October 23, 2024

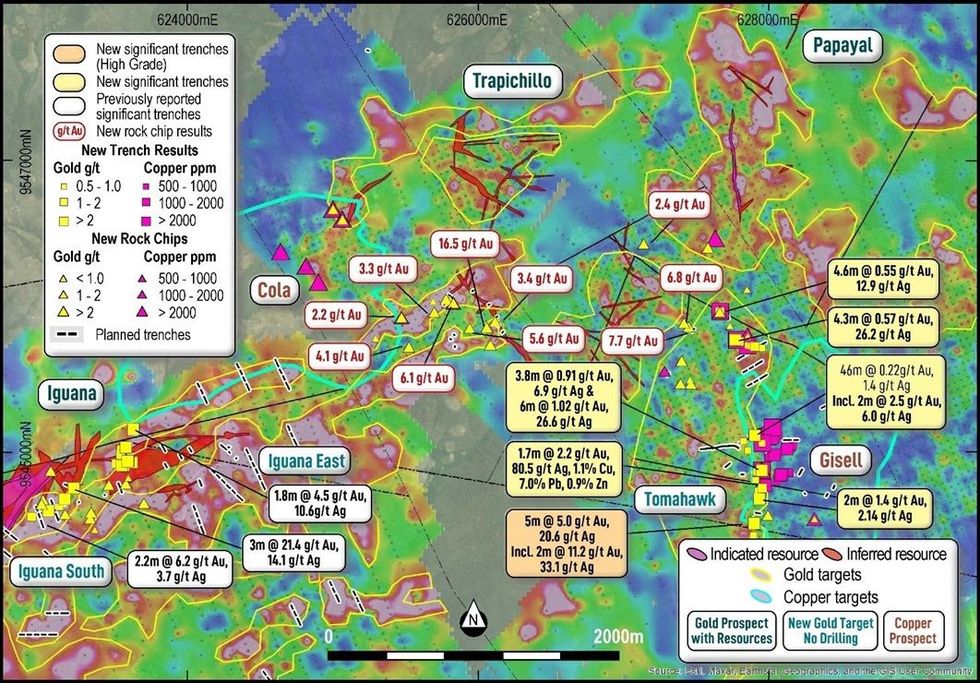

5m @ 5.0 g/t Au G 20.6 g/t Ag returned from trenching at new Tomahawk target

Titan Minerals Limited (Titan or the Company) (ASX:TTM) is pleased to provide an update on the Company’s 100% held Dynasty Gold Project (Dynasty) in southern Ecuador, where it has been conducting extensive exploration in underexplored areas outside the currently defined 3.1 Moz gold and 22 Moz silver Mineral Resource.

Key Highlights

- More high-grade gold discovered at Tomahawk, with an impressive trench result of 5m @ 5.0 g/t Au G 20.6 g/t Ag, including a high-grade zone of 2m @ 11.2 g/t Au and 33.0 g/t Ag. Discovered by reconnaissance soil geochemical sampling earlier this year, Tomahawk is a new exploration target that has never been drill tested.

- The latest result from Tomahawk is in addition to previously announced high- grade trench results from Iguana extensional areas including:

- 3.0m @ 21.4 g/t Au G 14.1 g/t Ag returned from Iguana south, where a new +400m high-grade gold-silver vein has been discovered. The new vein remains open along strike, is located within a 1km soil geochemical anomaly and has never been drilled.

- 1.8m @ 4.5 g/t Au G 10.6 g/t Ag returned from Iguana east, with results located at the edge of Inferred Mineral Resources within 1.5km long soil geochemical anomaly, in an area that has never been drilled.

- Iguana trench results were returned from areas outside the Dynasty Mineral Resource, in areas which have never been drilled, representing strong resource growth targets.

- These trench results validate the prospectivity of multiple new targets which exhibit high grade gold in rock chips coincident with soil geochemical anomalies and mapped veins. New significant gold-silver trench results from Tomahawk and Iguana provide “proof of concept” over these new exploration and resource extensional targets.

- A large campaign of surface trenching is being expedited over new exploration and resource extensional targets, with a steady flow of results expected over the coming weeks.

- Dynasty mineralisation footprint confirmed to be much larger than the 5.5km x 1km area which contains the 3.1Moz gold and 22Moz silver Mineral Resource. Reconnaissance work and latest results have confirmed mineralisation footprint to be Gkm x 2km, providing significant scope for resource growth from surface.

- Up to 10,000m of drilling is set to test lateral and depth resource extensions along with testing multiple new exploration targets at Dynasty, as the Company works toward a resource update planned for mid-2025.

Titan’s CEO Melanie Leighton commented:

“It’s exciting that our exploration efforts are being rewarded with high-grade gold results fromtrench in several of our newly identified exploration targets at the Dynasty Gold Project. This latest result of 5m @ 5.0 g/t Au returned from Tomahawk, along with the recent result of 3m @ 21.4 g/t Au at Iguana south has proven the fertility of Dynasty over a Skm x 2km area. We now know that the mineral system encompasses a much larger area than the current 3.1Moz gold & 22Moz silver Mineral Resource.

“The revelation of a much larger mineral system bodes extremely well for us, feeding into our Dynasty resource growth strategy. We are expediting the development of further trenches over priority target areas, with a view to test many of these exploration targets in the upcoming ~ 10,000m drilling campaign.

