- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

March 04, 2025

Lahontan Gold Corp. (TSXV:LG,OTCQB:LGCXF) is dedicated to advancing its portfolio of high-quality gold and silver projects in Nevada, a top-tier mining jurisdiction. The company’s flagship Santa Fe Mine — a past-producing operation from 1988 to 1992 — yielded 356,000 ounces of gold and 784,000 ounces of silver. Lahontan is focused on unlocking the mine’s full potential by expanding resources and advancing permitting efforts to fast-track the project toward production.

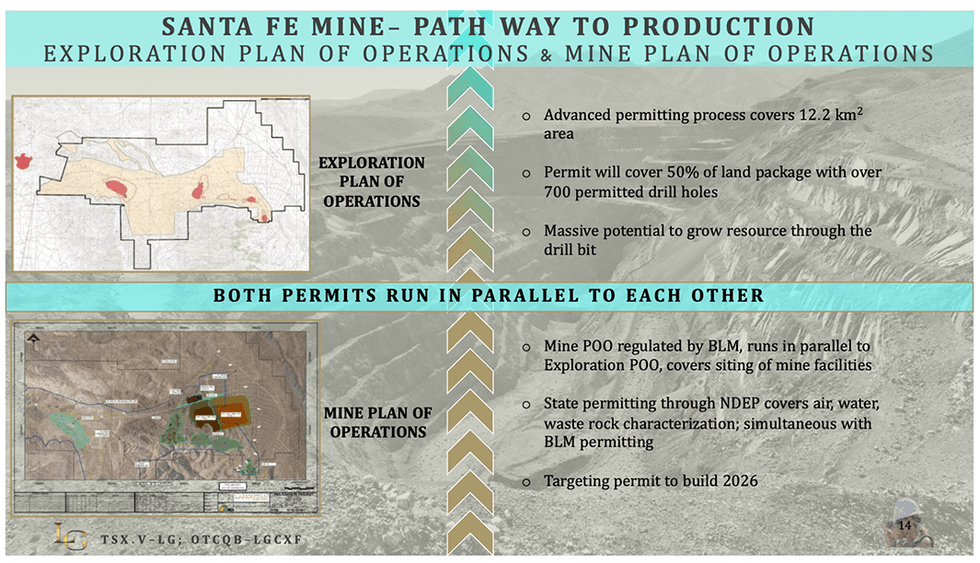

A recently completed preliminary economic Assessment (PEA) highlights a clear pathway to restarting operations, demonstrating the project’s robust economics. Permitting with the Bureau of Land Management (BLM) is underway, with the company targeting a 2026 construction start.

The Santa Fe mine, located in Mineral County, Nevada, spans 26.4 sq km and represents Lahontan Gold’s flagship development project. With an updated mineral resource estimate of 1.95 Moz gold equivalent, the project hosts multiple oxide and sulfide zones that remain open for expansion.

Company Highlights

- Flagship Santa Fe Project: 100 percent owned, past-producing open-pit heap leach mine with a current MRE of 1.95 Moz gold equivalent at a grade of ~0.9 g/t.

- Strategic Nevada Location: Situated in Walker Lane, one of the world’s best mining jurisdictions, with excellent infrastructure, water access, and a mining-friendly regulatory environment.

- Strong Resource Growth Potential: The Santa Fe Mine and its satellite projects, West Santa Fe and Moho, offer exploration upside, with further drilling planned to expand resources.

- Advancing Toward Production: With a positive Preliminary Economic Assessment (PEA) completed in late 2024, Lahontan is aggressively moving toward permitting and development.

- Experienced Leadership: The company is led by an experienced management team with a proven track record in mine development, permitting, and value creation for investors.

This Lahontan Gold profile is part of a paid investor education campaign.*

Sign up to get your FREE

Prince Silver Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

10 March

Prince Silver

Advancing a large-scale, past-producing polymetallic silver-manganese project in Nevada.

Advancing a large-scale, past-producing polymetallic silver-manganese project in Nevada. Keep Reading...

3h

Peruvian Metals Announces Private Placement

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that it has arranged a non-brokered private placement for gross proceeds of up to $750,000 which will be used to make improvements and additions for expansion to its Aguila Norte processing... Keep Reading...

8h

Additional Strong Assays Results Extend High-Grade Antimony Mineralisation at Oaky Creek

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”) a Critical Minerals exploration and development company with an established portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce that it has received continued strong assay results... Keep Reading...

16h

Jeffrey Christian: Gold, Silver Prices to Rise, Risk Highest Since WWII

Jeffrey Christian, managing partner at CPM Group, sees gold and silver prices continuing to rise as global political and economic risks persist. "We look at the world right now and we see a world where the risks and uncertainties are greater now than at any time since Pearl Harbor. December... Keep Reading...

17h

Precious Metals Price Update: Gold, Silver, PGMs Volatile on Oil Spike, Fed Rates

Precious metals prices are responding to the impact of the US-Iran war, as well as inflation data.The war has weighed on the precious metals market for much of this past week. An oil price surge past US$100 per barrel increased the threat of inflation and strengthened the US dollar, softening... Keep Reading...

11 March

Pan African To Acquire Emmerson Resources in US$218 Million Gold Deal

South African gold producer Pan African Resources (LSE:PAF) has agreed to acquire Australian explorer Emmerson (LSE:EML) in an all-share transaction valued at approximately US$218 million.The acquisition will be carried out through a scheme of arrangement under which Pan African will acquire 100... Keep Reading...

11 March

American Eagle Announces Exercise of Participation Rights by South32 and Teck, Updates Details of Recently Announced Financing

Highlights: South32 and Teck will maintain their equity ownership in American Eagle Gold.Including Eric Sprott's private placement, American Eagle Gold's cash balance will increase by $34 million to more than $55 million upon close of this financing.Eric Sprott, South32 and Teck are the sole... Keep Reading...

Latest News

Sign up to get your FREE

Prince Silver Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00