Nevada Sunrise Metals Corporation (TSXV: NEV,OTC:NVSGF) (OTC Pink: NVSGF) ("Nevada Sunrise" or the "Company") is pleased to announce that it has deepened its partnership with VRIFY Technology Inc. ("VRIFY") by leveraging DORA, VRIFY's AI-Assisted Mineral Discovery Platform, to identify new target areas at the Griffon Gold Mine Project ("Griffon", or the "Project") in Nevada, USA. In February 2025, the Company entered into a mining lease to purchase Griffon from an arm's-length party (see Nevada Sunrise news release dated February 20, 2025). Gold was mined at Griffon in two open pits from 1998 to 1999 and was reported to have produced 62,661 ounces of oxide gold until its premature closure in 1999, a year when the price of gold averaged approximately US$278 per ounce.1

VRIFY Target Generation at Griffon

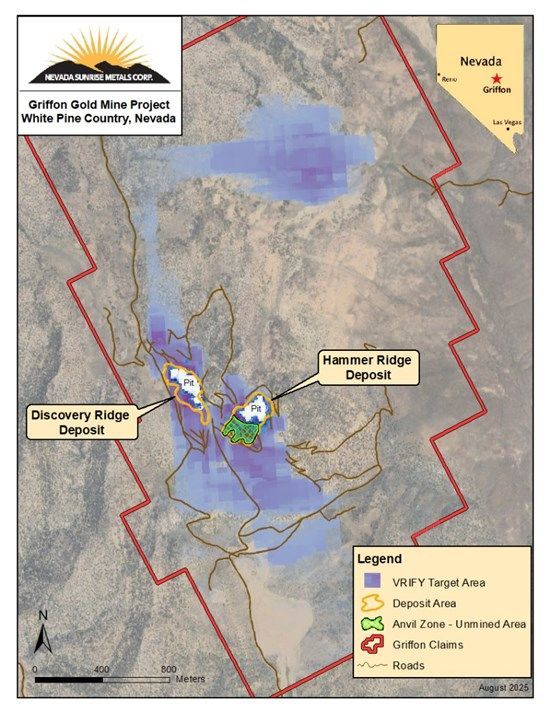

In March 2025, the Company announced a partnership with VRIFY to implement innovative AI software at the Project. During Q2 2025, VRIFY's Geoscience AI teams worked closely with Nevada Sunrise in compiling, cleansing and expanding upon decades of available historical exploration data collected since the discovery of gold at the Project in 1986. The historical data includes surface geological, geochemical, and geophysical results, as well as a digitized drill hole database, which created a comprehensive, high-quality dataset. Using DORA, several areas within the Project were identified as having high prospectivity for additional gold mineralization (see Figure 1).

Figure 1. Griffon Gold Mine Project, 2025 VRIFY target areas

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2799/265651_0ec3c28e84efa823_002full.jpg

Nevada Sunrise plans to conduct Soil Gas Hydrocarbon and conventional soil surveys and perform ground geophysical surveys over the new target areas early in the fall of 2025 to validate these findings and define future drill targets for the Project. The 2025 work will initially focus on an area southwest of the Hammer Ridge pit that was identified as gold-bearing by Alta Gold Co. ("Alta") but was never mined due to Alta's untimely bankruptcy in 1999.2 Once a geochemical and geophysical signature of the unmined "Anvil Zone" is established, the Company will seek to compare those signatures to the new targets developed by the VRIFY software.

Griffon Permitting Update

In late July 2025, Nevada Sunrise submitted a Notice of Intent ("NOI") to the United States Forest Service (the "USFS") to advise the USFS of its initial surface exploration plans at Griffon. The NOI contained details of a proposed SGH soil sampling survey, an induced polarization ("IP") survey and a controlled source audio frequency magnetotellurics ("CSAMT") survey that the Company plans to carry out on the newly-identified target areas within the Project. On August 11, 2025, the USFS responded positively to the Company's exploration proposal and plans are underway to perform the aforementioned exploration work in the fall of 2025 before inclement weather begins in the region.

About VRIFY

VRIFY is redefining mineral discovery by putting the power of AI into the hands of geoscientists with mission-critical exploration software. DORA, VRIFY's AI-Assisted Mineral Discovery Platform, empowers technical teams to leverage the industry's largest proprietary exploration dataset and mineral system-specific AI models to identify, rank, and validate high-potential targets faster, and with greater confidence. A high-growth software company trusted globally by over 170 mineral exploration and mining companies, VRIFY is shaping a new era of exploration and discovery.

