Lode Gold Resources Inc. (TSXV: LOD) (OTCQB: LODFF) ("Lode Gold" or the "Company") is pleased to announce 2025 exploration targets for its Phase 1 exploration program in its subsidiary, Gold Orogen, which will be spun out as a separate public company in March 2025, pending Exchange and Shareholder approval. The Annual Shareholder Meeting is set for March 10, 2025. Shareholders of Lode Gold as of the Record Date will be eligible to receive shares of the new Spin Co (Gold Orogen). This tax-efficient spin-out is to ensure maximum return on investment for shareholders.

Gold Orogen has formed a JV-Co, Acadian Gold, with Fancamp, creating one of the largest land packages on the Iapetus Suture Belt in New Brunswick. This potential district-scale play covers 445 km². Atlantic Canada, especially New Brunswick, equipped with excellent infrastructure and geopolitics, is under-explored yet highly prospective for both gold and polymetallic minerals. In recent months, majors such as Kinross, Equinox Gold and others have strategically made advancements in the area.

The potential for highly prospective mineralized systems at McIntyre Brook has been evidenced with the integration of soil geochemistry and geophysical data. In January 2024, the Company confirmed gold endowment in mineralized rhyolites in McIntyre Brook; the geology is consistent with the surrounding Puma/Kinross JV property. These results build positively on previously announced findings and enhance the potential for a gold-copper discovery at McIntyre Brook. Of note, a small test drill program was conducted in 2019; both holes were mineralized with a best intercept: 5.73 g/t Au in a broader 20 m zone of 1.20 g/t Au. New targets are being identified for further work in the upcoming 2025 Exploration Program.

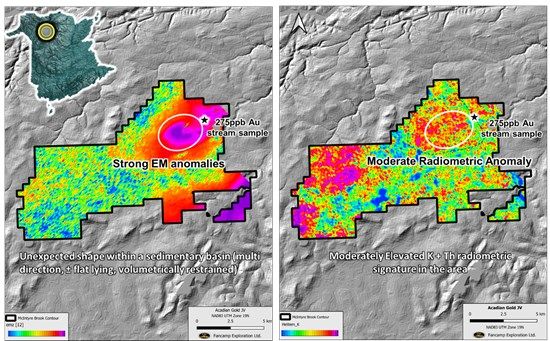

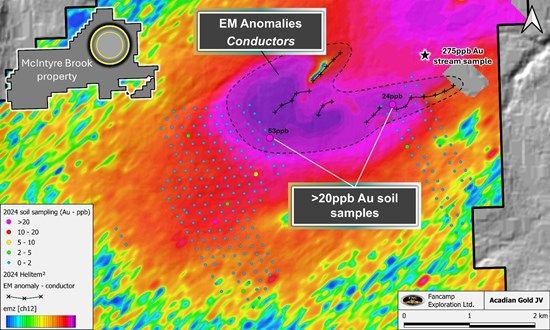

The HeliTEM² survey and soil geochemistry work completed in November 2024 at McIntyre Brook revealed EM conductors near gold-in-soil anomalies, suggesting potential nearby gold mineralization (refer to press releases dated October 15, 2024, and January 20, 2025).

Highlights

- The Heliborne HeliTEM² Survey revealed, among other aspects, the presence of a series of EM conductors in the northeastern part of the McIntyre Brook Property, which create an open ellipsoid over a significative area (refer to Figure 2).

- The initial soil geochemical survey conducted in November 2024 at the periphery of the southeast and northeast area of the conductors revealed the presence of gold-in-soil anomalies associated with Arsenic (As), Antimony (Sb) and Tungsten (W) anomalies.

- The area is also characterized by a 275 ppb Au stream sediment anomaly downstream from the conductive area. This sample was the highest value returned from the 1981 regional stream sampling program conducted in the area by the Geological Surveys Branch of the Government of New Brunswick.

These new results from McIntyre Brook reveal coincident gold-in-soil anomalies and prominent electromagnetic conductors, significantly enhancing the potential for a substantial gold-copper discovery. These promising targets are situated within the geologically favourable Wapske Formation, structurally defined by the McIntyre Brook and Ramsay Brook faults.

Furthermore, analysis of new HeliTEM² magnetic and radiometric data has identified additional faulting and a coincident elevated radiometric signature, potentially indicative of rhyolites or hydrothermal activity-key indicators of significant gold mineralization in the Wapske Formation. Consequently, this area at McIntyre Brook has been designated a high-priority target for Gold Orogen's 2025 New Brunswick exploration program, offering considerable potential for a new gold discovery.

"It's satisfying to see Phase 1 of exploration in New Brunswick yield such encouraging results. The coincident geochemical and EM findings, along with the previously reported results at Riley Brook, clearly outline the path forward," comments Jonathan Hill, Director of the Board and Chair of the Technical Committee. "We'll be conducting soil sampling and trenching in both areas, which will help generate and ultimately test drill targets. We anticipate field crews will begin this work once we finalize the exploration plan."

With the complete dataset from the 2024 New Brunswick exploration program now received, target generation is progressing, and the 2025 exploration plan will be finalized in the coming weeks.

