July 01, 2025

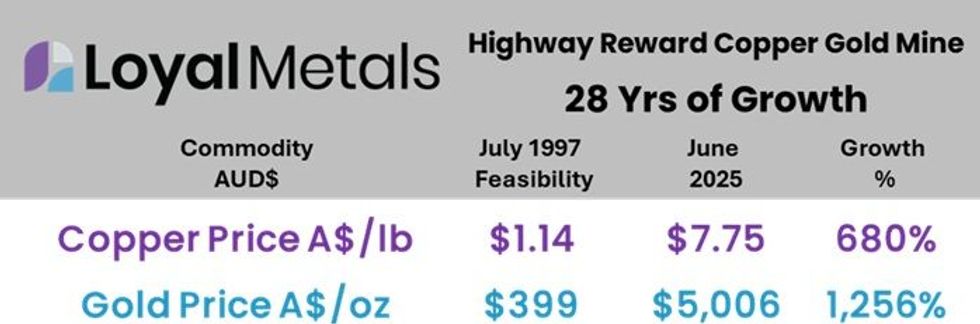

Loyal Metals Limited (ASX:LLM) (Loyal, LLM, or the Company) is pleased to announce that it has acquired a binding option to purchase the Highway Reward Copper Gold Mine in Queensland, Australia, one of the highest-grade copper mines worldwide, with past production totalling 3.65 million tonnes at 5.7% Cu and 260,000 tonnes at 4.5 g/t Au 1-9. This acquisition is the first step in Loyal’s 2025 Strategic Plan to broaden its critical minerals portfolio into copper. No exploration has been conducted on the mining leases since mining ceased in July 2005, despite a ~680% increase in copper prices and a ~1,256% increase in gold prices since the 1997 feasibility study 3,4. With over $4.4 million in funding, Loyal is well-positioned to revisit the high-grade Highway Reward Copper Gold Mine by deploying modern exploration techniques11.

Key Highlights

- Loyal secures binding option to acquire the Highway Reward Copper Gold Mine in Queensland, Australia - one of the world’s highest-grade copper mines, with past production totalling 3.65Mt at 5.7% Cu and 260kt at 4.5 g/t Au.

- The acquisition is the first step in Loyal’s 2025 Strategic Plan to broaden its critical minerals portfolio into copper.

- No exploration has been conducted on the granted mining leases since operations ceased in July 2005 despite a ~680% increase in copper prices and a ~1,256% increase in gold prices since the 1997 feasibility study.

- Significant increase in copper and gold prices, combined with the previous exclusion of gold in sulphides from the mine plan, highlights the enhanced remnant copper-gold potential.

- Exploration potential for new discoveries both along strike and at depth, as previous mining only reached depths of 220 metres for open pit and 390 metres for underground operations, with limited exploration beyond mined zones.

- With $4.4 million in funding, Loyal is well-positioned to revisit the high-grade Highway Reward Copper Gold Mine by deploying modern exploration techniques. With global initiatives to enhance energy grids and no USA tariffs on Australian copper, the outlook for copper is strong and unencumbered.

Loyal‘s Managing Director, Mr. Adam Ritchie, commented:

"We are thrilled to secure this incredibly rare opportunity for our current and future Loyal investors. The Highway Reward Copper Gold Mine, considered one of the highest-grade copper mines in the world, is now primed for a revisit after 20 years of dormancy.

The granted mining leases of the Highway Reward mine provide an amazing speed to market opportunity - especially when both copper and gold are near all-time highs. The short-term and long-term opportunities at Highway Reward are exciting, considering the significant growth in commodity prices since the 1997 feasibility study. Copper is driving our electric future and gold continues to play an important role in our global economy.

Whilst a lot has changed in the past 28 years, the unwavering demand for copper and gold has only intensified. This is truly an amazing opportunity to unlock and showcase the immense potential of this forgotten mine. With modern technology and innovative mining techniques, we believe the Highway Reward Copper Gold Mine will provide exceptional value and returns to our Loyal shareholders."