By integrating Griffon's project-specific data with VRIFY's industry-leading database, DORA's proprietary algorithms have identified patterns that would be time consuming and difficult, if not impossible, to extract through manual processes alone, delivering data-backed insights and highlighting high-potential areas of mineralization.

Using DORA, Nevada Sunrise will gain direct access to the web-based software, receive comprehensive training, and be able to generate and iterate on their own predictive models, allowing for hands-on exploration targeting and validation.

To learn more about VRIFY visit https://vrify.com.

About Griffon

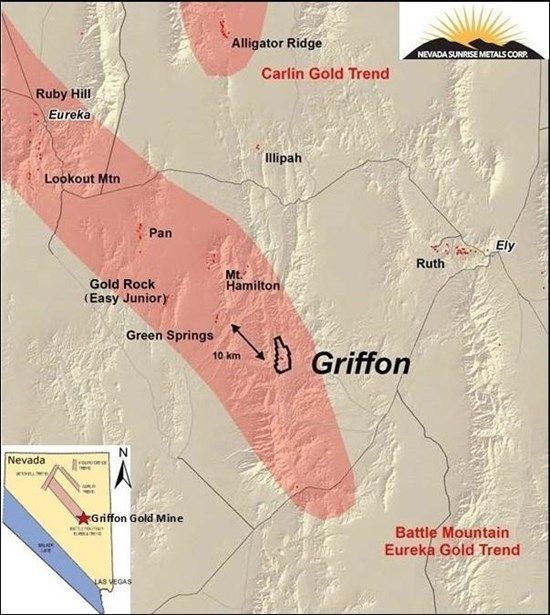

Griffon is located approximately 50 kilometres (33 miles) southwest of Ely, Nevada and consists of 89 unpatented mineral claims totaling approximately 1,780 acres (720 hectares). Griffon is situated within a 60 kilometre (40 mile) section of the Battle Mountain-Eureka trend, which hosts the following gold mines and significant deposits (see Figure 2):

Pan Mine: Currently the subject of a purchase and sale transaction between Minera Alamos Inc. and Equinox Gold Corp. Reported to host Measured and Indicated resources of 358,900 oz. gold and Inferred resources of 42,000 oz. gold3, and was reported as producing 35,267 oz. gold in 2024.4

Gold Rock (formerly Easy Junior): Also the subject of a purchase and sale transaction between Minera Alamos Inc. and Equinox Gold Corp. Reported to host Measured and Indicated resources of 370,700 oz. gold and Inferred resources of 58,100 oz. gold5 and was reported as producing 12,100 ounces of gold in the years 1990 and 1997.6

Mt. Hamilton: Owned by Bendito Resources Inc. Reported to host Proven and Probable Mineral Reserves of 545,000 oz. gold and 4,459,600 oz. silver contained within Measured and Indicated resources of 727,000 oz. gold and 6,569,000 oz. silver, and Inferred resources of 119,000 oz. gold and 1,153,000 oz. silver.7

Green Springs: Owned by Orla Mining Ltd., and currently under option to Centerra Gold Inc. Historical production at Green Springs of 63,000 oz. of gold was reported from 1988 to 1991 under USMX Inc.'s heap leach operation.8

Lookout Mountain: Operated by Timberline Resources Corporation. Reported to host Measured and Indicated resources of 423,000 oz. gold, and Inferred resources of 84,000 oz. gold. Historical production of 17,700 oz. gold was reported in 1987.9

Figure 2: Griffon Gold Mine Project Location, White Pine County, Nevada

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2799/265651_0ec3c28e84efa823_003full.jpg

For more information about Griffon, including maps and photos, visit the Company's website at: www.nevadasunrise.ca.

