CMC Metals Ltd. (TSXV:CMB)(Frankfurt:ZM5N)(OTC PINK:CMCZF); (the "Company") is pleased to announce that recent exploration at its flagship Silver Hart property has identified high grade polymetallic samples within the calcareous units at its proposed future exploration targets

The Company has completed detailed mapping and sampling on it targets at Silver Hart identified from the SkyTEM airborne geophysical survey completed earlier this year. This work has successfully confirmed the merit of these targets for future drilling and the potential of the calcareous units to host high grade silver and zinc with assays returning up to 1,243 g/t silver, 20.06% lead and 28% zinc. The values are obtained in limestone and skarns that are in close contact with the granodiorite and extend for over 4.0 kilometers southeastwards onto the Blue Heaven property that the Company optioned from Strategic Metals.

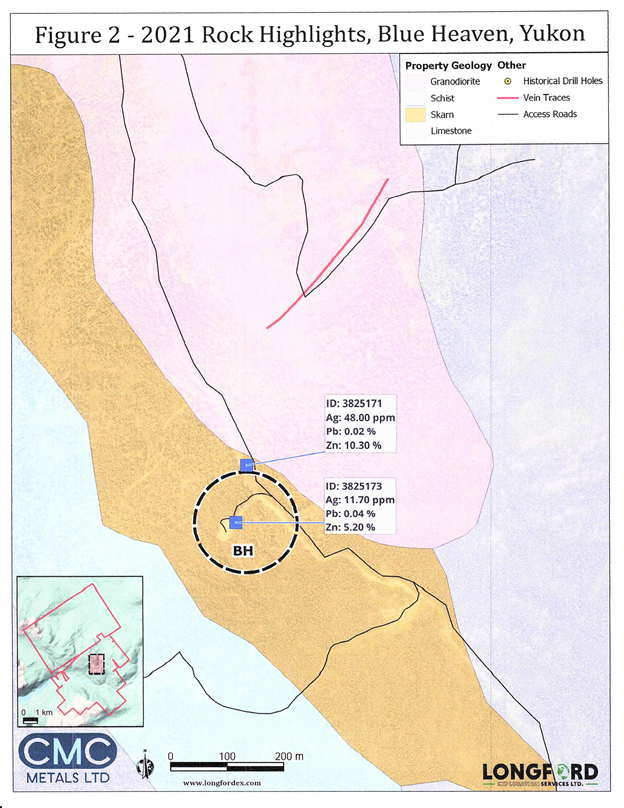

Key highlights of the sampling effort are as follows (also refer to Figures 1 and 2):

| Target | Sample No. | Silver (g/t) | Lead (%) | Zinc (%) |

| T1 | 3825106 | 631.0 | 20.06 | 22.90 |

| T1 | 3825120 | 29.0 | 0.01 | 4.0 |

| T1 | 3825161 | 71 | 0.05 | 0.90 |

| T3 | 3825125 | 1,243 | 0.70 | 17.20 |

| T3 | 3825150 | 4.8 | 0.0 | 9.40 |

| T3 | 3825153 | 1.10 | 0.0 | 10.8 |

| T4 | 3825157 | 51 | 0.19 | 28.0 |

| T5 | 3825133 | 0.60 | 0.0 | 5.2 |

| Blue Heaven | 3825171 | 48 | 0.02 | 10.3 |

| Blue Heaven | 3825173 | 11.7 | 0.04 | 5.2 |

The calcareous units at Silver Hart containing elevated silver, zinc and lead, appear to be present directly along strike with those on the Blue Heaven property where northeast mineralizing high grade polymetallic veins are also present. Drill pad building in 2021, in anticipation of future drilling, served to expose mineralization within the target areas identified from the SkyTEM survey where the calcareous units is in close contact with the Cassiar Batholith.

Mr. John Bossio, Chairperson noted, "The significant potential for high grade polymetallic deposits is being identified on our Silver Hart and Blue Heaven properties. This recent round of sampling is significant as it is demonstrating the potential of the calcareous units to host high grade mineralization outside of the high-grade vein system in the Main Zone that has been the sole focus of exploration to date. The highly positive results from our systematic exploration efforts are continuing to confirm our geological model for and in particular the importance of examining the contact relationship between the Cassiar batholith granodiorite and the overlying carbonates. We also see this important relationship throughout the Rancheria Silver District at our other properties such as Silverknife. Amy and Rancheria South. Our work at Silver Hart will help us understand the mineralizing systems throughout the district."

