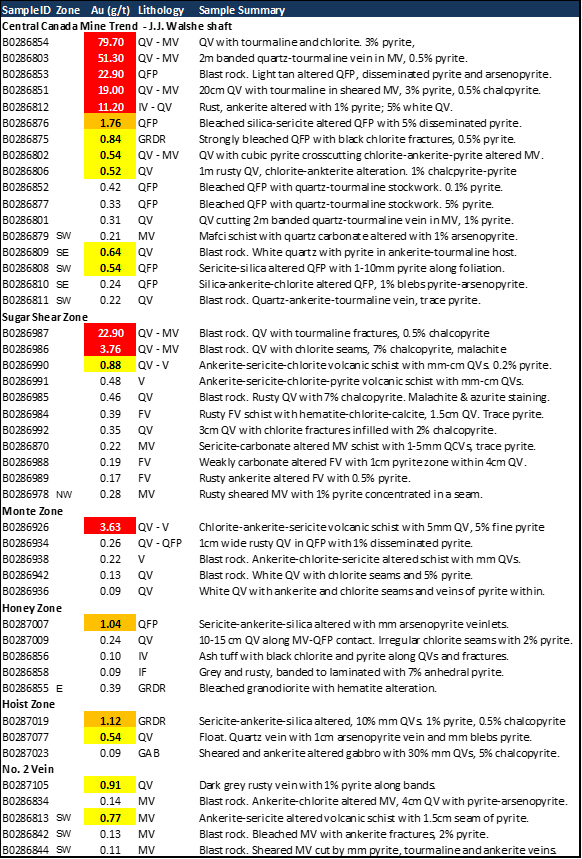

Falcon Gold Corp. (TSXV:FG)(GR:3FA)(OTCQB:FGLDF); ("Falcon" or the "Company") is pleased to provide an update on its summer 2021 mapping and sampling program at the Central Canada Gold Project located near Atikokan, Ontario. Sampling on the J.J. Walshe mine trend returned five grab samples ranging from 11.2 gt Au to 79.7 gt Au. Assay results also highlight several gold-bearing zones across the property previously undocumented including the Sugar Shear (22.9 gt Au), Monte (3.63 gt Au), Honey (1.04 gt Au) and Hoist Zone (1.12 gt Au) (Figure 1

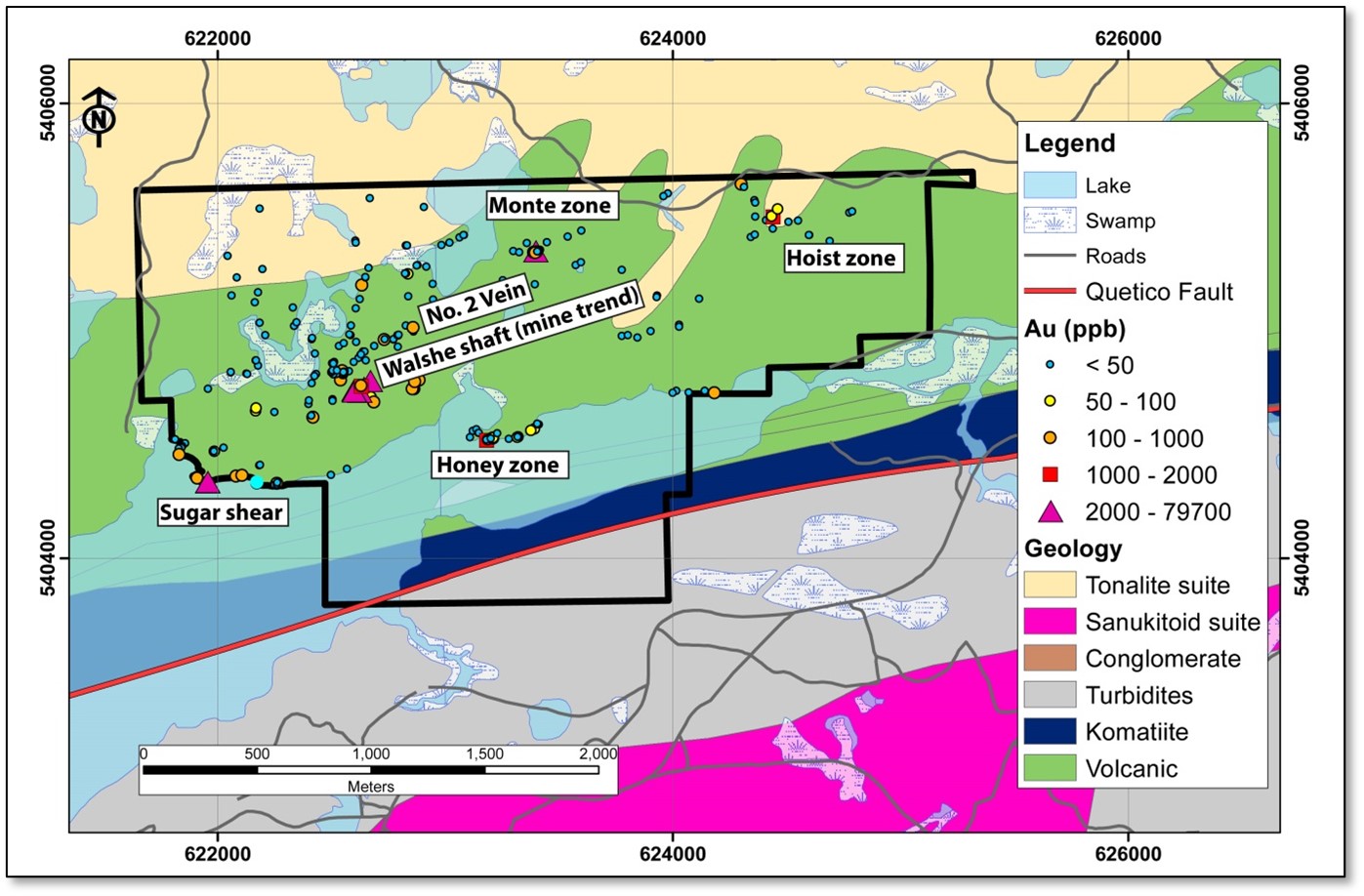

Figure 1. Gold distribution map from the summer 2021 mapping and sampling program, Central Canada Gold Project.

