Battery Mineral Resources Corp. (TSXV: BMR) (OTCQB: BTRMF) ("Battery" or "BMR" or the "Company") is pleased to provide an update regarding business activities and outline steps towards potential near term cash generation. The recently acquired Punitaqui mine in Chile is slated for resumption of copper production in mid to late-2022.

Battery is an investor focused company with high-quality assets providing shareholder exposure to the global mega-trend of electrification via our assets and the commodities they represent - namely cobalt, graphite, lithium and copper. BMR is determined to provide value growth through cash-flow, exploration and acquisitions in top mining jurisdictions.

Punitaqui Copper Mine

Punitaqui is a former producing copper mine located in the Coquimbo region of Chile with an eight-plus year operating history within which it produced up to 25 million pounds of copper in concentrate annually. Punitaqui was recently acquired by BMR via a private placement equity financing announced on July 13, 2021. BMR began developing the project immediately by initiating a drilling program, operating as well as environmental permit modifications and engineering studies.

Exploration and Infill Drill Program

- Currently, four drills are operating at Punitaqui - one at San Andres, two at Dalmacia and one at Cinabrio Norte.

- San Andres and Dalmacia, along with Cinabrio, which was the primary feed to the mill over the eight-plus years of operating history, have existing underground workings and are being developed for upcoming resource updates and potential sources of copper mineralized feed to the mill, Cinabrio Norte is a new target to be developed in the nearby future;

- 6,484 meters of diamond core drilling in 31 drill holes have been completed at San Andres (See Figure 1 and Figure 2).

Sample assay results, reported herein, are from the first thirteen drillholes completed at San Andres (see Table 1 and Table 2 below). These results are only partial and additional significant intervals may be reported from these same holes when complete results are received.

Environmental and Social Permitting Activity

- Consolidation of several operating and exploration permits to a lesser number of permits;

- Modifications to allow for higher extraction rate than previously permitted;

- Modification of tailings deposition permit to allow for the use of tailings filters and a transition from thickened to dry-stack tailings in the future to secure long term deposition of tailings;

- Update of social base line study to identify enhancements for continuation of positive and mutually beneficial community relationships;

- Ongoing interaction with local and national authorities regarding BMR developments.

Engineering Studies

- Trade-off studies for mine operations regarding owner versus contractor;

- Trade-off studies for mineral processing and tailings storage regarding thickened versus dry-stack tailings deposition;

- Metallurgical testing to determine opportunity for higher recovery of certain finely disseminated copper ores through finer grinding prior to flotation;

- Updated mine designs and optimized development and production schedules for up to four mine production areas.

Northern Ontario Cobalt

BMR is continuing its efforts to build on its prior success of outlining a new high-grade cobalt resource at its McAra property near the town of Cobalt, Ontario. This resource was announced on April 22, 2021, and defines an NI 43-101 compliant Measured and Indicated resource of 1,124,000lbs Co-Eq that includes 1,102,000 pounds of cobalt. On the heels of two successful flow through financings which raised an aggregate gross proceeds of $2,306,800, BMR is initiating a winter drilling program designed to follow up on three prior successful cobalt drilling campaigns. In addition to the recent achievements at McAra, Battery has designed drill programs intended to build on prior successes at the Fabre property with drill intercept values such as 1.3 meters of 1.6% cobalt and at Bald Rock with values such as 3.0 meters of 0.6% cobalt. Drilling has commenced at Fabre and will follow with Bald Rock and McAra in the coming months, with results expected in Q1 2022.

Funding

In order to support ongoing development efforts in Chile and Ontario, BMR also announces that it has, through ESI Energy Services Inc. - a BMR subsidiary company - entered into a loan agreement with USMT 18 LLC for a secured loan (the "Loan") in the amount of US$1,200,000. The Loan is repayable one year from closing with an option to extend for an additional one year and bears interest at a rate of 8.5% per annum, with interest payable monthly. In addition, a 1.5% origination fee and a 2% exit fee is payable in connection with the Loan. In the event the loan is repaid prior to June 30, 2022, yield maintenance will be payable by the borrower through June 30, 2022. The Loan will be secured by certain real property owned by two subsidiaries of Battery, including the borrower.

On the heels of some very positive drill results at the Punitaqui mine site, this non-dilutive financing allows BMR to keep up the pace and activity to move this project to full production as soon as possible in 2022.

Battery CEO, Martin Kostuik, states; "There are very few companies around the world that have the opportunity to transition from development into potential resumption of copper in the second half of 2022 and we are thrilled be one of them. Our recent acquisition of the former producing Punitaqui copper mine in Chile will give our investors an opportunity to participate in a potentially significant re-rating in BMR's valuation as we transition from development to operations and positive cash-flowing. The development of Punitaqui towards a restart is progressing well on all fronts such as drilling, engineering and permit modifications and we look forward to presenting the restart plan for the mine in Q1 2022. We look forward to providing further exciting updates as we progress towards a potential near term resumption of operations and cashflow at Punitaqui".

