Mawson Finland Limited (" Mawson " or the " Company ") (TSX-V: MFL) is pleased to confirm that it has completed its first drill program on its wholly-owned Rajapalot Gold-Cobalt property in Northern Finland. The objective of this season's drilling was to further increase the inferred resources inventory at the Rajapalot project by exploring for potential continuations to the presently defined mineral-system.

The Rajapalot project is the subject of a current preliminary economic assessment, entitled " NI 43-101 Technical Report on a Preliminary Economic Assessment of the Rajapalot Gold-Coblat Project, Finland ", with an effective date of December 19, 2023, which the Company has filed and which is available on SEDAR+ (the " PEA "). The PEA demonstrates an NPV 5% of USD $211 million post-tax and an IRR of 27% post tax. The Rajapalot deposit inferred resource estimate has been calculated pursuant to the PEA at a size of 9.78 mt @ 2.8 g/t gold and 441 ppm cobalt, for total contained metal of 867 koz of gold and 4,311 tonnes of cobalt.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is no certainty that the PEA will be realized.

Ms. Noora Ahola, Mawson Finland CEO, states: "We had excellent conditions for drilling in winter and spring 2024 and we successfully completed an extensive 12,070-metre diamond drilling program at Rajapalot. We expect to shortly receive our assay results from this program. We hope that the results will confirm our belief in the growth potential of the deposit."

Executive Chairman, Mr. Neil MacRae added, "Management is very pleased with the progress made with the drilling campaign so far and, with the recent successful completion of the IPO, we are also very proud to have compiled a strong shareholder registry. We would especially like to thank our shareholders who have supported us since December 2023 during the Special Warrant financing round, pursuant to which we acquired the Rajapalot asset. " Mr. MacRae continued, " As well, we would like to acknowledge the efforts of our legal team at Peterson McVicar LLP and the agent for our IPO financing, Eight Capital, who were instrumental in our success. Finally, we are also very thankful to have had a significant number of local Finnish investors who have chosen to support us. We thank them in particular for their support of our Finnish-based CEO Ms. Noora Ahola, as we work to advance the Rajapalot project for the benefit of all shareholders and locals alike."

