March 04, 2025

Lahontan Gold Corp. (TSXV:LG,OTCQB:LGCXF) is dedicated to advancing its portfolio of high-quality gold and silver projects in Nevada, a top-tier mining jurisdiction. The company’s flagship Santa Fe Mine — a past-producing operation from 1988 to 1992 — yielded 356,000 ounces of gold and 784,000 ounces of silver. Lahontan is focused on unlocking the mine’s full potential by expanding resources and advancing permitting efforts to fast-track the project toward production.

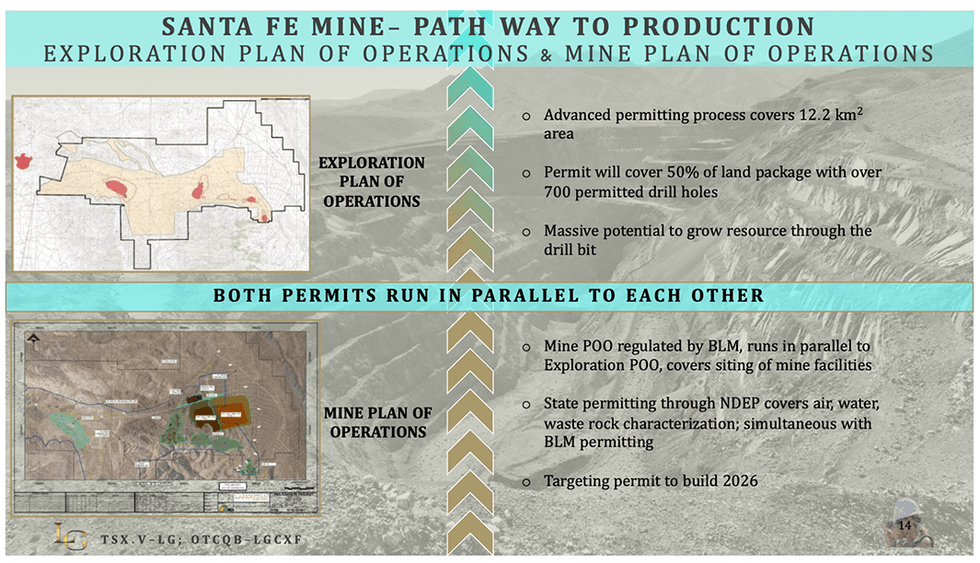

A recently completed preliminary economic Assessment (PEA) highlights a clear pathway to restarting operations, demonstrating the project’s robust economics. Permitting with the Bureau of Land Management (BLM) is underway, with the company targeting a 2026 construction start.

The Santa Fe mine, located in Mineral County, Nevada, spans 26.4 sq km and represents Lahontan Gold’s flagship development project. With an updated mineral resource estimate of 1.95 Moz gold equivalent, the project hosts multiple oxide and sulfide zones that remain open for expansion.

Company Highlights

- Flagship Santa Fe Project: 100 percent owned, past-producing open-pit heap leach mine with a current MRE of 1.95 Moz gold equivalent at a grade of ~0.9 g/t.

- Strategic Nevada Location: Situated in Walker Lane, one of the world’s best mining jurisdictions, with excellent infrastructure, water access, and a mining-friendly regulatory environment.

- Strong Resource Growth Potential: The Santa Fe Mine and its satellite projects, West Santa Fe and Moho, offer exploration upside, with further drilling planned to expand resources.

- Advancing Toward Production: With a positive Preliminary Economic Assessment (PEA) completed in late 2024, Lahontan is aggressively moving toward permitting and development.

- Experienced Leadership: The company is led by an experienced management team with a proven track record in mine development, permitting, and value creation for investors.

This Lahontan Gold profile is part of a paid investor education campaign.*

Sign up to get your FREE

Oreterra Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

05 March

Oreterra Metals

Close on the trail of a potentially major new BC copper-gold discovery

Close on the trail of a potentially major new BC copper-gold discovery Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Sign up to get your FREE

Oreterra Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00