Table 1: Punitaqui Mine - San Andres Drilling Significant Assays Results - November 2021

| Drillhole Number | From (m) | To (m) | Sample Interval (m) | Copper Cu (%) | Silver Ag (g/t) |

| SAS-21-14 | 203.2 | 239.0 | 35.8 | 0.98 | 3.3 |

| including | 203.2 | 216.0 | 12.8 | 1.44 | 1.4 |

| including | 207.0 | 216.0 | 9.0 | 1.83 | 5.9 |

| and | 227.0 | 239.0 | 12.0 | 1.24 | 3.4 |

| SAS-21-15 | 116.0 | 119.0 | 3.0 | 0.50 | 8.3 |

| and | 133.0 | 136.0 | 3.0 | 0.48 | 6.0 |

| and | 139.0 | 141.0 | 3.0 | 0.51 | 0.4 |

| SAS-21-17 | 241.4 | 245.0 | 3.6 | 1.04 | 1.0 |

| SAS-21-19 | 74.0 | 79.0 | 5.0 | 1.08 | 2.0 |

| including | 74.0 | 78.0 | 4.0 | 1.24 | 2.2 |

| SAS-21-20 | 266.9 | 269.3 | 2.4 | 0.70 | 0.1 |

| SAS-21-21 | 106.0 | 131.0 | 25.0 | 0.88 | 14.9 |

| including | 106.0 | 119.0 | 13.0 | 0.96 | 21.8 |

| including | 115.0 | 119.0 | 4.0 | 1.19 | 20.1 |

| and | 136.0 | 138.0 | 2.0 | 1.12 | 18.2 |

| SAS-21-23 | 194.0 | 196.75 | 2.8 | 1.00 | 8.7 |

| SAS-21-24 | 231.0 | 234.0 | 3.0 | 0.82 | 1.7 |

Note: All Intercepts reported as downhole core intervals

Table 2: San Andres Drilling Significant Assays Results - November 2021 - Continued