Winter Drill Campaign, January to April 2024

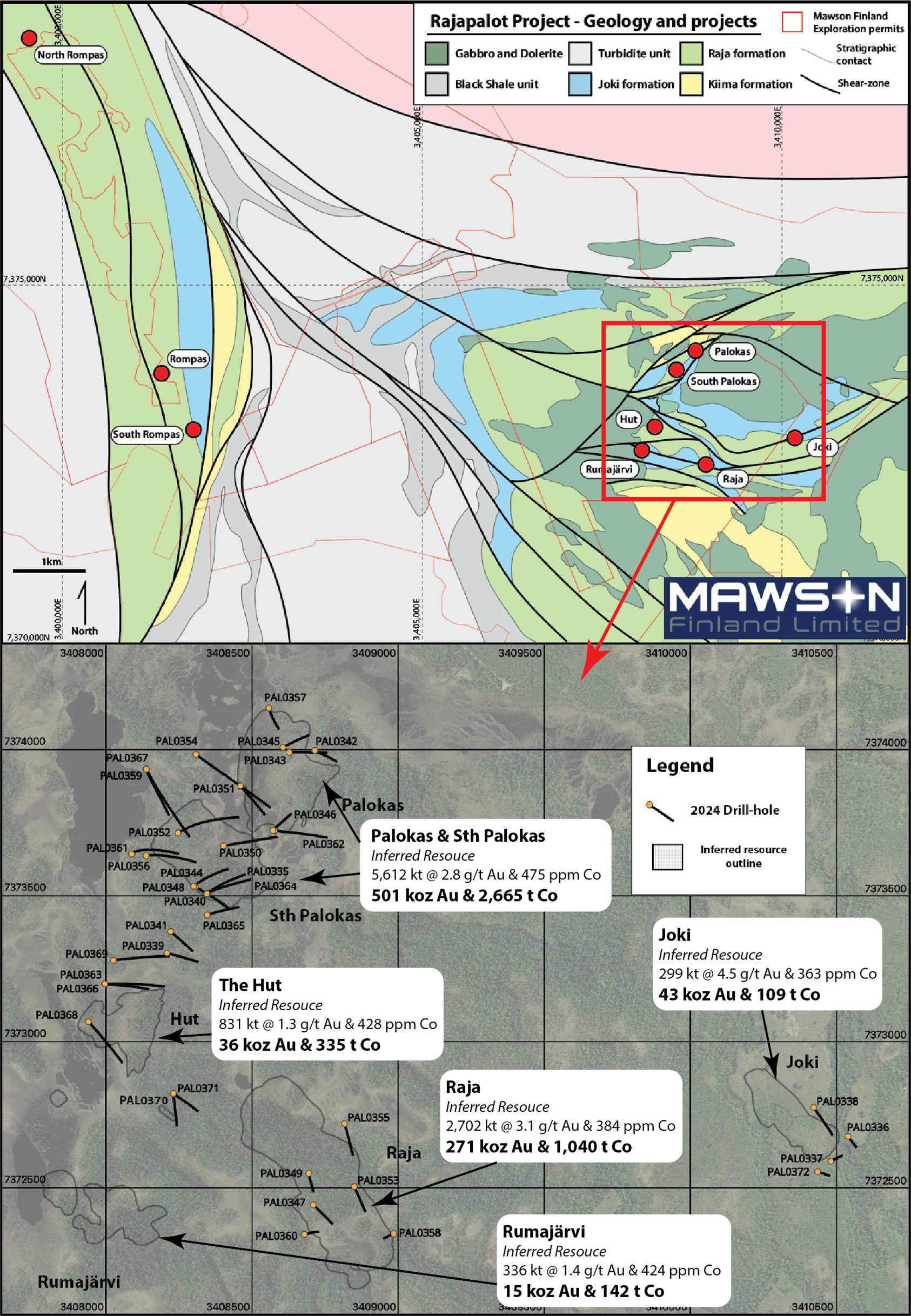

During January to April 2024, 3 drill-rigs drilled a total of 12,070 metres of diamond core from 38 drillholes around the Palokas, Hut, Raja and Joki deposits. Primary aims for this drilling were to intercept gold-cobalt mineralisation, both the along-strike and down-dip, of the presently defined envelopes of inferred-category gold-cobalt mineralisation at Rajapalot. 20 drillholes were drilled around the Palokas deposits, 8 around the Hut, 6 at Raja and 4 at Joki deposit (see Figure 1 hereinbelow). Drilling has focused on extending higher-grade areas defined from within the current published resource, with the aim of delivering additional, higher-grade tonnes into the future resource base. Assay results from this drilling will be released as they become available. Additionally, 5 of these drillholes were selected for "downhole EM" geophysical surveys of which results will be published in due course.

Figure 1. Geological map of the Rajapalot property showing location of major deposits and other known prospects. Inset/lower map illustrates the location of drillholes completed at Rajapalot between January and April of 2024. Drilling can be seen focusing around the major deposits at Rajapalot, with inset text boxes documenting their current estimated inferred resource metrics as per the PEA.

Geological Preparation Work for the 2025 Winter Drilling Campaign

Leading into the 2025 winter drilling campaign, Mawson intends to undertake a series of surface geochemical and geophysical surveys to further develop potential mineralised extensions of the Rajapalot resource and search for additional exploration targets in and around the broader Rajapalot area. Summer and autumn exploration work will focus on the collection of a 1000-sample soil geochemical survey, and additional "downhole EM" and "fixed-loop EM" geophysical surveys will be undertaken in late-August through to December to develop further exploration targets around the Rajapalot area, whilst also searching for extensions in the periphery to the mineralisation forming the current resource inventory. At Rajapalot, historical surface geochemical and geophysical surveys have successfully identified new areas of gold and cobalt mineralization. Regional exploration activities will also occur in conjunction with these resource-expansion objectives to recognize new promising drill targets.

