April 27, 2025

Significant reconnaissance air‐core drilling results confirm multiple zones of gold mineralisation at Cardinia, further strengthening Patronus Resources’ exploration pipeline in this highly prospective region.

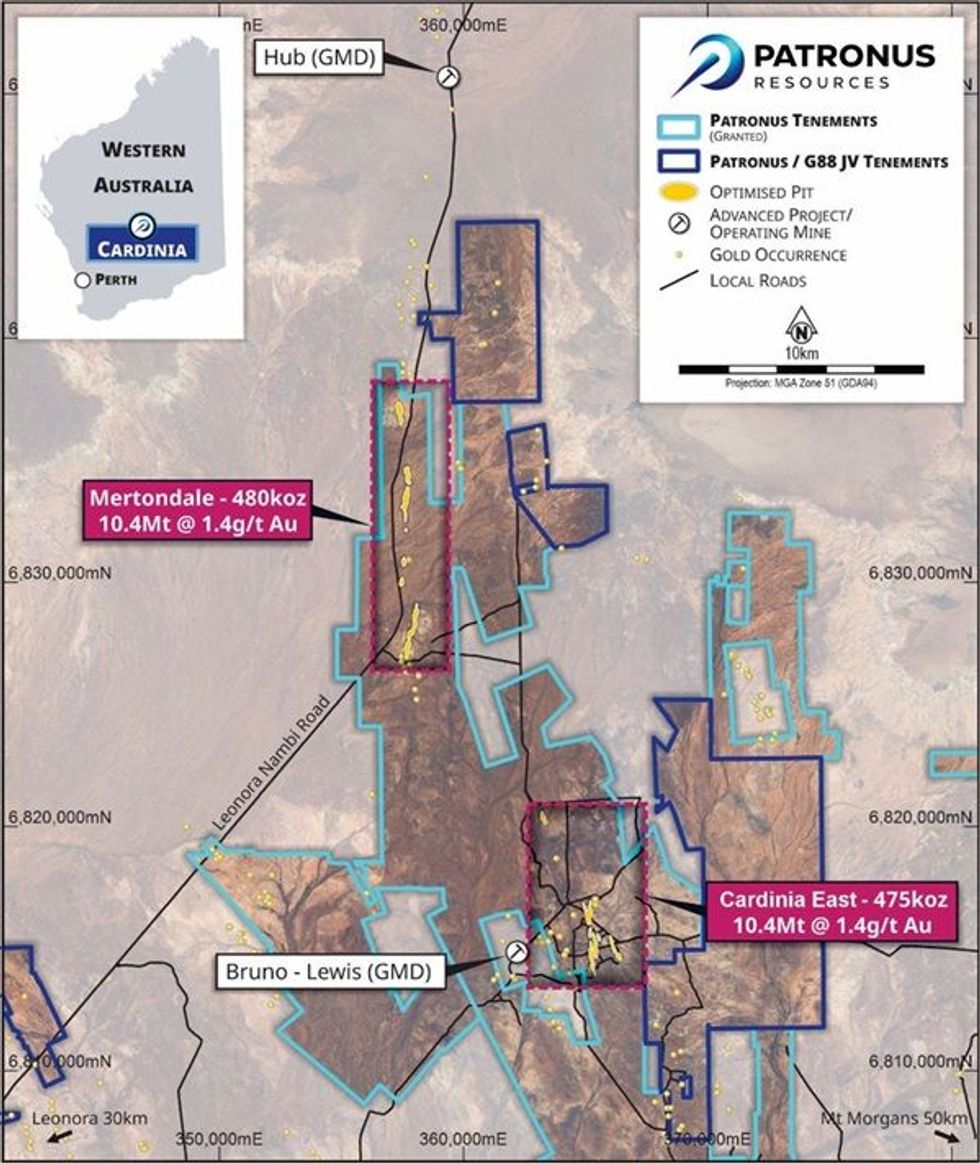

Patronus Resources Limited (ASX: PTN; “Patronus” or “the Company”) is pleased to report assay results from recent air‐ core drilling at its 100%‐owned Cardinia Gold Project, located near Leonora in Western Australia (see Figure 1), which has resulted in the delineation of multiple strong gold anomalies.

Highlights

- 153‐hole/6,679m reconnaissance Air‐Core (AC) drilling program completed at Cardinia East.

- Significant gold intersections returned, including:

- SC24AC002: 7m @ 0.86 g/t Au from 68m

- X424AC015: 8m @ 1.20 g/t Au from 32m

- X424AC016: 4m @ 1.69 g/t Au from 44m

- The new Scallop Prospect now hosts a confirmed 1km‐long gold trend, situated adjacent to the established Cardinia East resources.

- Follow‐up Reverse Circulation (RC) drilling planned for next quarter to further assess these promising targets.

The results further enhance the Cardinia Gold Project’s reputation as a high‐potential gold asset and reinforce the Company's commitment to advancing this exciting exploration opportunity.

The latest exploration campaign involved an integrated approach, including Induced Polarisation (IP) geophysical surveying, geological mapping, geochemical sampling, RC drilling, and Down‐Hole Electro‐Magnetic (DHEM) surveys—all of which have contributed to a growing understanding of the Cardinia gold system.

Patronus Resources’ Managing Director, John Ingram, commented: “This air‐core program has delivered highly encouraging results, further enhancing our understanding of the mineralised corridors within the Cardinia East Project. The identification of a new 1km‐long anomalous gold trend at Scallop, coupled with its strategic location adjacent to existing resources, significantly enhances the potential of this area. We are excited to commence follow‐up RC drilling next quarter to refine these targets and unlock further value for our shareholders.”

Air‐core Program Overview

The recently completed AC drilling campaign spanned 6,679m across 13 lines and six key prospects within the Cardinia East area (Figure 2). Line spacing varied between 200m and 350m, strategically designed to test geochemical anomalies and underlying structures beneath transported and weathered cover.

Several targets were identified as potential extensions of known mineralised systems, providing further evidence of gold continuity within the project area.

Significant gold intercepts include:

- SC24AC002: 7m @ 0.86 g/t Au from 68m

- SC24AC007: 4m @ 0.61 g/t Au from 8m

- X424AC015: 8m @ 1.20 g/t Au from 32m

- X424AC016: 4m @ 1.69 g/t Au from 44m

The Scallop prospect continues to emerge as a priority exploration target, with geological logging revealing the presence of a distinct pink porphyritic unit—a feature commonly associated with high‐ grade gold shoots in the Cardinia‐Mertondale corridor.

The 1km‐long corridor of gold anomalism sits within a highly prospective structural setting, adjacent to an interpreted D1 shear zone, in close proximity to significant gold mineralisation and with historic workings located nearby. The trend is located between the Helens deposit to the east and the Chieftess and Comedy King prospects to the west (Figure 3). The relationship between the mineralisation at Chieftess, Comedy King, Scallop and Helens is not yet known, and the Company believes that further RC drilling will aid in the geological understanding of these mineralised structures.

Notably, mineralisation appears to continue to the north of the prospect, where the Cardinia Creek currently creates a gap in drilling coverage. However, strong geochemical signatures indicate the potential extension of gold mineralisation beyond the currently drilled area.

Click here for the full ASX Release

This article includes content from Patronus Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00