Nevada Sunrise Metals Corp. ("Nevada Sunrise", or the "Company") (TSXV: NEV) (OTC: NVSGF) is pleased to announce that a novel form of metallurgical testing is underway on lithium mineralization from its 100%-owned Gemini Lithium Project ("Gemini") in Nevada utilizing super critical carbon dioxide as a leaching agent. A new patent granted by the U.S. Patent and Trademark Office in August 2023 to the Company's consultant, Willem Duyvesteyn M.Sc. of Extractive Metallurgy Consultants LLC of Reno, Nevada ("EMC"), is currently being tested on Gemini clay mineralization. EMC's patented process could revolutionize the extraction of lithium from clay deposits by offering a "green" processing method while at the same time providing in-ground sequestration of captured carbon dioxide ("carbon capture").

About Super Critical Carbon Dioxide

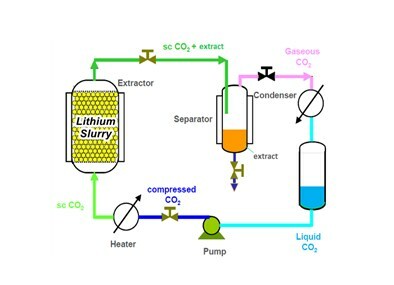

Super critical carbon dioxide ("scCD" or "sc CO 2 ") is used extensively in chemical industries, including, for example, for the production of decaffeinated coffee and various plant oils and extracts. Carbon dioxide ("CO 2 ") reaches a supercritical state at 1,071 pounds per square inch (75.299 kg/cm 2 ) pressure and a temperature of 87.98° F (31.1° C), whereupon it attains the properties of both liquid and gas and can be utilized as a fast-acting solvent. Most importantly, scCD has been extensively investigated for the sequestration of CO 2 in various geological formations, including clay-type deposits.

It is commonly believed that lithium present in clay or "claystone" deposits is held in the interlayer between the silica sheets of clays, such as smectite (hectorite), or illite (tainiolite) and is not very strongly bound. In the scCD extraction process proposed by EMC, CO 2 is converted to bicarbonate and this anion is readily picked up by the freed lithium ion, forming a water-soluble lithium bicarbonate. The resulting lithium bicarbonate compound is much more soluble than lithium carbonate. Some water in the interlayer will be displaced by CO 2 and therefore will provide opportunities to sequester CO 2 , thus providing an environmentally-friendly method of lithium extraction while establishing a unique form of carbon capture.

While the initial focus of the scCD testing is on the ex-situ , or off-site, processing of lithium-bearing clays, EMC has also identified the opportunity to use an in-situ approach employing freeze walls to contain the CO 2 in a section of a lithium-bearing clay deposit while implementing carbon capture of the CO 2 used during the lithium extraction process.

Results of the scCD testing of Gemini lithium-in-clay mineralization are expected in Q4 2023.

About Gemini

Gemini consists of 291 unpatented claims on Bureau of Land Management land covering approximately 5,600 acres (2,266 ha.) located in the western Lida Valley, Esmeralda County , approximately 6 miles (10 kilometres) east of the town of Lida, Nevada . The Lida Valley is a flat, arid basin with a similar geological setting to the better-known Clayton Valley basin where Albemarle Corporation operates the Silver Peak lithium brine mine, which has operated continuously since 1966.

Gemini is situated adjacent to the Gold Point Solar Energy Zone, a BLM land reserve set aside for solar and wind power generation projects until 2033. Exploration at Gemini is complemented by the Company's 80.09 acre/feet/year water right, a pre-requisite for the exploration and development of lithium projects in Nevada .

In March and April 2022 , Nevada Sunrise drilled two RC boreholes for a total of 2,020 feet (615.85 metres) in its maiden drilling program at Gemini. The drill sites were located within a defined gravity low that hosts conductive layers detected by historical ground electromagnetic surveys. The results from the first two holes at Gemini represented a new discovery of lithium mineralization in the western Lida Valley, which was not historically drill tested for lithium (see Nevada Sunrise news release dated May 18, 2022 ). In July 2022 , Nevada Sunrise received a permit for an expanded drilling area from the Bureau of Land Management and began Phase 2 drilling at Gemini in October 2022. Three additional boreholes were completed from October 2022 to April 2023 , with each intersecting lithium mineralization (see Nevada Sunrise news release dated May 24, 2023 ).