Mawson has also conducted a full geological review of the Rajapalot property over the last 6 months and has identified some primary factors that have been consistently found to control the gold-cobalt ore-system in the Rajapalot district, among which is a structural control in the form of re-activated shear-zones hosting mineralisation in close conjunction with certain geochemical and rock-permeability affinities belonging to the host-stratigraphy. As such, the intersection of reactivated shear-zones (those containing extreme hydrothermal alteration), that cross-cut preferable litho-stratigraphic units (fiamme-tuff beds of basaltic affinity) present ideal locations for mineralisation in the Rajapalot area. Mawson intends future exploration activities in the Rajaplot district to hereafter focus on areas where mapped shear-structures are seen interacting/cross-cutting with key litho-stratigraphic horizons. Both soil and subsurface geochemical sampling and "EM" geophysical surveys will be conducted over these hypothesised ‘ore-forming' environments in order to develop drill-targets for further exploration of gold-cobalt mineralisation around the Rajapalot area, whilst also searching for extensions in the periphery to the mineralisation forming the current resource inventory. Mawson expects to subsequently drill-test developed targets as part of its planned 2025 winter drilling campaign.

Background of Rajapalot

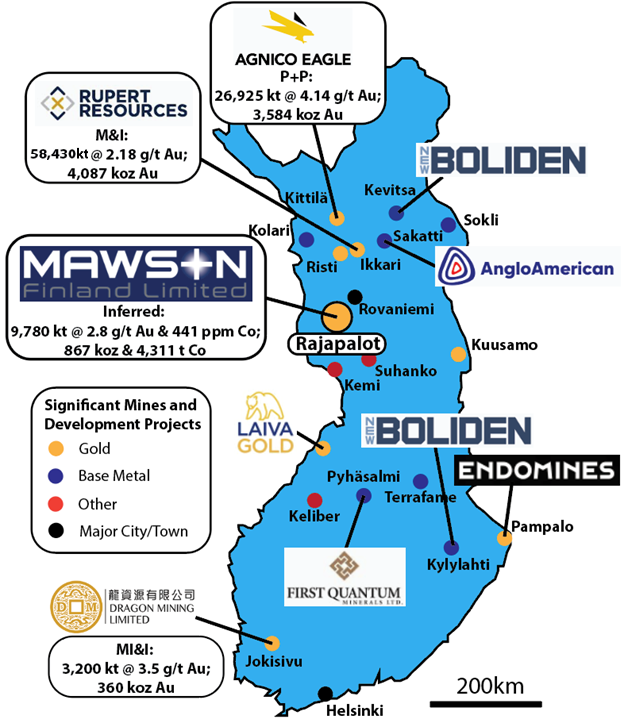

The Rajapalot gold-cobalt mineralisation was first discovered by the previous owner Mawson Gold Ltd. (then Mawson Resources Ltd.) in 2012 through sampling of surface outcropping sulfide-bearing rocks. This initial discovery was immediately drilled and has become what is now named the Palokas deposit. Over the subsequent 10 years, approximately 100,000 meters of core has been drilled, culminating in the current PEA, pursuant to which a total of 867 koz of gold and 4,311 tonnes of cobalt has been defined in the inferred resources category, being 9.78 mt @ 2.8 g/t gold and 441 ppm cobalt. Geologically, the Rajapalot deposit is considered an orogenic-style deposit, with mineralisation hosted in the Paleoproterozoic-aged Kivalo Group of the Peräpohja greenstone belt. Several productive orogenic-style gold deposits are known from northern Finland, including the Agnico-Eagle Kittila Mine (2 MOz Au produced and 3.5 MOz Au in proven and probably mineral reserves, being 26,925 kt @ 4.14 g/t Au), and Rupert Resources Ikkari deposit (4 MOz Au in measured and indicated mineral resources, being 58,430 kt @ 2.18 g/t Au) which is presently still in its development phase (see Figure 2 hereinbelow, being a locality map of Finland).

Figure 2) Locality map of Finland illustrating the location of Mawson Finland's Rajapalot project, relative to the locations of other major mines and development projects currently active in Finland.

