- WORLD EDITIONAustraliaNorth AmericaWorld

October 12, 2023

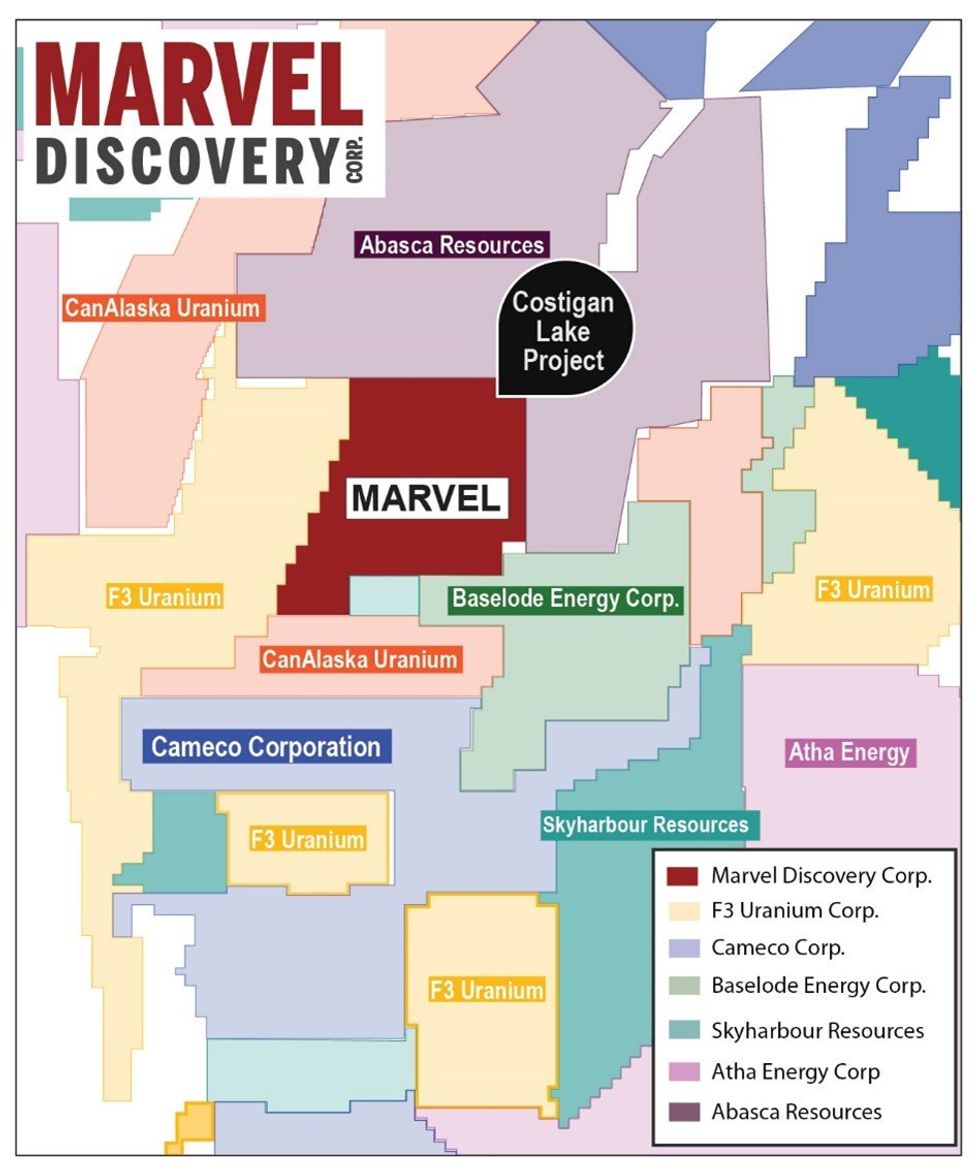

Marvel Discovery Corp. (TSX-V:MARV)(Frankfurt:O4T)(OTCQB:MARVF); ("Marvel" or the "Company") is pleased to announce that the Company has entered into an agreement to acquire the Costigan Lake Uranium project, which covers 5,518ha located on the eastern side of the Athabasca Basin. The acquisition enhances Marvel's land portfolio of uranium holdings at Key Lake, which is adjacent to Cameco, F3 Uranium, Skyharbour, and Abasca Resources. This acquisition increases the Company's footprint to 4 distinct projects covering over 23,130ha and is in line with Marvel's aggressive approach to project generation and exploration. The company is utilizing the same innovative techniques that have led to some of the largest discoveries in the Athabasca Basin including radon surveys, ground geophysics, underwater spectrometer analysis, and airborne radiometric surveys.