| Drillhole Number | From (m) | To (m) | Sample Interval (m) | Copper Cu (%) |

| SAS-21-01 | 180.2 | 183.2 | 3.0 | 1.52 |

| SAS-21-02 | 185.0 | 188.0 | 3.0 | 0.04 |

| SAS-21-03 Including | 198.0 | 209.0 | 11.0 | 1.39 |

| 201.0 | 209.0 | 8.0 | 1.63 | |

| SAS-21-04 Including and | 185.0 | 201.7 | 16.7 | 1.37 |

| 190.0 | 201.7 | 11.7 | 1.64 | |

| 223.0 | 232.0 | 9.0 | 1.75 | |

| SAS-21-05 Including and | 200.0 | 210.0 | 10.0 | 0.52 |

| 203.0 | 207.0 | 4.0 | 0.87 | |

| 220.0 | 229.0 | 9.0 | 2.06 | |

| SAS-21-07 and | 244.65 | 248.05 | 3.4 | 2.10 |

| 257.0 | 261.0 | 4.0 | 1.56 | |

| SAS-21-08 and | 221.75 | 227.0 | 5.25 | 1.39 |

| 232.9 | 236.65 | 3.75 | 1.85 | |

| SAS -21-11 | 53.0 | 55.0 | 2.0 | 0.91 |

| SAS-21-12 and | 162.0 | 164.0 | 2.0 | 1.04 |

| 176.0 | 183.0 | 7.0 | 1.81 | |

| SAS-21-13 and and | 199.0 | 202.0 | 3.0 | 0.87 |

| 211.0 | 212.8 | 1.8 | 0.83 | |

| 217.0 | 220.0 | 3.0 | 1.96 |

Note: All Intercepts reported as downhole core intervals

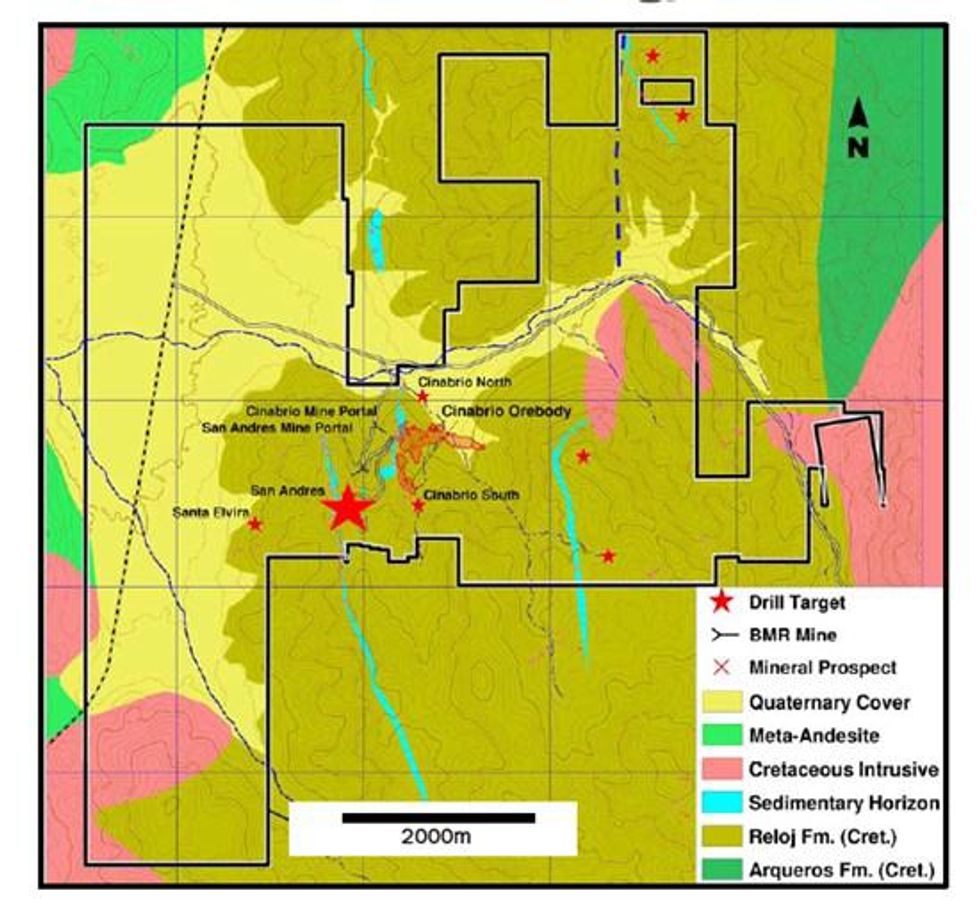

Figure 1: Cinabrio - San Andres Area Geology and Targets Map

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/6076/105089_1073477e84295b0f_002full.jpg

Qualified Persons

Michael Schuler, Battery Mineral Resources Corp. Chile Exploration Manager, supervised the preparation of and approved the scientific and technical information in this press release pertaining to the Punitaqui Exploration Drill Program. Mr. Schuler is a qualified person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Technical reports filed by the Company under the Company's profile at www.sedar.com: "Technical Report on Cobalt Exploration Assets in Canada" dated as of May 26, 2020 with an effective date of March 31, 2020, prepared by SRK Consulting - G Cole PGeo (APGO#1416).

RSU Grant

The Company announces it has granted an aggregate of 6.25 million restricted share units (the "RSUs") to its directors, officers, employees, and consultants, pursuant to the RSU plan. The RSU will vest over the next 1 to 3 years. The Company's RSU and stock-based option plans are aimed to compensate and reward its directors, officers and employees for working towards the Company's long term objectives and in alignment with the shareholders' best interest.

ESI Energy Services Inc.

ESI is a pipeline equipment rental and sales company with principal operations in Leduc, Alberta and Phoenix, Arizona. The company currently operates in most provinces in western Canada as well as in the United States of America and Australia. The Company, through its operating divisions, Ozzie's Pipeline Padder (Canada) and Ozzie's Pipeline Padder (US) and Ozzie's Pipeline Padder (Australia), supplies (rentals and sales) backfill separation machines (utility padding machines) with customers including contractors for mainline pipeline and utilities, oilfield pipeline and construction, wind and solar farm construction and communications. BMR wholly owns ESI and related subsidiaries. ESI has generated positive EBITDA historically and is forecasted to generate $4-$5 million in EBITDA for the 2021 fiscal year. For more information on the business of Ozzie's Pipeline Padder, see www.ozzies.com.

About Battery Mineral Resources Corp.

A battery mineral company with high-quality assets providing shareholders exposure to the global mega-trend of electrification and focused on growth through cash-flow, exploration and acquisitions in the world's top mining jurisdictions. Battery is currently developing the Punitaqui Mining Complex and pursuing the potential near term resumption of operations for second half of 2022 at the prior producing Punitaqui copper-gold mine. The Punitaqui copper-gold mine most recently produced approximately 21,000 tonnes of copper concentrate in 2019 and is located in the Coquimbo region of Chile.

Battery is engaged in the discovery, acquisition, and development of battery metals (cobalt, lithium, graphite, nickel and copper), in North and South America and South Korea with the intention of becoming a premier and sustainable supplier of battery minerals to the electrification marketplace. Battery is the largest mineral claim holder in the historic Gowganda Cobalt-Silver Camp, Canada and continues to pursue a focused program to build on the recently announced, +1-million-pound high grade cobalt resource at McAra by testing over 50 high-grade primary cobalt silver-nickel-copper targets. In addition, Battery owns 100% of ESI Energy Services, Inc., also known as Ozzie's, a pipeline and utilities equipment rental and sales company with operations in Leduc, Alberta and Phoenix, Arizona.

For further information, please contact:

Battery Mineral Resources Corp.

Martin Kostuik

Phone: +1 (604) 229 3830

Email: info@bmrcorp.com

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

Forward-Looking Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections of the Company on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability of the Company to obtain sufficient financing to complete exploration and development activities, risks related to share price and market conditions, the inherent risks involved in the mining, exploration and development of mineral properties, government regulation and fluctuating metal prices. Accordingly, readers should not place undue reliance on forward-looking statements. Battery undertakes no obligation to update publicly or otherwise revise any forward-looking statements contained herein, whether as a result of new information or future events or otherwise, except as may be required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/105089