Qualified Person and Technical Information

Technical and scientific information contained herein relating to the Rajapalot project located in Finland is derived from the PEA, which was prepared for the Company by Christopher Bray, BEng (Mining), MAusIMM(CP), of SRK Consulting (UK) Limited, Ove Klavér, MSc (Geology), Eur.Geol., FAMMP, of GeoPool Oy, Eemeli Rantala, MSc (Geology), P.Geo., of AFRY Finland Oy, Craig Brown, B.E. (Chem), GradDipGeosci, FAusIMM, of Resources Engineering & Management Pty Ltd, and Mathieu Gosselin, P.Eng., of Gosselin Mining AB. The PEA was prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (" NI 43-101 ").

The technical and scientific information in this news release was reviewed, verified and approved by Dr. Thomas Fromhold, an employee of Fromhold Geoconsult AB, and Member of The Australian Institute of Geosciences (MAIG, Membership No. 8838). Mr. Fromhold is a "qualified person" as defined under NI 43-101.

The PEA is based on technical data, documents, reports and information supplied by Mawson Oy, a wholly-owned subsidiary of the Company, including copies of concession application and award documents, historical reports on exploration and drilling, and internal reports by Mawson Oy staff and consultants/contractors. The specific reports which form the basis for the PEA are listed in Section 27 of the PEA. Please see the PEA for discussion of, among other things, data verification and additional exploration information applicable to the technical disclosure herein provided.

About Mawson Finland Limited

Mawson Finland is an exploration stage mining development company engaged in the acquisition and exploration of precious and base metal properties in Finland. The Company is primarily focused on gold and cobalt. The Corporation currently holds a 100% interest in the Rajapalot Gold-Cobalt Project located in Finland. The Rompas-Rajapalot Property consists of 11 granted exploration permits for 10,204 hectares and 2 exploration permit applications and a reservation notification area for a combined total of 40,496 hectares. In Finland, all operations are carried out through the company's fully owned subsidiary, Mawson Oy. The Company maintains an active local presence of Finnish staff with close ties to the communities of Rajapalot.

Additional disclosure including the Company's financial statements, technical reports, news releases and other information can be obtained at mawsonfinland.com or on SEDAR+ at www.sedarplus.ca .

Media and Investor Relations Inquiries

Please contact: Neil MacRae Executive Chairman at neil@mawsonfinland.com or +1 (778) 999-4653, or Noora Ahola Chief Executive Officer at nahola@mawson.fi or +358 (505) 213-515.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No securities regulatory authority has reviewed or approved of the contents of this news release.

Forward-looking Information

This news release includes certain "forward-looking information" and "forward-looking statements" within the meaning of applicable securities laws (collectively, "forward-looking information") which are not comprised of historical facts. Forward-looking information includes, without limitation, estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking information may be identified by such terms as "believes", "anticipates", "expects", "estimates", "aims", "may", "could", "would", "will", "must" or "plan". Since forward-looking information is based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, and management of the Company believes them to be reasonable based upon, among other information, the contents of the PEA, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, any expected receipt of assay results or other exploration results and the impact upon the Company thereof, potential mineralization whether peripheral to the existing Rajapalot resource or elsewhere, any anticipated disclosure of assay or other exploration results and the timing thereof, the estimation of mineral resources, exploration and mine development plans, including drilling, soil sampling, geophysical and geochemical work, any expected search for additional exploration targets and any results of such searches, the existence of, location of and results of finding any hypothesised ore-forming environment, potential acquisition by the Company of any property, the growth potential of the Rajapalot resource, all values, estimates and expectations drawn from or based upon the PEA, and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: any change in industry or wider economic conditions which could cause the Company to adjust or cancel entirely its exploration plans, failure to identify any hypothesised ore-forming environments or failure of any such identified environments to yield meaningful results, failure to identify mineral resources or any additional exploration targets, failure to convert estimated mineral resources to reserves, any failure to receive the results of completed assays or other exploration work, poor exploration results, the inability to complete a feasibility study which recommends a production decision, the preliminary and uncertain nature of the PEA, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDAR+. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.