January 28, 2026

Mayfair Gold (TSXV: MFG,NYSE American: MINE) is a development-stage company focused on advancing the Fenn-Gib gold project, a large, bulk-tonnage open-pit deposit situated in one of Canada’s most prolific gold districts. The company’s technical team is actively progressing provincial permitting, engaging in Indigenous consultation, advancing engineering, and conducting ongoing exploration to expand the deposit beyond its current pit boundaries.

The Preliminary Feasibility Study (PFS), prepared in accordance with NI 43-101 standards and filed in January 2026, outlines a base-case economic model with an after-tax NPV (5 percent) of C$652 million and an IRR of 24 percent, based on conservative gold prices, demonstrating rapid payback potential. Under a spot price scenario, project economics improve markedly, highlighting the asset’s strong leverage to higher gold prices. Once in operation, the project is expected to generate over $200 million in annual free cash flow, providing a robust source of capital to fund growth initiatives.

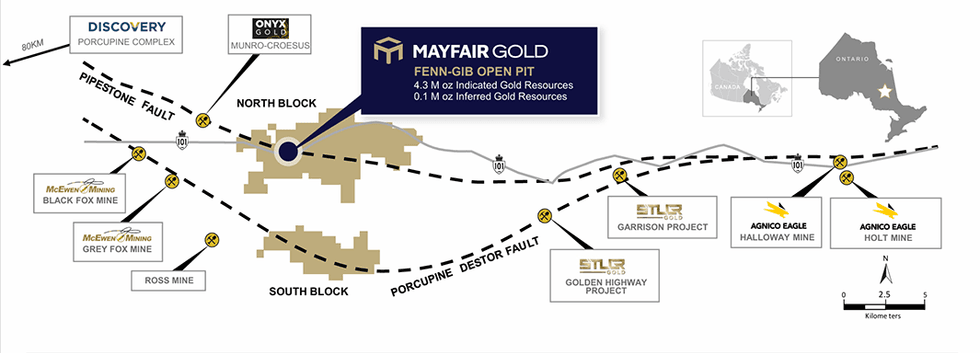

Mayfair Gold’s flagship Fenn-Gib gold project is located within the established Timmins Gold District in Ontario, which has produced more than 100 million ounces of gold historically.

Mayfair Gold’s flagship Fenn-Gib gold project is located within the established Timmins Gold District in Ontario, which has produced more than 100 million ounces of gold historically. Fenn-Gib is Mayfair’s flagship asset, encompassing a significant indicated mineral resource of 181.3 million tonnes grading 0.74 g/t gold for 4.3 million contained ounces, and additional inferred ounces. The project benefits from excellent access via Highway 101 and proximity to regional mining services.

Company Highlights

- Robust Pre-feasibility Study: The 2026 PFS highlights compelling returns on a modest initial throughput design while leveraging a large resource base.

- High-grade Early Focus: The staged plan targets higher-grade, near-surface material to optimize permitting timelines, construction risk, financing, and ultimately accelerate value capture.

- Strategic Location: Fenn-Gib sits on the highly prospective Timmins Gold District, Ontario — a tier-one mining jurisdiction with established infrastructure and a long history of mining-related activity and supportive communities.

- Strong Financial Backing: The company has a committed shareholder base, including Muddy Waters, Heeney Capital, Oaktree and Vestcor. With a tight share structure and strong Insider ownership of 35% there is clear alignment for long-term shareholder value creation.

- Exploration Optionality: Mineralization at Fenn-Gib remains open at depth and along strike, with multiple underexplored targets identified across the property. This includes a Southern Block that has not been explored but sits directly on the prolific Porcupine-Destor fault.

- Long-term optionality: With a truncated timeline to production the company will be in an advantageous spot for growth initiatives that can be funded with free cash flow.

- CEO Nick Campbell, heads a technically strong and capital-markets-savvy team with a demonstrated ability to unlock value from high-quality gold assets (previously at Artemis Gold and Silvercrest Metals) and position projects for long-term growth.

- COO Drew Anwyll is an experienced mine builder; he successfully permitted the Marathon PGM project in Ontario and was a senior executive during the construction, commissioning and start-up of Detour Lake, Canada’s largest gold mine.

This Mayfair Gold profile is part of a paid investor education campaign.*

Click here to connect with Mayfair Gold (TSXV:MFG) to receive an Investor Presentation

Sign up to get your FREE

Metro Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 March

Metro Mining

Pure-play low-cost producer of high-grade Australian bauxite

Pure-play low-cost producer of high-grade Australian bauxite Keep Reading...

8h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

8h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

04 March

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

Latest News

Sign up to get your FREE

Metro Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00