February 13, 2024

West Australian gold exploration and development company, Rox Resources Limited (“Rox” or “the Company”) (ASX: RXL), is pleased to report results from recently completed geophysical Gradient Array Induced Polarisation (GAIP) surveys at its Mt Fisher and Mt Eureka Projects in Western Australia.

- Mt Fisher greenstone belt is one of the most remote and least explored greenstone belts within the gold-prolific Yilgarn Craton

- Past drill intercepts at Mt Fisher of 9m @ 34.34 g/t Au demonstrate the high-grade potential of the belt

- Currently, limited drilling in the Mt Fisher - Mt Eureka corridor has delineated a gold Mineral Resource of 187koz Au within 100km of Strickland Metals’ Milrose Project, which was recently acquired by Northern Star for approximately A$61m.

- Rox holds a dominant tenure position over the Mt Fisher-Mt Eureka belt and has recently conducted a Gradient Array Induced Polarisation (GAIP) survey over the project area

- The geophysical surveys have identified multiple walk-up drill targets, located along strike from known gold mineralised trends that are characterised by high-sulphide content (consistent with the causative geology of GAIP anomalies).

- Rox is progressing opportunities to advance and monetise the highly-prospective Mt Fisher - Mt Eureka Project, given the Company’s priority focus on developing its flagship high- grade Youanmi Gold Project in WA

