February 20, 2025

Targeting high-demand copper-gold projects, Metal Bank (ASX:MBK) offers a compelling investment opportunity by exploring assets in Australia, Saudi Arabia and Jordan. The company focuses on optimizing and divesting the Livingstone gold project to generate capital for expanding its copper projects in the Middle East. Metal Bank's strong regional presence, particularly in Saudi Arabia and Jordan, is underpinned by deep industry relationships and extensive operating experience.

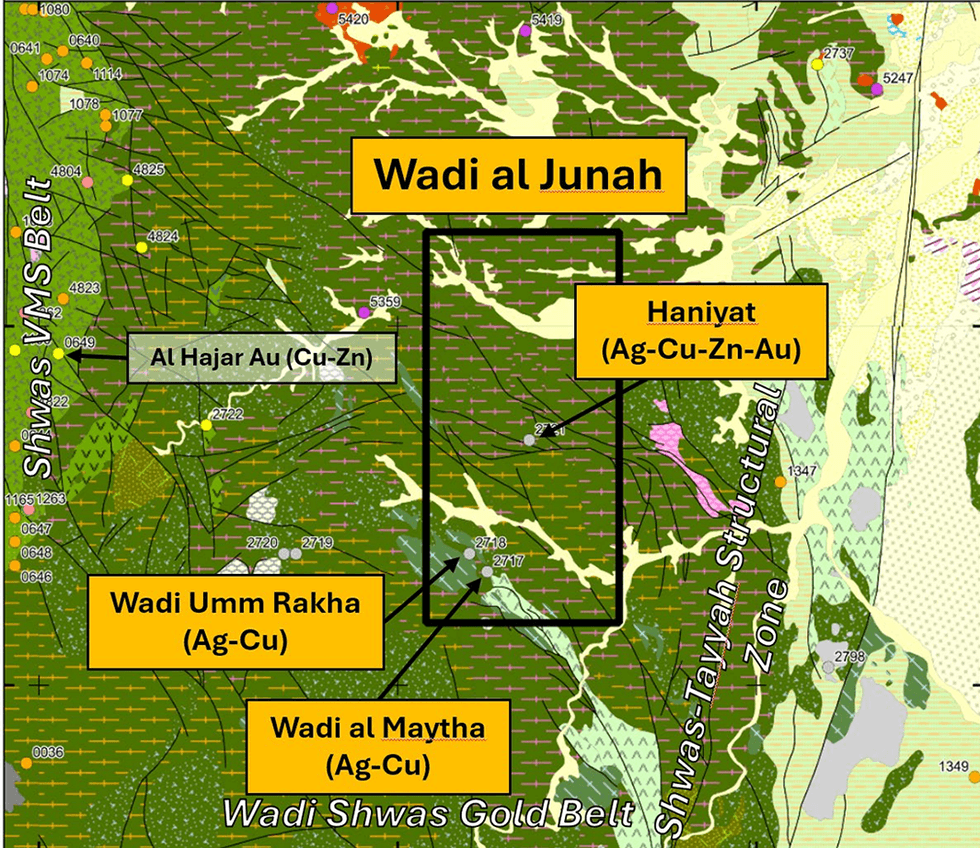

The company is securing copper and other critical minerals projects in Saudi Arabia, through its joint venture company, Consolidated Mining Company (CMC). CMC is 60 percent owned by MBK and 40 percent by Central Mining Holding Company. Its first project, Wadi Al Junah, has been awarded exploration licences in November 2024.

Wadi Al Junah is a joint venture through Consolidated Mining Company (CMC, MBK 60 percent). Exploration activities include regional geochemical surveys, surface mapping, and shear-zone anomaly identification. Phase 1 drilling is planned for Q2 2025.

Company Highlights

- Strategically focused on copper exploration and development, leveraging extensive experience and partnerships in the MENA region. Aiming for long-term growth from copper assets.

- Focused on the Livingstone gold project divestment, with ongoing JORC resource optimization, and strong corporate acquisition interest. If divested, proceeds are earmarked to fast-track exploration on the company’s copper projects.