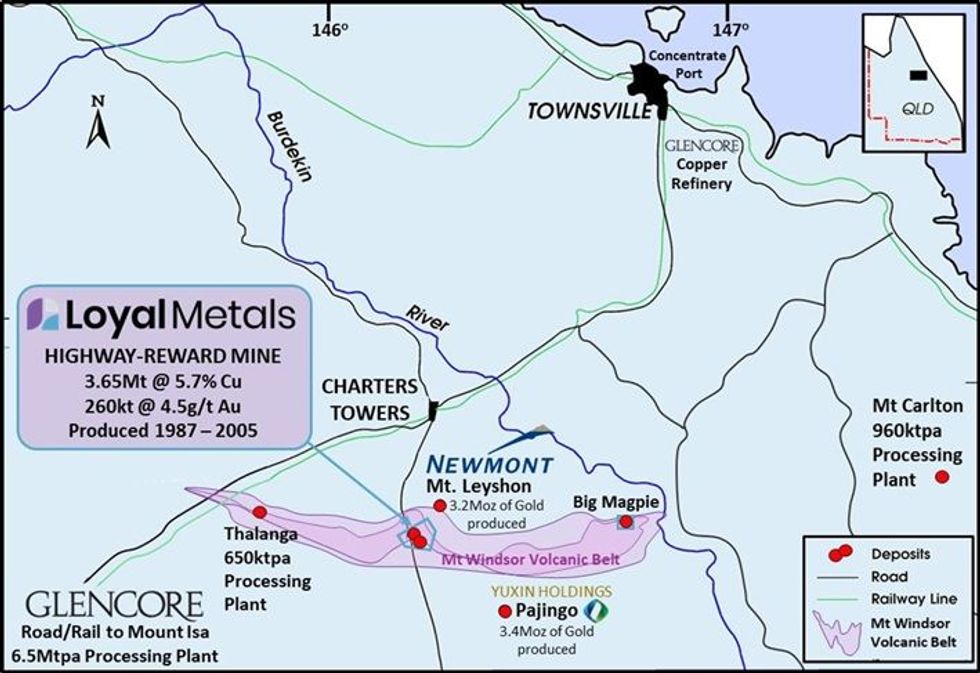

The Highway Reward Copper Gold Mine is located only 37 km from the active mining town of Charters Towers in Queensland, Australia, within the Mount Windsor Volcanic Belt. This area is renowned for its rich history in copper and gold mining, with strong social license support for mining activities. It features large-scale mining operations such as, Newmont’s 3.2 Moz Mt Leyshon gold mine and Yuxin Holding’s 3.4 Moz Pajingo gold mine. The region is close to the polymetallic, Thalanga Processing Plant and the Mount Carlton Processing Plant, with road and rail to Glencore’s Mount Isa copper hub, Townsville copper refinery and the Port of Townsville.

With the growth in commodity prices and advancements in exploration and mining technologies, the potential for remnant copper-gold mining has significantly improved. Previous mining operations targeted copper within chalcopyrite, while gold associated with both chalcopyrite and pyrite was excluded from the mine plan. With lower copper equivalent cut-off grades (copper & gold), higher continuity of copper-gold can be drill tested to demonstrate the reasonable prospects for eventual economic extraction and mineral resource potential.

Significant potential will be assessed and areas tested for copper-gold extensions to subvertical trends, that may exist below current mining levels at the Highway Reward Copper-Gold Mine. The previously mined, copper-gold rich pipes will also be assessed for drill testing along strike (Figure 2). Previous mining and surface mapping geological observations illustrate that high- grade copper-gold pipes have been identified in dacite, rhyolite, and volcaniclastic host rocks, therefore strong prospectivity exists for discovering additional pipes beyond the historically mined zones in all rock types on the property, except recent overlying sediments that conceal the basement host rocks (Figure 2). No modern advanced geophysical techniques or data processing methods have yet been applied to assess this potential.

Click here for the full ASX Release

This article includes content from Loyal Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

17h

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00