Lahontan Gold Corp. (TSXV:LG) (formerly, 1246765 B.C. Ltd.) (the "Company" or "Lahontan") is pleased to announce drill results from two reverse-circulation rotary ("RC") drill holes exploring the Santa Fe pit area of the Company's 19 km2 Santa Fe Project in Nevada's Walker Lane. The two drill holes, totaling 518.2 metres, were completed in late 2021. These drill holes targeted northwest and down-dip step outs from known gold and silver mineralization along the Santa Fe fault. Highlights include

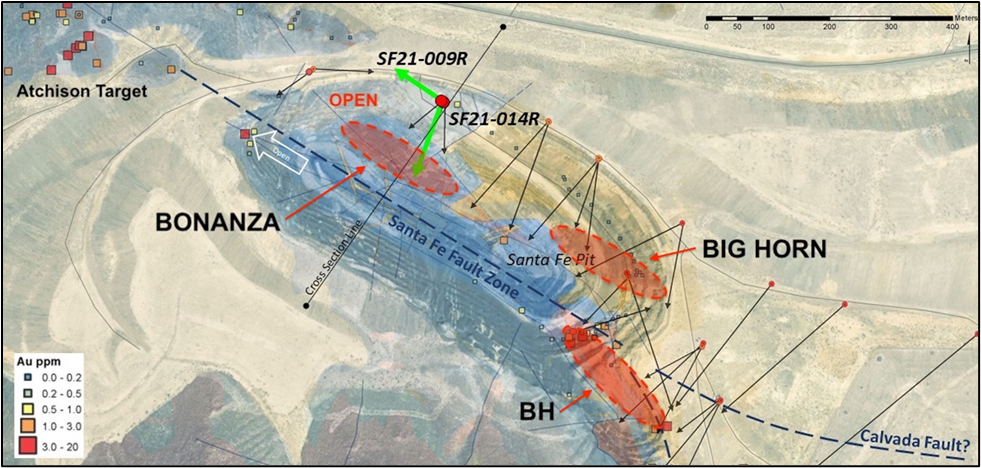

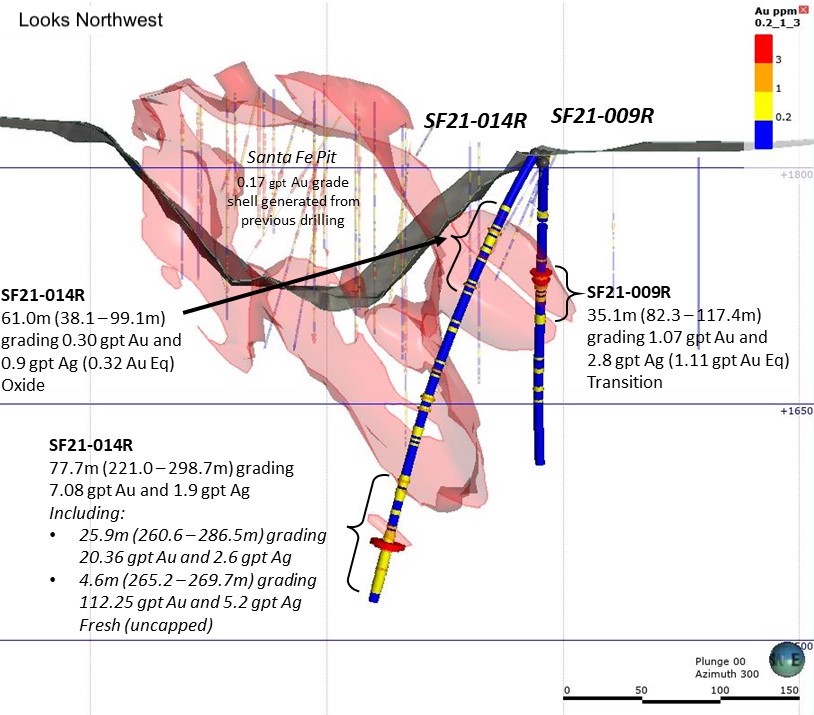

- SF21-014R: This RC drill hole is located approximately 350 metres northwest of the newly discovered Big Horn high-grade zone and intercepted yet another area of high-grade gold mineralization: 25.9 metre interval grading 20.36 gpt Au (please see table and map below). This newly discovered high-grade zone, called "Bonanza", has set a new standard with the highest-grade Au assays in project history: 4.6m grading 112.3 gpt Au. The Company has now identified three distinct high-grade gold zones along nearly 800 metres of strike length on the Santa Fe fault that remain open at depth and to the northwest.

- SF21-009R: This hole was drilled from the same site as SF21-014R and intercepted shallow transition and oxide gold mineralization: 35.1m grading 1.07 gpt Au, expanding the envelope of oxide and transition mineralization in this corner of the Santa Fe pit and producing new targets for further step-out drilling.

Kimberly Ann, CEO, President, Director, and Founder of Lahontan Gold Corp commented: "The discovery of yet another high-grade zone along the Santa Fe fault underscores the opportunity for finding additional high-grade zones at the Santa Fe Project. The grades seen in the Bonanza and Big Horn zones are exceptional for a Carlin-style gold deposit. The distribution of high-grade gold and silver mineralization occurs in a "string of pearls" manner, with each "pearl" corresponding to the intersection between the northwest-trending Santa Fe fault and easterly-trending structures. This interpretation generates multiple high-grade targets northwest of the Bonanza zone and can also be applied elsewhere in the district as we search for additional high-grade mineralization. The BH, Big Horn, and Bonanza high-grade zones are open down-dip, down-rake, and the Bonanza zone remains open to the northwest with the high-grade resource potential unconstrained at depth by drilling."