- Expanding in Saudi Arabia by progressing the Wadi Al Junah copper project through a joint venture with Central Mining Holding Company.

- Disciplined capital allocation approach focused on low overheads and in-ground exploration investment.

- The company’s leadership team brings a proven track record in Saudi Arabia and Australia of exploration success and project execution, positioning the company for long-term value creation in the critical minerals market.

This Metal Bank profile is part of a paid investor education campaign.*

Click here to connect with Metal Bank (ASX:MBK) to receive an Investor Presentation

MBK:AU

Sign up to get your FREE

Metal Bank Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

19 February 2025

Metal Bank

Copper and gold-focused exploration in Australia and the Middle East

Copper and gold-focused exploration in Australia and the Middle East Keep Reading...

15 December 2025

Maiden Gold Resource for Seven Leaders Starter Pit

Metal Bank (MBK:AU) has announced Maiden Gold Resource for Seven Leaders Starter PitDownload the PDF here. Keep Reading...

01 December 2025

Hastings Acquisition to proceed – CEO Appointed

Metal Bank Limited (‘MBK’ or ‘the Company’) is pleased to advise that following the approval of shareholders of Hastings Technology Metals Ltd (Hastings) to the in-specie distribution of MBK Consideration Shares at the Hastings Annual General Meeting held on 28 November 2025, all conditions... Keep Reading...

26 November 2025

Millennium Drilling Commenced

Metal Bank (MBK:AU) has announced Millennium Drilling CommencedDownload the PDF here. Keep Reading...

16 November 2025

HAS:Drilling-High Grade Gold Mineralisation at Seven Leaders

Metal Bank (MBK:AU) has announced HAS:Drilling-High Grade Gold Mineralisation at Seven LeadersDownload the PDF here. Keep Reading...

06 November 2025

Entitlement Offer raises $2.42M

Metal Bank (MBK:AU) has announced Entitlement Offer raises $2.42MDownload the PDF here. Keep Reading...

20h

Editor's Picks: Gold Price Breaks US$4,600, Silver Tops US$93 in Record-Setting Week

Gold and silver are wrapping up yet another record-setting week that's seen economic uncertainty and geopolitical tensions combine to push prices upward.The yellow metal moved decisively through US$4,600 per ounce on Monday (January 12), trading above that level for a decent amount of the... Keep Reading...

15 January

Will Rhind: Gold, Silver at Record Highs, Mania Phase Still to Come

Will Rhind, CEO of GraniteShares, outlines his thoughts on gold and silver heading into 2026, noting that historical precedents point to higher prices. "Clearly when you look back on some of those other periods for gold — and silver particularly — where they went to all-time highs, then we could... Keep Reading...

15 January

Sirios Adds $1.5 Million to the Treasury After Warrant and Option Exercises

Expanding investor outreach in Q1 by participating in key investor conferences and adding to its distribution network

Sirios Resources Inc. (TSXV: SOI) (OTCQB: SIREF) ("Sirios" or "the Company") has started the year with an infusion of capital, giving the Company additional financial flexibility for enhancing its exploration and investor programs in 2026.The exercise of 10,209,000 warrants and 1,750,000 options... Keep Reading...

15 January

American Eagle Continues to Expand South Zone near Surface Mineralization: Highlights Include 140 m of 0.74% Copper Eq. and 130 m of 0.62% Copper Eq.

American Eagle Gold Corp. (TSXV: AE) ("American Eagle" or the "Company") is pleased to announce drill results that further expand the South Zone at its NAK copper-gold project in British Columbia. Holes NAK25-55 and NAK25-62 extend shallow mineralization nearly 150 meters east-southeast, while... Keep Reading...

15 January

Positive Study Results - Kalahari Copperbelt

Aterian Plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce encouraging results from an independent geophysical study completed over Prospecting Licence PL265/2025 ("Licence") in the Kalahari Copperbelt ("KCB"), in the Republic of Botswana ("Botswana").... Keep Reading...

Latest News

Sign up to get your FREE

Metal Bank Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00