The Central Canada Mine trend has a mineralized strike length of 140m as defined by drilling intercepts and consists of parallel zones striking east-northeast and dipping very steeply to the north-northwest. The mine trend includes the historical J.J. Walshe shaft, which was sunk on a 2 m wide quartz vein hosted by strongly tourmaline-quartz-sericite-fuchsite altered banded volcanic tuff and chert.

The newly documented Sugar Shear extends over 360m along the northern shore of Sapawe Lake, 650m southwest of the J.J. Walshe workings and returned values up to 22.9 g/t Au in blast rock from historical workings. Mineralization occurs within strongly quartz-sericite-ankerite-chlorite-pyrite altered felsic to mafic volcanic schist with millimeter to decimeter wide quartz-chlorite-pyrite-chalcopyrite veins with a strike width of 5-7m across.

The Monte Zone, 970m east-northeast of the J.J. Walshe shaft, is also newly documented and returned values up to 3.63 g/t Au in ankerite-sericite-chlorite-pyrite altered volcanic schist, and anomalous values in altered quartz-feldspar porphyritic intrusions and quartz veins in the schist.

The Honey Zone is a new discovery located on the north shore of Sapawe Lake, 600m east-southeast of the J.J. Washe showing with up to 1.04 g/t Au. Gold mineralization occurs within and along a strongly altered, steeply north-dipping, boudinaged quartz porphyritic intrusion in very highly strained volcanic rocks, associated with arsenopyrite and pyrite in fractures, quartz veins and disseminated in wall rock.

The Hoist Zone occurs 1900m east-northeast of the J.J. Walshe shaft, within mixed tonalite, granodiorite and gabbro near the folded contact of the greenstone and intrusive complex to the north. Mineralization consists of mm quartz-pyrite-chalcopyrite veins near gabbro-granodiorite contacts displaced by steep north dipping shear zones. Up to 1.12 g/t gold occurs in altered granodiorite.

A total of 269 grab samples were taken across the property. Highlights are tabled below. Grab samples are select samples and may not be representative of mineralization on the property.

Table 1. Highlighted results of the 2021 summer sampling program at the Central Canada Gold Project Lithology abbreviations are as follows: QV - quartz vein, MV - mafic volcanic, FV - felsic volcanic, IV - intermediate volcanic, QFP - quartz feldspar porphyry, GRDR - granodiorite, GAB - gabbro

Mr. Karim Rayani, Falcon's Chief Executive Officer commented, "The summer 2021 detailed mapping and sampling program has exceeded our expectations. Falcon has confirmed the high-grade tenor of the J.J. Walshe shaft zone. Further outlining 4 controls of gold mineralization. These results only augment our belief that the Central Canada Gold Project has tremendous potential to host a large tonnage system."

Falcon has begun stripping and trenching at the Monte, Hoist, No. 2 Vein and the J.J Walshe trend. Additional mapping and prospecting is recommended for the Sugar Shear and Honey Zones. Additional property wide mapping focusing on structure and lithologies is underway. Those areas in the above exploration efforts will determine the next phase of diamond drilling.

Qualified Person

The technical content of this news release has been reviewed and approved by Mike Kilbourne, P.Geo., who is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

About Falcon Gold Corp.

Falcon is a Canadian mineral exploration company focused on generating, acquiring, and exploring opportunities in the Americas. Falcon's flagship project, the Central Canada Gold Mine, is approximately 20 km southeast of Agnico Eagle's Hammond Reef Gold Deposit which has currently estimated 3.32 million ounces of gold (123.5 million tonnes grading 0.84 g/t gold) mineral reserves, and 2.3 million ounces of measured and indicated mineral resources (133.4 million tonnes grading 0.54 g/t gold). The Hammond Reef gold property lies on the Hammond shear zone, which is a northeast-trending splay off the Quetico Fault Zone ("QFZ") and may be the control for the gold deposit. The Central Gold property lies on a similar major northeast-trending splay of the QFZ.

The Company holds 8 additional projects. The Esperanza Gold/Silver/Copper mineral concessions located in La Riojo Province, Argentina. The Springpole West Property in the world-renowned Red Lake mining camp; a 49% interest in the Burton Gold property with Iamgold near Sudbury Ontario; and in B.C., the Spitfire-Sunny Boy, Gaspard Gold claims; and most recently the Great Burnt, Hope Brook, and Baie Verte acquisitions adjacent to First Mining, Benton-Sokoman's JV, and Marvel Discovery in Central Newfoundland.

CONTACT INFORMATION:

"Karim Rayani"

Karim Rayani

Chief Executive Officer, Director

Telephone: (604) 716-0551

Email: info@falcongold.ca

Cautionary Language and Forward-Looking Statements

This news release may contain forward looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, etc. Forward looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

This news release may contain forward looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, etc. Forward looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Falcon Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/668712/Falcon-Receives-High-Grade-Gold-Results-Sampling-Program-at-Central-Canada-Gold-Project-Ontario