Drill | Total Depth (m) | From (m) | To | Interval | Au | Ag | Au Eq | Metallurgical |

SF21-009R | 213.4 | 82.3 | 117.4 | 35.1 | 1.07 | 2.8 | 1.11 | Transition |

SF21-014R | 304.8 | 38.1 | 99.1 | 61.0 | 0.30 | 0.9 | 0.32 | Oxide |

260.6 | 286.5 | 25.9 | 20.36 | 2.6 | 20.39 | Fresh | ||

including: | 265.2 | 269.8 | 4.6 | 112.25 | 5.2 | 112.32 | Fresh |

*Notes: Au Eq equals Au (gpt) + (Ag gpt/75). Metallurgical recovery has not been factored as insufficient test-work is available to determine potential Ag recoveries. True thickness of the intercepts shown above are estimated to be 80-90% of the drilled interval. Assays shown above are uncapped.

The upper portion of SF21-014R and -009R both intercepted shallow oxide and transition mineralization expanding the envelope of oxide and transition mineralization in this corner of the pit and produce new targets for further step-out drilling (please see cross section below).

The discovery of a third high-grade zone, with the highest gold grades seen to date at Santa Fe, is a significant development for the Company. Potential future mining of these high-grade zones requires that significant tonnages must be discovered, with three distinct high-grade zones already identified, rock volumes in these zones continue to grow. It should be noted that the high-grade intercepts in SF21-014R are approximately 140 metres below the bottom of the Santa Fe pit and therefore easily accessible (please see cross section below). In the Bonanza high-grade zone, two previous drill holes were drilled above the high-grade zone and missed the target, highlighting the value of "deeper" drilling.

To the northwest, outside of the pit, additional structural targets have been developed, in search of the next high-grade zone along the Santa Fe fault (please see map above). In this area, termed the "Atchison" target, high grade surface rock-chip samples and historic soil sampling highlight another structural intersection between easterly and northwest-trending faults. Drilling of this potential high-grade target is planned for this summer.

QA/QC Protocols:

Lahontan conducts an industry standard QA/QC program for its core and RC drilling programs. The QA/QC program consisted of the insertion of coarse blanks and Certified Reference Materials (CRM) into the sample stream at random intervals. The targeted rate of insertion was one QA/QC sample for every 16 to 20 samples. Coarse blanks were inserted at a rate of one coarse blank for every 65 samples or approximately 1.5% of the total samples. CRM's were inserted at a rate of one CRM for every 20 samples or approximately 5% of the total samples. The standards utilized include three gold CRM's and one blank CRM that were purchased from Shea Clark Smith Laboratories (MEG) of Reno, Nevada. Expected gold values are 0.188 gpt, 1.107 gpt, 10.188 gpt, and -0.005 gpt, respectively. The coarse blank material comprised of commercially available landscape gravel with an expected gold value of -0.005 gpt.

As part of the RC drilling QA/QC process, duplicate samples were collected of every 20th sample interval at the drill rig to evaluate sampling methodology. Samples were collected from the reject splitter on the drill rig cyclone splitter. Samples were collected at each 95- to 100-foot (28.96 - 30.48m) mark and labeled with a "D" suffix on the sample bag. No duplicates were submitted for core.

All drill samples were sent to American Assay Laboratories (AAL) in Sparks, Nevada, USA for analyses. Delivery to the lab was either by a Lahontan Gold employee or by an AAL driver. Analyses for all RC and core samples consisted of Au analysis using 30-gram fire assay with ICP finish, along with a 36-element geochemistry analysis performed on each sample utilizing two acid digestion ICP-AES method. Tellurium analyses were performed on select drill holes utilizing ICP-MS method. Cyanide leach analyses, using a tumble time of 2 hours and analyzed with ICP-AES method, were performed on select drill holes for Au and Ag recovery. AAL inserts their own blanks, standards and conducts duplicate analyses to ensure proper sample preparation and equipment calibration. We have all results reported in grams per tonne (gpt).

About Lahontan Gold Corp:

Lahontan Gold Corp. (TSX.V: LG) is a Canadian mineral exploration company that holds, through its US subsidiaries, three top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan's flagship property, the 19 km2 Santa Fe Project, is a past producing gold and silver mine with excellent potential to host significant gold and silver resources (past production of 375,000 ounces of gold and 710,000 ounces of silver between 1988 and 1992; Nevada Bureau of Mines and Geology, 1996). Modeling of over 110,000 metres of historic drilling, geologic mapping, and geochemical sampling outline both shallow, oxidized gold and silver mineralization as well as deeper high grade potential resources. The Company is completing an aggressive 25,000 metre drilling program with the goal of publishing a National Instrument 43-101 ("NI 43-101") compliant mineral resource estimate in 2022. For more information, please visit our website: www.lahontangoldcorp.com

All scientific and technical information in this press release has been reviewed and approved by Quentin J. Browne, P.Geo., Consulting Geologist to Lahontan Gold Corp., who is a qualified person under the definitions established by National Instrument 43-101.

On behalf of the Board of Directors

Kimberly Ann

Founder, Chief Executive Officer, President, and Director

FOR FURTHER INFORMATION, PLEASE CONTACT:

Lahontan Gold Corp.

Kimberly Ann

Founder, Chief Executive Officer, President, Director

Phone: 1-530-414-4400

Email: Kimberly.ann@lahontangoldcorp.com

Website: www.lahontangoldcorp.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedar.com

SOURCE: Lahontan Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/706682/Lahontan-Drills-New-Bonanza-High-Grade-Zone-at-Santa-Fe-259m-Grading-2036-gpt-Au-Incl-46m-Grading-1123-gpt-Au