August 06, 2024

Horizon Minerals Limited (ASX: HRZ) (“Horizon” or the “Company”) is pleased to announce that it has executed through its wholly owned subsidiary, Greenstone Resources Limited, an open pit mining Joint Venture (JV) Agreement with BML Ventures Pty Ltd (“BML” or the “Miner”) for the Phillips Find Gold Project (“Phillips Find” or “Project”).

HIGHLIGHTS

- Joint Venture (JV) Agreement executed with BML Ventures Pty Limited (BML) to develop and mine two open pits at Phillips Find

- Existing 200kt Toll Miiling Agreement executed with FMR Investments Pty Ltd (FMR) to be utilised for Phillips Find JV ore

- All management, technical, operational and maintenance roles to be undertaken by BML with oversight by the Company

- Low financial risk JV structure with BML to fund all project costs, with net cashflow after the asset recovery and repayment of costs to be split 50/50 between Horizon and BML

- Mining Proposal (MP) submitted to DMIRS and is currently under assessment

- Mobilisation and site establishment is imminent, with mining commencing in the September 2024 quarter subject to MP permit being approved

- First gold production planned for the December 2024 quarter, subject to permitting

- Processing at FMR’s Greenfields mill to be undertaken for a period of eight months under the Toll Milling Agreement

- Mining at Phillips Find is independent of mining at Boorara being treated at Norton Gold Fields’ Paddington mill, with production and cashflows now coming in from two production sources

- Current Australian gold price provides favourable environment to deliver strong margins and cashflow generation

Commenting on the JV agreement, Managing Director and CEO Mr Grant Haywood said:1

“We are pleased to have partnered up with BML Ventures, who have a proven track record of delivering projects in the eastern goldfields of Western Australia. BML will be managing and sole funding the Phillips Find JV which greatly derisks the project for the Company, particularly from a financial perspective. This agreement does not require any capital from Horizon and allows us to keep our focus on our Boorara startup. The Cannon Project will be paused until sufficient cash flows are generated from our two production sites, Boorara and Phillips Find, to sole fund rather than joint venture.

We look forward to generating cash over the next 19 months from two gold mining projects in this very strong gold price environment.”

Overview

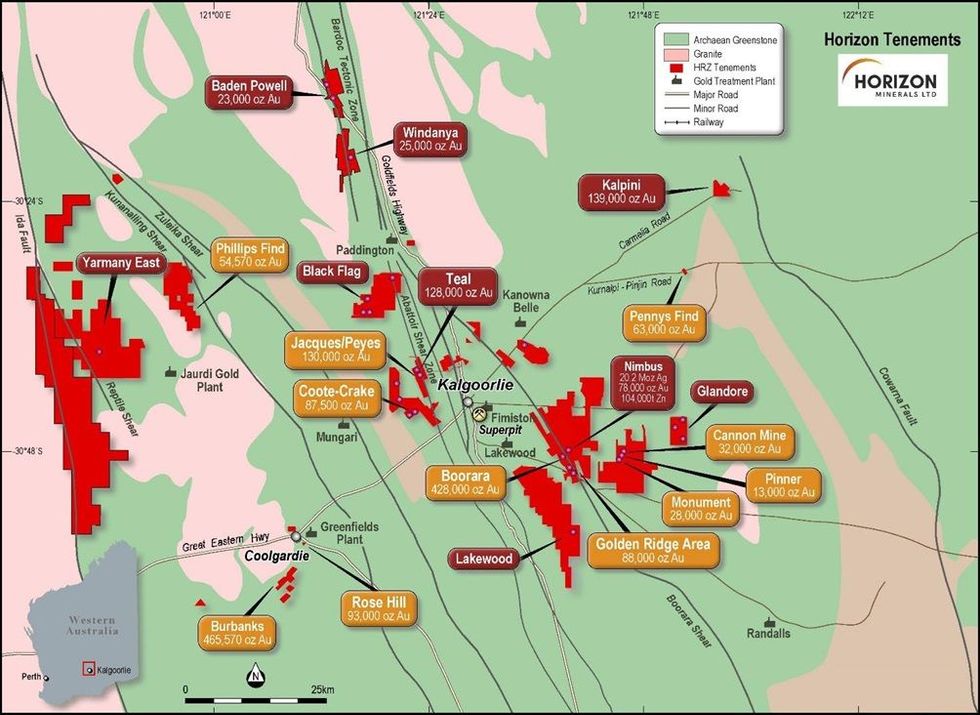

The proposed mining project is 100% owned and located 45 km north-west of Coolgaride, Western Australia in the heart of the Western Australian goldfields (Figure 1).

Phillips Find Overview

The Project covers over 10 kilometres of strike over prospective greenstone stratigraphy and includes the Phillips Find Mining Centre (PFMC) where approximately 33,000 ounces of gold has been produced between 1998 and December 2015 from three open‐pit operations; Bacchus Gift, Newhaven and Newminster.

Click here for the full ASX Release

This article includes content from Horizon Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

HRZ:AU

Sign up to get your FREE

Horizon Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

21 August 2025

Horizon Minerals

Emerging stand-alone gold producer in Western Australia

Emerging stand-alone gold producer in Western Australia Keep Reading...

25 February

Share Purchase Plan

Horizon Minerals (HRZ:AU) has announced Share Purchase PlanDownload the PDF here. Keep Reading...

18 February

Successful A$175M Capital Raising

Horizon Minerals (HRZ:AU) has announced Successful A$175M Capital RaisingDownload the PDF here. Keep Reading...

17 February

Studies Support Standalone Gold Development in WA Goldfields

Horizon Minerals (HRZ:AU) has announced Studies Support Standalone Gold Development in WA GoldfieldsDownload the PDF here. Keep Reading...

17 February

Gold Ore Reserve Update

Horizon Minerals (HRZ:AU) has announced Gold Ore Reserve UpdateDownload the PDF here. Keep Reading...

16 February

Trading Halt

Horizon Minerals (HRZ:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Horizon Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00