Nevada Sunrise believes that the southern and western parts of the Gemini basin are highly prospective for additional lithium mineralization and that further drilling could eventually define a large lithium resource. The Company has engaged ABH Engineering Inc. of Surrey, BC , Canada to calculate a National Instrument 43-101-compliant resource estimate leading to a Preliminary Economic Assessment of the lithium-bearing zones at Gemini.

Initial metallurgical tests carried out by Nevada Sunrise achieved a 90.2% lithium extraction rate from the Gemini clay mineralization, a rate which compares favorably with the average lithium extraction of 84% reported by Lithium Americas at its Thacker Pass lithium project ( Source: Feasibility Study, National Instrument 43-101 Technical Report for the Thacker Pass Project, Humboldt County, Nevada , USA, by Roth, D., et al, dated November 2, 2022 ). Follow-up testing of the resulting leach solutions at the facilities of McClelland Laboratories Inc. in Sparks, Nevada produced a sample that was near-100% lithium carbonate (see Nevada Sunrise news release dated July 31, 2023 ).

For further information on Gemini, including maps and photos click here

Statement of Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Willem Duyvesteyn , M.Sc., who is a Qualified Person for Nevada Sunrise as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects .

About Nevada Sunrise

Nevada Sunrise is a junior mineral exploration company with a strong technical team based in Vancouver, BC , Canada , that holds interests in lithium, gold, and copper exploration projects located in the State of Nevada, USA .

Nevada Sunrise owns 100% interests in the Gemini, Jackson Wash and Badlands lithium projects, with no applicable royalties, all of which are located in the Lida Valley in Esmeralda County, NV. The Company owns Nevada water right Permit 86863, also located in the Lida Valley basin, near Lida, NV.

The Company's key gold asset is a 20.01% interest in a joint venture at the Kinsley Mountain Gold Project near Wendover, NV with CopAur Minerals Inc. Kinsley Mountain is a Carlin-style gold project hosting a National Instrument 43-101 compliant gold resource consisting of 418,000 indicated ounces of gold grading 2.63 g/t Au (4.95 million tonnes), and 117,000 inferred ounces of gold averaging 1.51 g/t Au (2.44 million tonnes), at cut-off grades ranging from 0.2 to 2.0 g/t Au 1 . The Company has elected not to contribute to the 2023 exploration program at Kinsley Mountain and projects to incur dilution of its participating interest in the joint venture to an approximate 19.0% interest.

| 1 Technical Report on the Kinsley Project, Elko County, Nevada, U.S.A., dated June 21, 2021 with an effective date of May 5, 2021 and prepared by Michael M. Gustin, Ph.D., and Gary L. Simmons, MMSA and filed under New Placer Dome Gold Corp.'s Issuer Profile on SEDAR ( www.sedar.com ). |

| |

Nevada Sunrise has the right to earn a 100% interest in the Coronado VMS Project, located approximately 48 kilometers (30 miles) southeast of Winnemucca, NV.

Website: www.nevadasunrise.ca

FORWARD LOOKING STATEMENTS

This release may contain forward – looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur and include disclosure of anticipated exploration activities. Although the Company believes the expectations expressed in such forward – looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward looking statements. Forward – looking statements are based on the beliefs, estimates and opinions of the Company's management on the date such statements were made. The Company expressly disclaims any intention or obligation to update or revise any forward – looking statements whether as a result of new information, future events or otherwise.

Such factors include, among others, risks related to the results and outcomes of the Company's 2022-2023 exploration activities and future plans at the Gemini Lithium Project; reliance on technical information provided by third parties on any of our exploration properties; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or metallurgical recovery rates; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; labor disputes and other risks of the mining industry; delays due to pandemic; delays in obtaining governmental approvals, financing or in the completion of exploration, as well as those factors discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for the Nine Months ending June 30 , 2023, which is available under Company's SEDAR profile at www.sedar.com .

Although Nevada Sunrise has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Nevada Sunrise disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Nevada Sunrise Metals Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2023/26/c4558.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2023/26/c4558.html