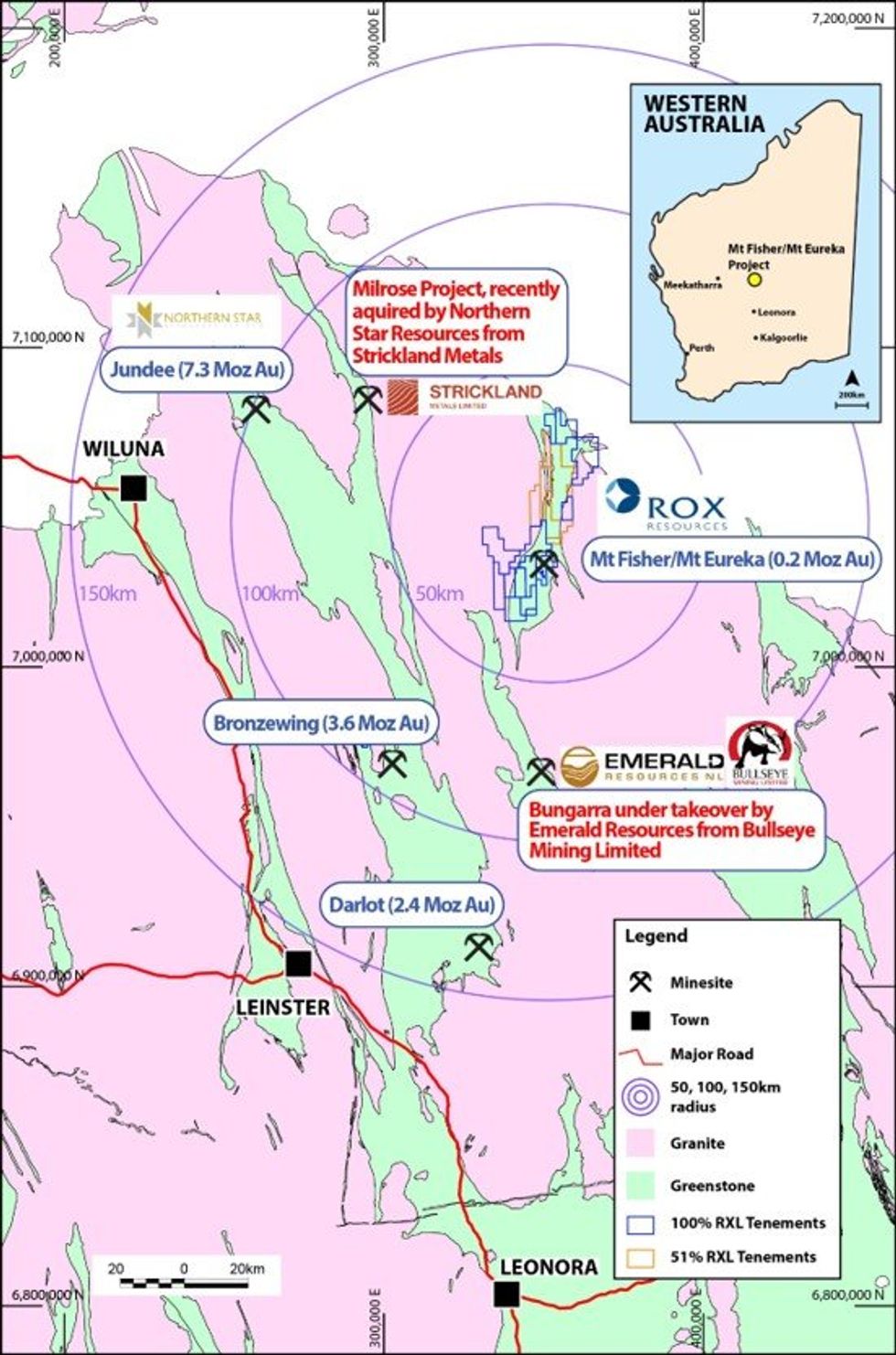

The 100% Rox Resources owned Mt Fisher Gold Project and the 51% gold rights (rights to earn uo to 75%) Mt Eureka Gold Project are located in the Northern Goldfields, with a gold Mineral Resource of 187koz Au defined within a 1,150km2 tenement package that is highly prospective for gold and nickel mineralisation.

Managing Director Comments

Rox Resources’ Managing Director, Mr Robert Ryan, said:

“The geophysical surveys conducted recently at Mt Fisher and Mt Eureka have highlighted a number of walk- up drill targets. The surveys have detected potential sulphide-bearing structures, which could host gold mineralisation as seen elsewhere in the tenement package.

"The 1,150km2 tenement package represents a district-scale exploration opportunity for both gold and nickel sulphides, that Rox will continue to advance in order to generate value for our shareholders.”

The 100% Rox Resources owned Mt Fisher Gold Project and the 51% gold rights (rights to earn uo to 75%) Mt Eureka Gold Project are both located in the Northern Goldfields, approximately 500km north of Kalgoorlie (120km east of Wiluna) (Figure 1).

The Projects are at an advanced exploration stage with an existing gold Mineral Resource of 187koz Au defined at Mt Fisher - Mt Eureka and significant exploration upside identified across the broader 1,150km2 tenement package.

