March 16, 2025

New Age Exploration (ASX: NAE) (NAE or the Company) is pleased to announce that Strike Drilling has mobilised to site with a Schramm T450 rig, and Reverse Circulation (RC) drilling has begun as of Sunday, 16 March 2025.

HIGHLIGHTS

- Maiden Reverse Circulation (RC) drill program of 3,000m has commenced at the Wagyu Gold Project, Pilbara WA

- Drilling Contractor, Strike Drilling, to take 50% of payment in equity, demonstrating confidence in the project’s potential

- Program aims to extend gold mineralisation strike and depth, following high-grade intercepts up to 15.6g/t gold in recent Phase 2 Air Core drilling

- The Wagyu Project is located in the Central Pilbara’s fast-emerging gold region, adjoining De Grey Mining (ASX:DEG) tenure containing its ~11.2Moz1 Hemi Gold deposit

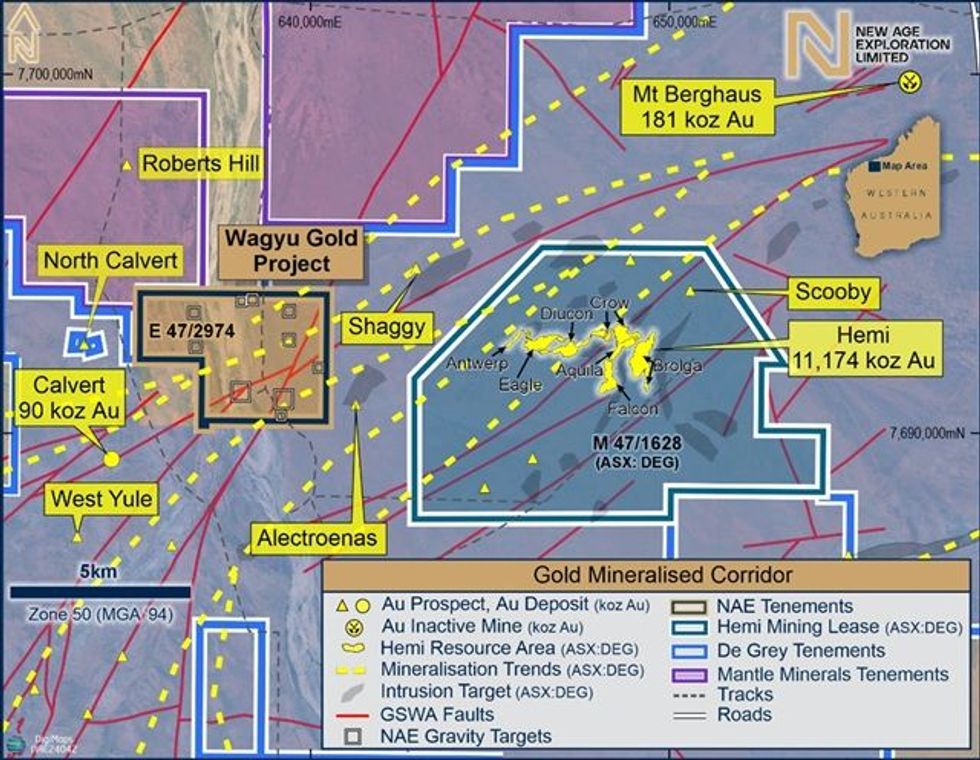

The Wagyu Gold Project, located within a fast-emerging gold mineralised corridor, represents a highly prospective Gold opportunity ~9km within the same mineralised trend as De Grey Mining’s (ASX:DEG) Hemi Gold Deposit containing ~11.2 Moz1 (refer to Figure 1) in the Central Pilbara.

NAE Executive Director Joshua Wellisch commented:

"The commencement of RC drilling marks an important milestone in advancing the Wagyu Gold Project. The support of Strike Drilling, who has agreed to take 50% of their payment in equity, is a strong endorsement of the project’s potential. We are eager to test these high-priority targets and further define the extent of gold mineralisation.”

This 3,000m RC drill program is the next step in NAE’s systematic exploration strategy at Wagyu, following promising results from recent geophysical surveys (refer ASX Announcement 11 March 2025) and Phase 2 Air Core (AC) drilling, which confirmed multiple high-grade gold intercepts including 15.6g/t gold over 1m (refer ASX Announcement 17 February 2025). The program will test five high-priority gravity targets on the eastern side of the project area, with particular emphasis on Gravity Targets 1 & 10 (Figure 2), following up on the significant gold mineralisation (>1g/t) identified in the AC drilling (Figure 3).

The Hemi Gold Mineral Resource was last updated by De Grey Mining on 14 November 20241. The estimate is for 264Mt @ 1.3g/t Au for 11.2Moz, which can be broken down into 13Mt @ 1.4g/t for 0.6Moz, 149Mt @ 1.3g/t Au Indicated for 6.3 Moz, and 103Mt @ 1.3g/t Au for 4.3 Moz Inferred.

NAE confirms that it is not aware of any new information or data that materially affects the information included in De Grey’s reported Mineral Resources referenced in this market announcement. To NAE’s full knowledge, all material assumptions and technical parameters underpinning the estimates in the relevant market announcements continue to apply and have not materially changed.

The previous AC drilling drilled to the top of fresh rock only, and this RC program will test for primary mineralisation in fresh rock below and adjacent to the oxide mineralisation identified in late 2024. RC drilling is also intended to outline better the boundaries, nature, and extent of mineralised intrusions identified from geophysics and AC drilling.

The RC drilling campaign is scheduled for completion within four weeks, with assay results expected between late April and May 2025.

Click here for the full ASX Release

This article includes content from New Age Exploration Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

New Age Exploration Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

07 July 2025

New Age Exploration

High potential for large-scale discovery in prolific gold regions in Western Australia and New Zealand

High potential for large-scale discovery in prolific gold regions in Western Australia and New Zealand Keep Reading...

16h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

18h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

22h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

New Age Exploration Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00