References:

1 Nevada Division of Minerals, "Major Mines of Nevada", published 1998 and 1999.

2 Fremont Gold Ltd. News Release, August 5, 2020.

3 NI 43-101 Updated Technical Report on Resources and Reserves, Pan Gold Project, White Pine County, Nevada, prepared by SRK Consulting (U.S.) Inc. and Apex Geoscience Ltd., with an effective date December 31, 2022;

4 Calibre Mining Corp., News Release dated January 8, 2025;

5 Amended Technical Report on the Preliminary Economic Assessment of the Gold Rock Project, White Pine County, Nevada, prepared by Fiore Gold Ltd. by Apex Geoscience Ltd. and John T. Boyd Company with an effective date of March 31, 2020;

6 Nevada Bureau of Mines & Geology, Special Publication, The Nevada Mineral Industry 1997;

7 NI 43-10 Technical Report Feasibility Study, Mt. Hamilton Gold and Silver Project, Centennial Deposit and Seligman Deposit. White Pine County, Nevada, prepared for Solitario Exploration & Royalty Corp. and Ely Gold Minerals Inc. by SRK Consulting (U.S.) Inc., with an effective Date of August 14, 2014;

8 Nevada Bureau of Mines & Geology, Special Publication, The Nevada Mineral Industry 1988, 1989, 1990 and 1991;

9 Technical Report, Lookout Mountain Project, Eureka County, Nevada, USA, prepared for Timberline Resources Corporation by RESPEC Company LLC, with an effective Date of September 1, 2023.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Robert Allender Jr, CPG, SME and a Qualified Person for Nevada Sunrise as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Mr. Allender has examined information regarding the historical exploration at Griffon, which includes his review of the historical sampling, analytical procedures and results underlying the information and opinions contained herein.

Management cautions that historical results were collected and reported by operators unrelated to Nevada Sunrise and have not been verified nor confirmed by its Qualified Person; however, the historical results create a scientific basis for ongoing work at the Griffon property. Management further cautions that historical results, discoveries and published resource estimates on adjacent or nearby mineral properties, whether in stated current resource estimates or historical resource estimates, are not necessarily indicative of the results that may be achieved on the Griffon property.

About Nevada Sunrise

Nevada Sunrise is a junior mineral exploration company with a strong technical team based in Vancouver, BC, Canada, that holds interests in gold, copper and lithium exploration projects located in the State of Nevada, USA.

Nevada Sunrise holds the right to purchase a 100% interest in the Griffon Gold Mine Project, located approximately 50 kilometers (33 miles) southwest of Ely, NV.

Nevada Sunrise holds the right to earn a 100% interest in the Coronado Copper Project, located approximately 48 kilometers (30 miles) southeast of Winnemucca, NV.

Nevada Sunrise owns 100% interests in the Gemini (currently the subject of an option-to-purchase transaction with Dome Rock Resources, LLC), Jackson Wash and Badlands lithium projects, all of which are located in the Lida Valley in Esmeralda County, NV. Gemini hosts an Inferred lithium resource estimate of 7.1 million tonnes of lithium carbonate equivalent, described in a National Instrument 43-101 ("NI 43-101") compliant technical report entitled "NI 43-101 Technical Report, Resource Estimate for Gemini Lithium Project, Esmeralda County, Nevada", effective January 15, 2024, and dated March 8, 2024, available at www.sedarplus.ca and on the Company's website: www.nevadasunrise.ca.

As a complement to its exploration projects in Esmeralda County, the Company owns Nevada Water Right Permit 86863, also located in the Lida Valley basin, near Lida, NV.

For Further Information Contact:

Warren Stanyer, President and Chief Executive Officer

email: warrrenstanyer@nevadasunrise.ca Telephone: (604) 428-8028

Website: www.nevadasunrise.ca

FORWARD-LOOKING STATEMENTS

This release may contain forward‐looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur and include disclosure of anticipated exploration activities. Although the Company believes the expectations expressed in such forward‐looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward looking statements. Forward‐looking statements are based on the beliefs, estimates and opinions of the Company's management on the date such statements were made. The Company expressly disclaims any intention or obligation to update or revise any forward‐looking statements whether as a result of new information, future events or otherwise.

Such factors include, among others, risks related to: the results of the VRIFY study seeking new target areas at Griffon; the ability of the Company to raise funds for exploration activities, permitting and property maintenance costs at Griffon; reliance on technical information provided by third parties on any of our exploration properties; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; labor disputes and other risks of the mining industry; delays due to pandemic; delays in obtaining governmental approvals, financing or in the completion of exploration, as well as those factors discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for the Nine Months ending June 30, 2025, which is available under Company's SEDAR profile at: www.sedarplus.ca.

Although Nevada Sunrise has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Nevada Sunrise disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265651