Costigan Lake Highlights

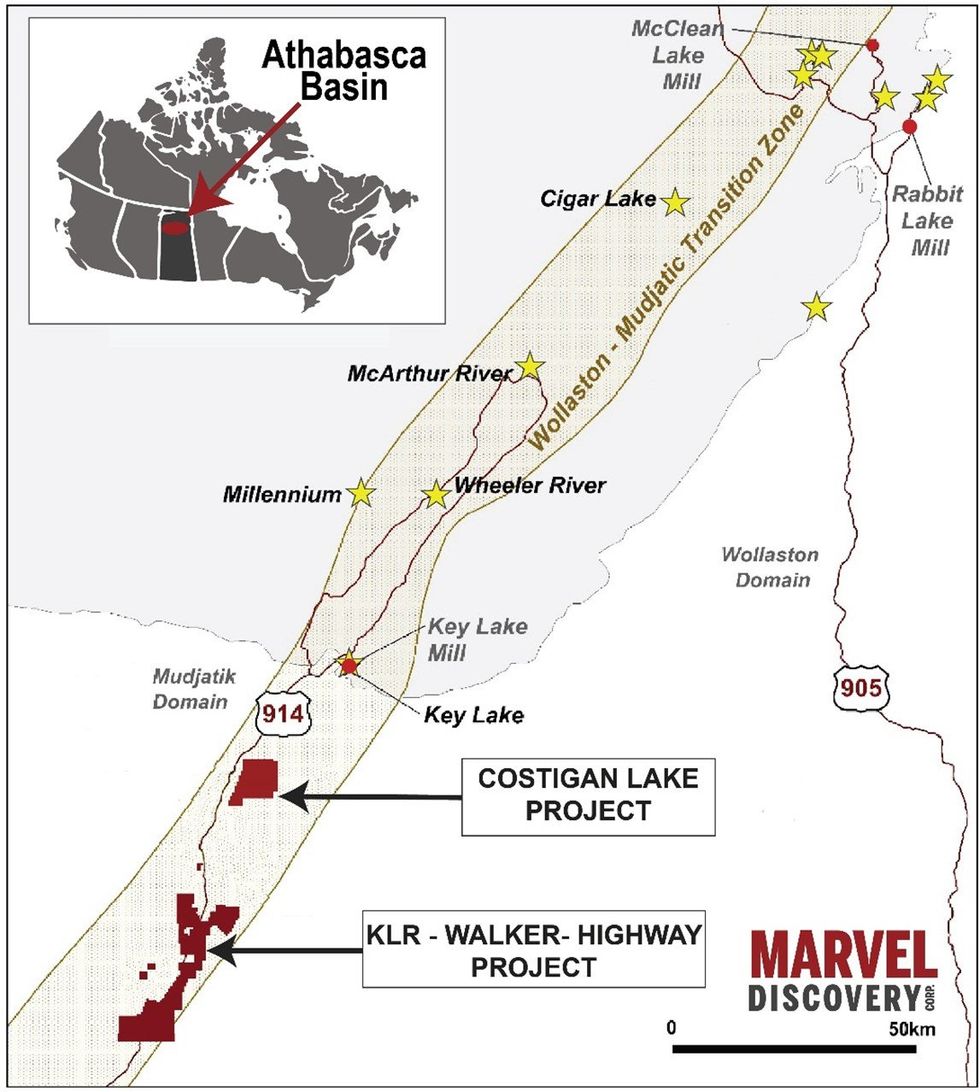

- Strategically located 25km southwest of Cameco's Key Lake Mine and mill complex and is perfectly situated along the Wollaston-Mudjactic Transition Zone ("WMTZ"), which hosts the highest-grade uranium mines in the world.

- Infrastructure: proximal to or within 8kms to the Highway 914 - a primary year-round maintained road servicing the operational Key Lake Mill.

- Prospective Geological Setting: within the "WMTZ" Zone - the same basement rocks that host all of the major uranium deposits on the east side of the Athabasca Basin.

- On trend with some of the world's largest Uranium Mines: Key Lake, Cigar Lake and McArthur River.

