February 07, 2024

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) advises that it has identified multiple very large uranium targets within the Company’s 100%-owned Bangemall Projects, in the Gascoyne region of Western Australia.

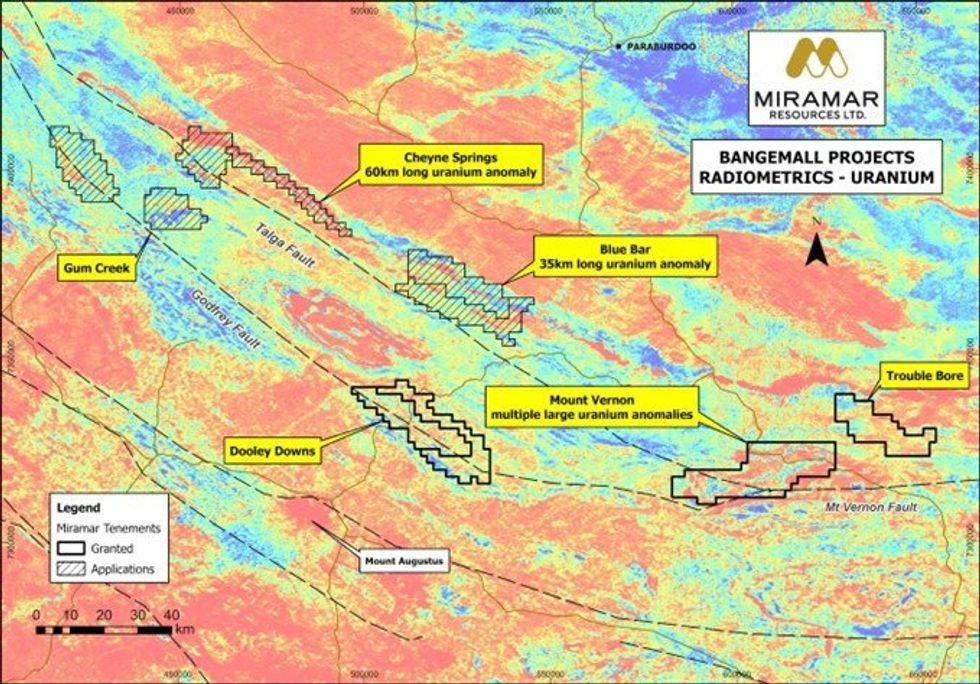

Regional radiometric data shows multiple very large and high-amplitude uranium anomalies that stretch over at least 100km of strike and across several of Miramar’s tenements (Figure 1).

Miramar’s Executive Chairman, Mr Allan Kelly, said the Company’s strategic Bangemall landholding has potential for multiple commodities and deposit types.

“Proterozoic orogens throughout Australia and worldwide host many large base and precious metal deposits, and we believe the Capricorn Orogen should be no exception,” Mr Kelly said.

“Whilst our current focus is on exploring for Norilsk-style nickel, copper and platinum group elements at our Mount Vernon and Trouble Bore Projects, we have a very long list of attractive exploration targets we aim to systematically explore,” he added.

Cheyne Springs Target

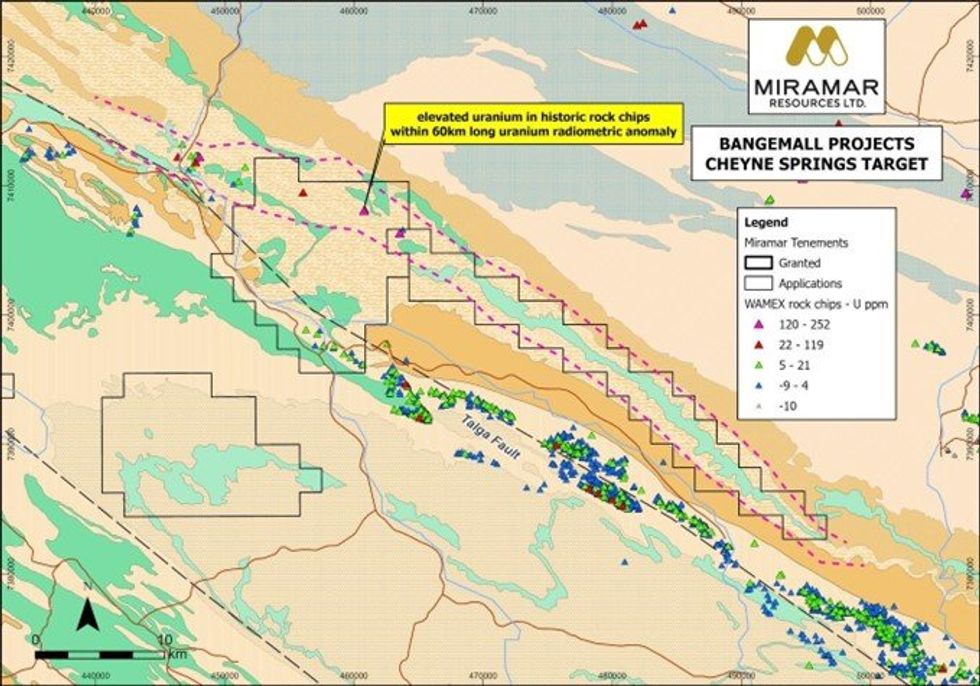

A well-defined, 60-kilometre-long uranium anomaly is located within the Cheyne Springs Target towards the northern edge of the Edmund Basin, at the contact with the older Ashburton Basin rocks (Figure 2).

The very large radiometric anomaly has been virtually unexplored except for a few wide-spaced rock chip samples that returned results up to 246ppm U (i.e. 290ppm U3O8) (WAMEX Reports a78053, a81036, a91967 and a92435) (Figure 3).

The Company is working towards grant of the tenement applications at Cheyne Springs, and the adjacent Blue Bar Target.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00