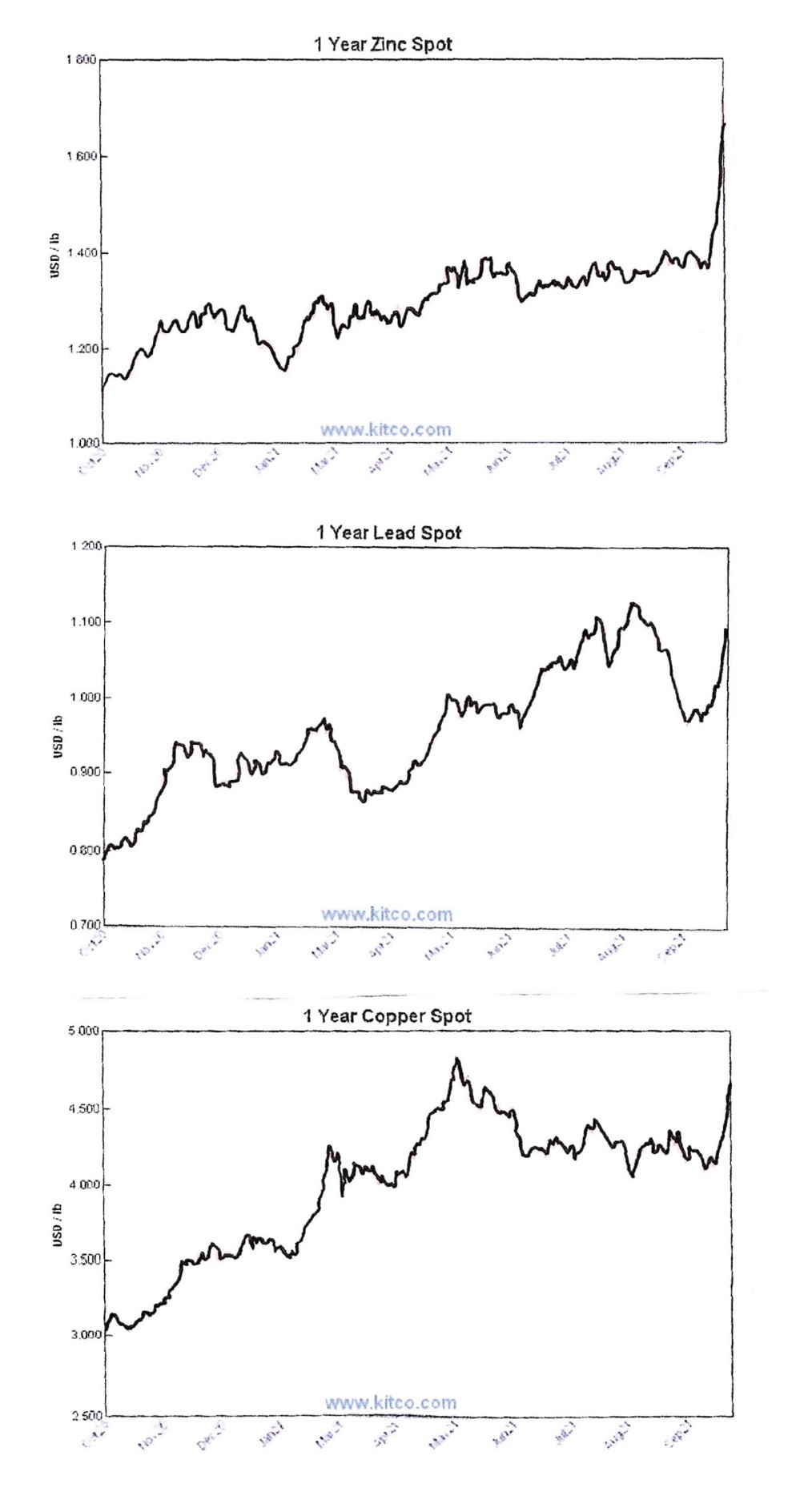

Mr. Kevin Brewer, President and CEO noted, "The polymetallic nature of mineralization on our properties is becoming more evident and we see this as a very positive development for future exploration. We are very excited about the potential of targets such as T1, T3, T4 and T5 and we are now planning efforts to further evaluate these areas through trenching and drilling in 2022 and beyond. The polymetallic high-grade nature of mineralization is especially important to the possible future viability of Silver Hart and our other properties in the Rancheria Silver district. The polymetallic nature of the mineralization is consistent with that of the Silvertip mine. Also, the Company considers that the content of minerals such as zinc, lead and copper will be increasingly important in the future as we are possibly entering a bull market in these commodities. According to date from kitco.com and Business Insider (see Figure 3), from October 2020 to current zinc prices have increased by approximately 57%, lead 36.7%, and copper 57.9%. We have seen a slight downturn in silver prices (-4%) but we are very positive in the outlook for silver prices in the foreseeable future. Silver Hart is clearly a polymetallic target where minerals such as zinc, lead and possibly copper are important contributors to the economic viability of the project. These recent results further serve to demonstrate the importance of being cognizant of the polymetallic nature of mineralization within the Rancheria Silver District. They also signal the potential for widespread mineralization at the Silver Hart Project."

Figure 3

The company also notes that it is starting to receive results from its 2021 exploration efforts which it is now evaluating and will be releasing in the new future.

Upcoming Presentation

Kevin Brewer, President and CEO of the Company will be providing a detailed update on 2021 exploration activities on Tuesday October 19, at 3:45PM (Eastern Standard Time). We look forward to all interested parties or persons to join us by registering for the presentation.

People can register to attend the conference here: https://www.redcloudfs.com/oktoberfest2021/

Qualified Person

Kevin Brewer, a registered professional geoscientist in BC, Yukon and Newfoundland, is the Company's President and CEO, and Qualified Person (as defined by National Instrument 43-101). He has approved the technical information reported herein. The Company is committed to meeting the highest standards of integrity, transparency and consistency in reporting technical content, including geological reporting, geophysical investigations, environmental and baseline studies, engineering studies, metallurgical testing, assaying and all other technical data.

