February 07, 2024

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) advises that it has identified multiple very large uranium targets within the Company’s 100%-owned Bangemall Projects, in the Gascoyne region of Western Australia.

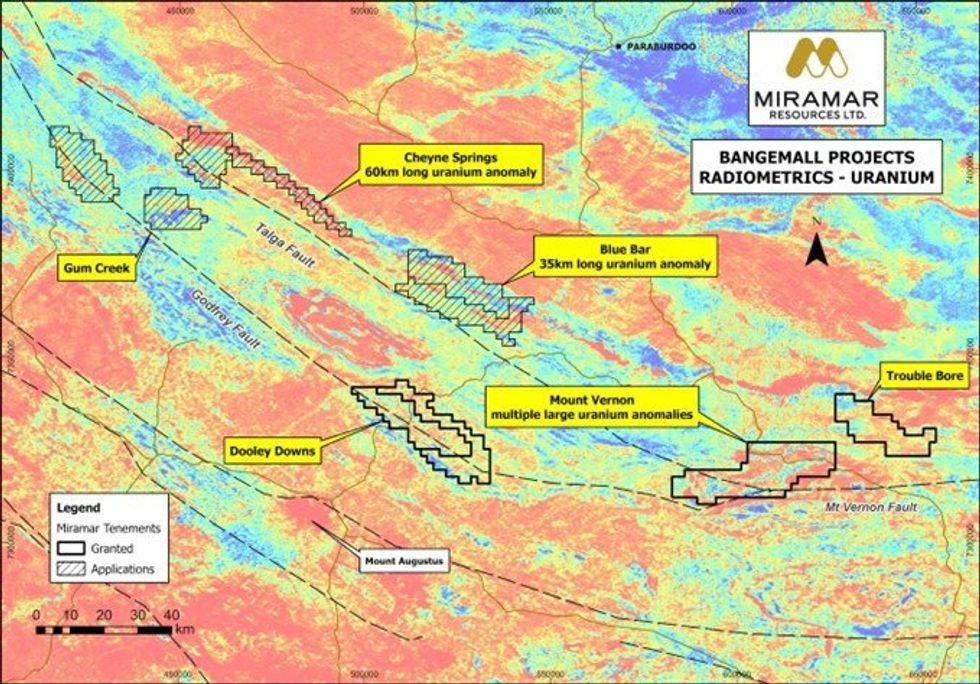

Regional radiometric data shows multiple very large and high-amplitude uranium anomalies that stretch over at least 100km of strike and across several of Miramar’s tenements (Figure 1).

Miramar’s Executive Chairman, Mr Allan Kelly, said the Company’s strategic Bangemall landholding has potential for multiple commodities and deposit types.

“Proterozoic orogens throughout Australia and worldwide host many large base and precious metal deposits, and we believe the Capricorn Orogen should be no exception,” Mr Kelly said.

“Whilst our current focus is on exploring for Norilsk-style nickel, copper and platinum group elements at our Mount Vernon and Trouble Bore Projects, we have a very long list of attractive exploration targets we aim to systematically explore,” he added.

Cheyne Springs Target

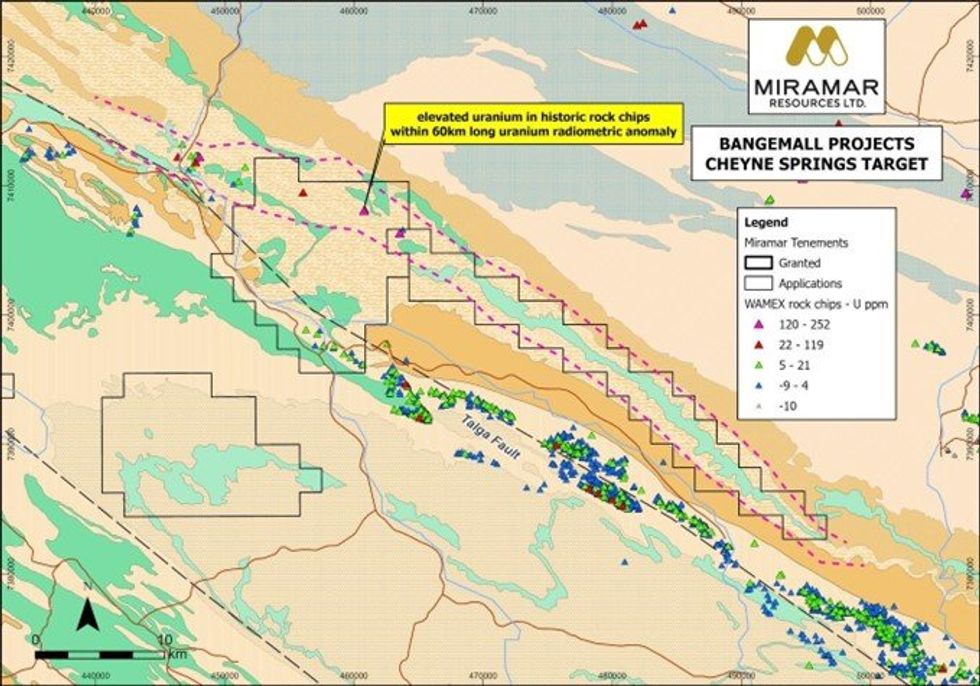

A well-defined, 60-kilometre-long uranium anomaly is located within the Cheyne Springs Target towards the northern edge of the Edmund Basin, at the contact with the older Ashburton Basin rocks (Figure 2).

The very large radiometric anomaly has been virtually unexplored except for a few wide-spaced rock chip samples that returned results up to 246ppm U (i.e. 290ppm U3O8) (WAMEX Reports a78053, a81036, a91967 and a92435) (Figure 3).

The Company is working towards grant of the tenement applications at Cheyne Springs, and the adjacent Blue Bar Target.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper stocksasx:m2rresource stocksasx stocksgold explorationgold stocksnickel stockscopper investingcopper explorationnickel exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00