- Adjoins F3 Uranium's (TSXV:FUU) Hobo Project who just announced a $15 million investment from Denison Mines (see press release dated Oct 6, 2023).

- Adjoins Abasca Resources (TSXV:ABA) Key Lake South Project, who just completed a 4,959 m drill program with 9 of the 11 holes intersecting anomalous uranium (see press release dated May 24, 2023)

- Several high-merit exploration targets: over 16 km of subsurface conductors lying within a magnetic low within the "WMTZ".

- Additional targets include anomalous radioactive boulder trains, first discovered in 1978 by Rainbow Oil Limited.

- The Property has limited systematic modern-day exploration, which presents blue sky potential.

Mr. Karim Rayani, Chief Executive Officer, commented, "Marvel has completed an almost impossible task of acquiring key ground in the prolific Key Lake Corridor. The addition of the Costigan Lake Property is within the WMTZ and the Key Lake Shear Zone, which represents tremendous opportunity. We are active in the richest uranium belt in the Basin and on trend with world class discoveries. Marvel's approach is nothing short of Marvelous: going after multi commodity- large scale projects that mimic the success of basement-hosted uranium deposits found on the western side of the Athabasca Basin, such as NexGen Energy's Arrow Deposit. We look forward to a very busy winter season of exploration in the Basin."

Figure 1. Marvel's Costigan Lake Project location along the Key Lake Fault in the eastern Athabasca Basin.

Figure 2. Location of Marvel's Costigan Lake, Walker, KLR and Highway Uranium Projects in the "WMTZ" Zone, host to the highest-grade uranium deposits in the world.

The Transaction

As consideration, the Company has agreed to pay the vendor a total of $1,000,000 and complete $2,000,000 in exploration expenditures over a 5-year period. In addition, the Optionee will retain a 1.0% net smelter royalty, which Marvel can purchase for $1,500,000.

Qualified Person

The technical content of this news release has been reviewed and approved by Mike Kilbourne, P.Geo., who is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects. The QP has not completed sufficient work to verify the historic information on the additional acquired ground particularly regarding historical exploration, neighbouring companies, and government geological work.

About Marvel Discovery Corp.

Marvel, listed on the TSX Venture Exchange for over 25 years, is a Canadian based emerging resource company. The Company is systematically exploring its extensive property positions in:

- Newfoundland (Slip, Gander North, Gander South, Victoria Lake, Baie Verte, and Hope Brook - Au Prospects)

- Atikokan, Ontario (BlackFly - Au Prospect)

- Elliot Lake, Ontario (East Bull - Ni-Cu-PGE Prospect)

- Quebec (Duhamel -Ni-Cu-Co prospect & Titanium, Vanadium, and Chromium Prospect)

- Prince George, British Columbia (Wicheeda North - Rare Earth Elements Prospect)

The Company's website is: https://marveldiscovery.ca/

ON BEHALF OF THE BOARD

Marvel Discovery Corp.

"Karim Rayani"

Karim Rayani

President/Chief Executive Officer, Director

Tel: 604 716-1036 email: k@r7.capital

Disclaimer for Forward-Looking Information:

Certain statements in this release are forward-looking statements which reflect the expectations of management. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward-looking statements in this press release relate to, among other things: completion of the proposed Arrangement. Actual future results may differ materially. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. There is no assurance any of the conditions for closing will be met. Forward-looking statements reflect the beliefs, opinions, and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the respective parties, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these times. Except as required by law, the Company does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

MARV:CA

The Conversation (0)

27 December 2023

Marvel Discovery

Acquisition, Exploration and Development of Mineral Assets in Canada

Acquisition, Exploration and Development of Mineral Assets in Canada Keep Reading...

10h

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

10h

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

17h

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold (TSX:ELD,NYSE:EGO) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that will create a larger, diversified gold and copper producer with two major development projects that are set to enter production in 2026.Following completion under a... Keep Reading...

19h

Stellar AfricaGold Intersects Multiple Gold-Bearing Zones and Confirms Structural Controls at Tichka Est, Morocco - Drilling Resumed on January 30, 2026

(TheNewswire) Vancouver, BC TheNewswire - February 3rd, 2026 Stellar AfricaGold Inc. ("Stellar" or the "Company") (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold... Keep Reading...

02 February

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

02 February

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00