About CMC Metals Ltd.

CMC Metals Ltd. is a growth stage exploration company focused on opportunities for silver in Yukon and British Columbia and polymetallic deposits in Yukon and Newfoundland. Our silver-lead-zinc prospects include the Silver Hart Deposit and Blue Heaven claims (the "Silver Hart Project") and the recently acquired Rancheria South, Amy and Silverknife claims (the "Rancheria South Project"). Our polymetallic projects with potential for copper-silver-gold and other metals include Logjam (Yukon), Bridal Veil and Terra Nova (both in Newfoundland).

On behalf of the Board:

"John Bossio"

John Bossio, Chairman

CMC Metals Ltd.

For Further Information and Investor Inquiries:

Kevin Brewer, P. Geo., MBA, B.Sc Hons, Dip. Eng

President, CEO and Director

Tel: (604) 670 0019

kbrewer80@hotmail.com

Suite 110-175 Victory Ship Way

North Vancouver, BC

V7L 0B2

To be added to CMC's news distribution list, please send an email to info@cmcmetals.ca or contact Mr. Kevin Brewer.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

"This news release may contain certain statements that constitute "forward-looking information" within the meaning of applicable securities law, including without limitation, statements that address the timing and content of upcoming work programs, geological interpretations, receipt of property titles and exploitation activities and developments. In this release disclosure regarding the potential to undertake future exploration work comprise forward looking statements. Forward-looking statements address future events and conditions and are necessarily based upon a number of estimates and assumptions. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks, including the ability of the Company to raise the funds necessary to fund its projects, to carry out the work and, accordingly, may not occur as described herein or at all. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, the timing and receipt of government and regulatory approvals, the impact of the constantly evolving COVID-19 pandemic crisis and continued availability of capital and financing and general economic, market or business conditions. Readers are referred to the Company's filings with the Canadian securities regulators for information on these and other risk factors, available at www.sedar.com. Investors are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. The forward-looking statements included in this news release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation."

SOURCE: CMC Metals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/668550/CMC-Metals-Identifies-High-Grade-Polymetallic-Samples-at-its-Proposed-Future-Targets-at-Silver-Hart-Yukon