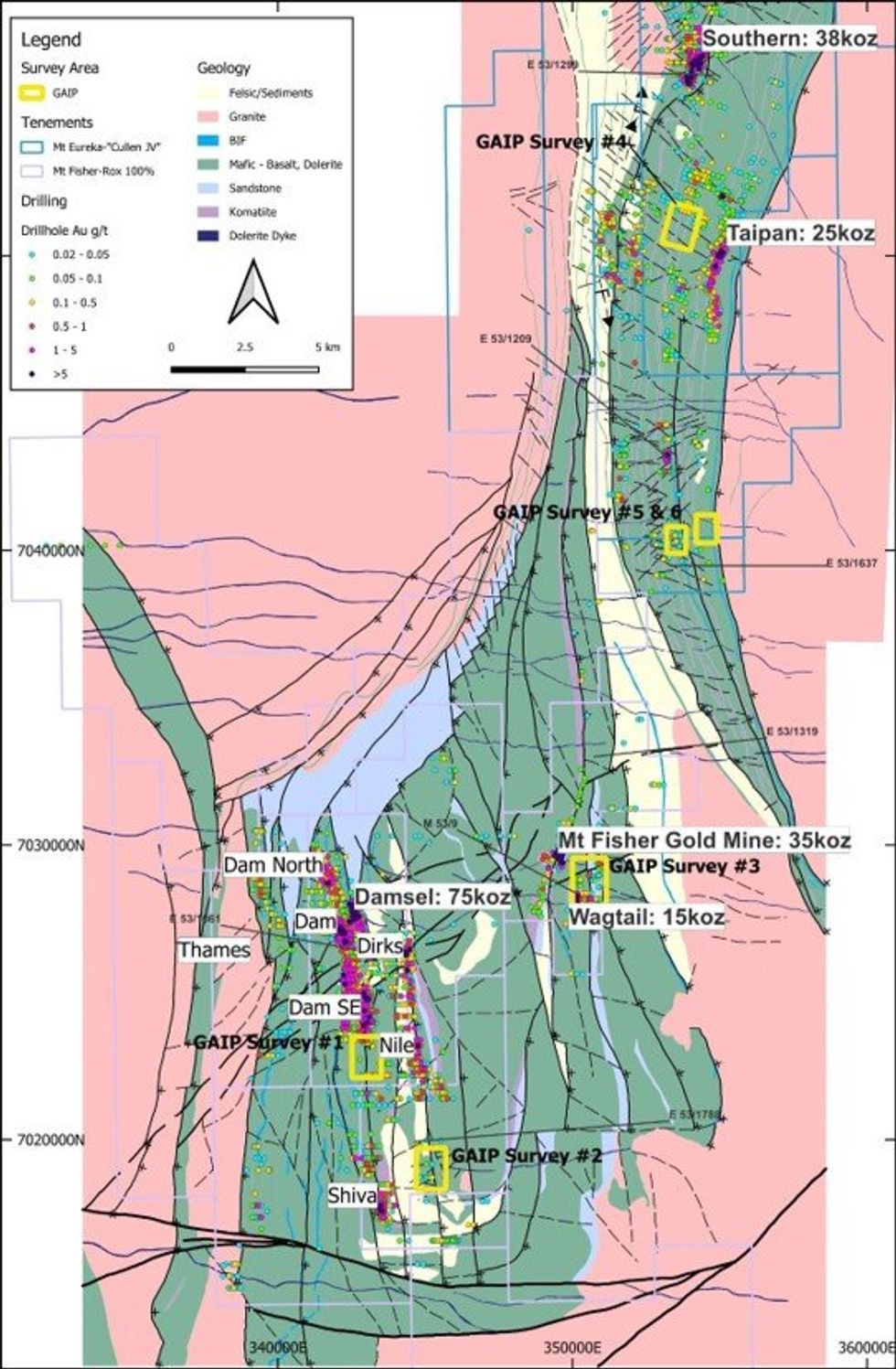

Rox has completed six Gradient Array Induced Polarisation (GAIP) geophysical surveys at the Mt Fisher and Mt Eureka Projects (Figure 2).

Each of the GAIP surveys were designed to advance the project exploration pipeline by defining potential sulphide-rich chargeability anomalies that represent drill-ready targets along the known gold mineralised trends.

The GAIP survey technique works particulary well at Mt Fisher and Mt Eureka due to the moderate percentages of disseminated sulphide, generally present as pyrite at the known gold deposits and along the mineralised trends within the project areas.

GAIP surveys are also able to cost effectively cover large strike lengths of mineralised trends to identify drill- ready targets for potential gold mineralisation associated with rich zones of disseminated sulphides.

GAIP survey #1 was completed on E53/1061 within the Damsel Project area (Figure 3), with the survey located at the southern end of the Damsel-Dam gold mineralised trend that hosts the underdrilled Damsel deposit containing 75koz Au, that was last drilled by Rox in December 2021 and July 2022 returning the following drilling results:

- 18m @ 6.99g/t Au from 69m, including 10m @ 10.27g/t Au from 74m;

- 11m @ 2.7g/t Au from 40m, including 4m @ 6.0g/t Au from 45m;

- 5m @ 3.18 g/t Au from 37m and 2m @ 4.64 g/t Au from 70m;

- 8m @ 2.55 g/t Au from 53m, including 5m @ 3.17 g/t Au from 53m; and

- 6m @ 2.84 g/t Au from 142m.

Click here for the full ASX Release

This article includes content from Rox Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

6h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

8h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

8h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

23h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00