“We look forward to delivering a steady flow of trench results over new targets in the coming weeks, and more excitingly we also look forward to delivering results from resource and exploration drilling programs over the coming months, as we work towards a Dynasty resource update in mid-2025”

Dynasty Activities Update

Titan Minerals Limited (Titan or the Company) (ASX:TTM) is pleased to provide an update on the Company’s 100% held Dynasty Gold Project (Dynasty) in southern Ecuador, where it has been conducting extensive exploration in underexplored areas outside the currently defined 3.1 Moz gold and 22 Moz silver Mineral Resource.

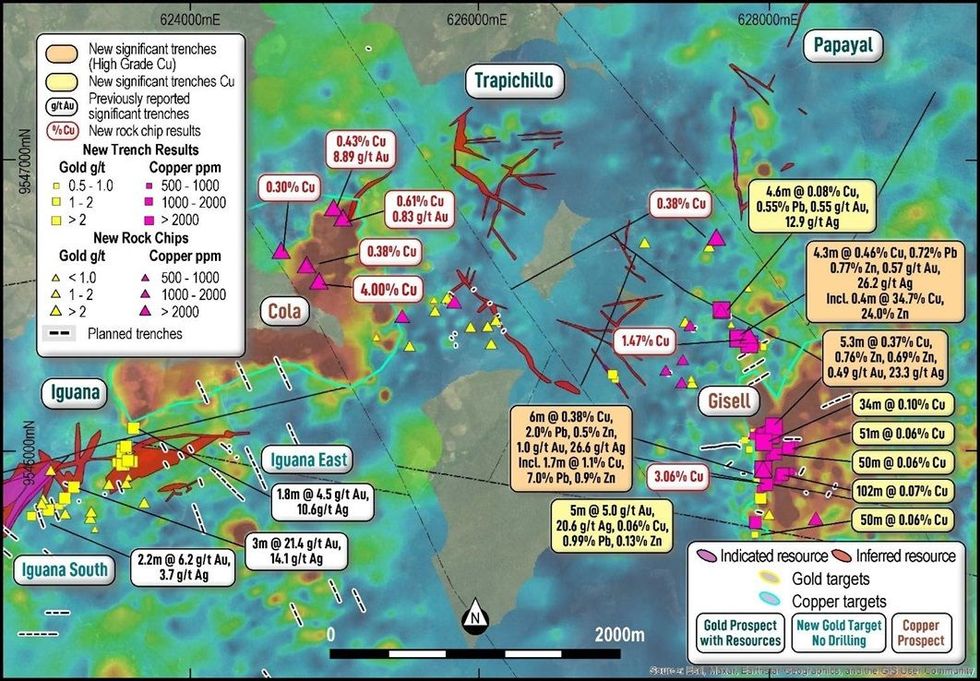

Reconnaissance exploration along the Dynasty epithermal system has successfully expanded the gold-silver mineralisation footprint along the entire 9-kilometre corridor, with the mineral system substantially expanded to an area of 9km by 2km, an area much larger than the Mineral Resource area which covers ~ 5.5km x 1km.

Along with the expanded mineralisation footprint, several new exploration and resource extensional gold and copper targets have been highlighted by recent work. Multiple new veins exhibiting high-grade gold have been confirmed from surface by mapping, rock chip sampling and most recently trenching. Importantly, the new veins are in areas never previously explored or drilled and are coincident with large-scale geochemical anomalies.

The Company has been undertaking trenching over new priority targets with the latest results returning significant intersections of high-grade gold-silver and base metals from surface at the new Tomahawk target.

Click here for the full ASX Release

This article includes content from Titan Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TTM:AU

The Conversation (0)

31 March 2022

Titan Minerals

Developing Ecuador’s Underexplored High-Grade Mineral Deposits

Developing Ecuador’s Underexplored High-Grade Mineral Deposits Keep Reading...

19h

Ole Hansen: Next Gold Target is US$6,000, What About Silver?

Ole Hansen, head of commodity strategy at Saxo Bank, believes US$6,000 per ounce is in the cards for gold in the next 12 months; however, silver may not enjoy the same price strength. "If gold moves toward US$6,000, I would believe that ... silver at some point will struggle to keep up, and... Keep Reading...

19h

Kinross’ Great Bear Gold Project Accelerated Under Ontario’s 1P1P Framework

Ontario is moving to accelerate one of Canada’s largest emerging gold projects, cutting permitting timelines in half for Kinross Gold's (TSX:K,NYSE:KGC) Great Bear development in the Red Lake district.The province announced that Great Bear will be designated under its new One Project, One... Keep Reading...

19h

Massan Indicated Conversion Programme Continues to Deliver

Asara Resources (AS1:AU) has announced Massan indicated conversion programme continues to deliverDownload the PDF here. Keep Reading...

19 February

Winston Tailings: Traxys Letter of Interest Signed

Panther Metals PLC (LSE: PALM), an exploration company focused on mineral projects in Canada, is pleased to announce that it has signed a letter of interest ("LOI") with Traxys Europe SA, a division of Traxys Group ("Traxys"), a global commodity trading and marketing market leader.The... Keep Reading...

19 February

Selta Project - Exploration Update

Rare-Earth Element Stream Sediment Sampling Results and Target Refinement

First Development Resources plc (AIM: FDR), the UK-based, Australia-focused exploration company with mineral interests in Western Australia and the Northern Territory, is pleased to provide results and interpretation from the December 2025 stream sediment sampling programme completed at its... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00