Figure 1: Gold Orogen - McIntyre Brook Airborne Magnetometer and Radiometric with superimposed soil Geochemical and Stream Sediments anomalies.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4064/243118_ed48d9edc4886827_004full.jpg

Figure 2: McIntyre Brook Soil Geochem Results.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4064/243118_ed48d9edc4886827_005full.jpg

About Lode Gold

Lode Gold (TSXV: LOD) is an exploration and development company with projects in highly prospective and safe mining jurisdictions in Canada and the United States.

In Canada, its Golden Culvert and WIN Projects in Yukon, covering 99.5 km2 across a 27-km strike length, are situated in a district-scale, high grade gold mineralized trend within the southern portion of the Tombstone Gold Belt. A total of four RIRGS targets have been confirmed on the property. A NI 43-101 technical report has been completed in May 2024.

In New Brunswick, Lode Gold has created one of the largest land packages with its Acadian Gold JV Co; consisting of an area that spans 445 km2 and a 44 km strike. McIntyre Brook covers 111 km2 and a 17-km strike in the emerging Appalachian/Iapetus Gold Belt; it is hosted by orogenic rocks of similar age and structure as New Found Gold's Queensway Project. Riley Brook is a 335 km2 package covering a 26 km strike of Wapske formation with its numerous felsic units. A NI 43-101 technical report has been completed in August 2024.

In the United States, the Company is advancing its Fremont Gold project. This is a brownfield project with over 43,000 m drilled and 23 km of underground workings. It was previously mined at 10.7 g/t Au in the 1930's.

Mining was halted in 1942 due the gold mining prohibition in World War Two (WWII) just as it was ramping up production. Unlike typical brownfield projects that are mined out, only 8% of the veins have been exploited. The Company is the first owner to investigate an underground high grade mine potential at Fremont.

The project is located on 3,351 acres of private and patented land in Mariposa County. The asset is a 4 km strike on the prolific 190 km Mother Lode Gold Belt, California that produced over 50,000,000 oz of gold and is instrumental in the creation of the towns, the businesses and infrastructure in the 1800s gold rush. It is 1.5 hours from Fresno, California. The property has year-round road access and is close to airports and rail.

Previously, in March 2023 the company completed an NI 43 101 Preliminary Economic Assessment ("PEA"). A sensitivity to the March 31, 2023 PEA at USD $2,000/oz gold gives an after-tax NPV of USD $370M and a 31% IRR over an 11-year LOM. At $1,750 /oz gold, NPV (5%) is $217M. The project hosts an NI 43-101 resource of 1.16 Moz at 1.90 g/t Au within 19.0 MT Indicated and 2.02 Moz at 2.22 g/t Au within 28.3 MT Inferred. The MRE evaluates only 1.4 km of the 4 km strike of Fremont property. Three step-out holes at depth (up to 1200 m) hit structure and were mineralized.

All NI 43-101 technical reports are available on the Company's profile on SEDAR+ (www.sedarplus.ca) and the Company's website (www.lode-gold.com)

QUALIFIED PERSON STATEMENT

The scientific and technical information contained in this press release has been reviewed and approved by Jonathan Victor Hill, Director, BSc (Hons) (Economic Geology - UCT), FAusIMM, and who is a "qualified person" as defined by NI-43-101.

ON BEHALF OF THE COMPANY

Wendy T. Chan, CEO & Director

Information Contact

Winfield Ding

CFO

info@lode-gold.com

+1-604-977-GOLD (4653)

Kevin Shum

Investor Relations

kevin@lode-gold.com

+1-604-977-GOLD (4653)

Cautionary Note Related to this News Release and Figures

This news release contains information about adjacent properties on which the Company has no right to explore or mine. Readers are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on the Company's properties.

Cautionary Statement Regarding Forward-Looking Information

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes "forward-looking statements" and "forward-looking information" within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the use of proceeds, advancement and completion of resource calculation, feasibility studies, and exploration plans and targets. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as "anticipate", "believe", "plan", "estimate", "expect", "potential", "target", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which the Company operates, are inherently subject to significant operational, economic, and competitive uncertainties, risks and contingencies. These include assumptions regarding, among other things: the status of community relations and the security situation on site; general business and economic conditions; the availability of additional exploration and mineral project financing; the supply and demand for, inventories of, and the level and volatility of the prices of metals; relationships with strategic partners; the timing and receipt of governmental permits and approvals; the timing and receipt of community and landowner approvals; changes in regulations; political factors; the accuracy of the Company's interpretation of drill results; the geology, grade and continuity of the Company's mineral deposits; the availability of equipment, skilled labour and services needed for the exploration and development of mineral properties; currency fluctuations; and impact of the COVID-19 pandemic.

There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include a deterioration of security on site or actions by the local community that inhibits access and/or the ability to productively work on site, actual exploration results, interpretation of metallurgical characteristics of the mineralization, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required approvals, unknown impact related to potential business disruptions stemming from the COVID-19 outbreak, or another infectious illness, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators, including those described under the heading "Risks and Uncertainties" in the Company's most recently filed MD&A. The Company does not undertake to update or revise any forward-looking statements, except in accordance with applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/243118