July 05, 2023

Titan Minerals Limited (Titan or the Company) (ASX:TTM) is pleased to announce a first Mineral Resource Estimate (MRE), which is reported in accordance with JORC (2012) on the Company’s 100% owned Dynasty Gold Project (Dynasty), in the Loja Province, southern Ecuador.

Key Highlights

- Indicated and Inferred Mineral Resource Estimate of 43.54 Mt at 2.23 g/t Au & 15.7 g/t Ag for a contained 3.12 million ounces of gold and 21.98 million ounces of silver1

- Mineral Resources reported by area:

- Cerro Verde: 28.8Mt @ 2.08 g/t Au, 13.00 g/t Ag for 1.92 Moz Au, 12.04 Moz Ag

- Iguana: 10.9Mt @ 2.02 g/t Au, 13.68 g/t Ag for 0.71 Moz Au, 4.81 Moz Ag

- Papayal: 2.9Mt @ 3.80 g/t Au, 39.31 g/t Ag for 0.36 Moz Au, 3.71 Moz Ag

- Trapichillo: 0.9Mt @ 4.54 g/t Au, 50.85 g/t Ag for 0.13 Moz Au, 1.43 Moz Ag

- Significant high-grade component of 17.3Mt @ 3.77 g/t Au, 24.0g/t Ag for a contained 2.09 million ounces of gold and 13.33 million ounces of silver2

- Over half of Mineral Resources contained within 100 metres from surface

- 39% Indicated and 61% Inferred Resources, with majority of Indicated resources at Cerro Verde, which is largely credited to the additional drilling and QAQC work completed by Titan over this area and gives confidence that the same classification can be achieved through moderate drilling and geological workstreams at other resource areas.

- Papayal and Trapichillo vein systems exhibit extremely high gold and silver grades, albeit relatively low tonnes, which is largely a function of sparse drilling. These areas will be a focus for resource growth, with drilling set to commence in the coming months.

- Dynasty Gold Project significantly derisked with completion of JORC compliant Mineral Resource, providing a robust 3D model for targeting resource growth and initiating future mine development studies.

- Substantial depth extensions to the epithermal Au-Ag vein system confirmed to 350m in latest drill results at Brecha-Comanche (Cerro Verde), providing the confidence to test, and potentially add substantial resources through delineating depth extensions across the project.

- Several high conviction

areas for resource additions identified with minimal drilling required. Several significant drill intercepts were excluded from the resource

due to uncertainty in geological interpretation in some areas. Minimal drilling required to improve geological understanding in these areas,

representing potential near-term future resource additions.

- Ongoing discussions with strategic investors for Dynasty and other projects progressing

Titan’s CEO Melanie Leighton commented:

“The completion of a JORC 2012 compliant Mineral Resource for Dynasty is a fantastic achievement, which represents a significant milestone. It is the culmination of a massive body of work, including validation of historical data, considerable QAQC, and 3D geological modelling. The integration of extensive qualitative and quantitative datasets has been instrumental in generating a robust mineral resource.

“The maiden JORC compliant MRE has not only verified, but substantially grown the previous NI43-101 resource, with 3.12M ounces of gold and 21.98M ounces of silver now contained in JORC resource estimates within the epithermal vein system, and even more impressive is that more than half of the resource sits within 100 metres from surface, with preliminary optimisation studies indicating robust economics for open pit and underground mining.

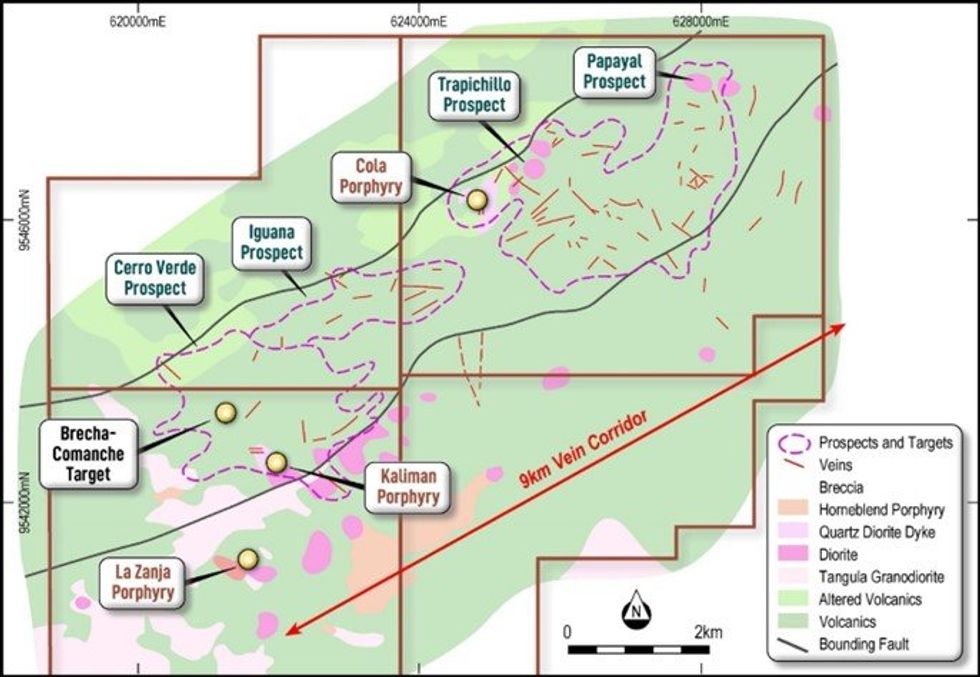

“Dynasty boasts a 9km epithermal corridor, seeded with porphyry targets, and drilling to date has only tested a portion- less than half- of the system. Titan is in a prime position to rapidly grow the resource, with resource extension drill testing set to commence in the coming month, along with the continuation of exploration work programs across priority targets identified in exploration work currently underway at the Papayal and Trapichillo prospects.

“Titan aspires to emulate the success of Lundin Gold Inc. (TSX:LUG) and their world-class Fruta del Norte Gold Project in southeast Ecuador, an epithermal gold-silver intermediate sulphidation system with many similarities to Dynasty and containing Mineral Resources of 9.81 Moz gold and 15.0 Moz silver. Touted as one of the highest grade, lowest cost mines in the world, Fruta del Norte commenced operation in 2019, and in 2022 total revenue was $841 million.”

Click here for the full ASX Release

This article includes content from Titan Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TTM:AU

The Conversation (0)

31 March 2022

Titan Minerals

Developing Ecuador’s Underexplored High-Grade Mineral Deposits

Developing Ecuador’s Underexplored High-Grade Mineral Deposits Keep Reading...

8h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

20h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

21h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

21h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

22h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

22h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00