September 19, 2023

Labyrinth Resources Limited (ASX: LRL) (‘Labyrinth’ or ‘the Company’) is pleased to advise that it is stepping up a “back-to-basics” exploration program at its Comet Vale gold project in WA (‘the Project’).

The preliminary field work will follow up historical data which revealed the presence of pegmatites and indicators of lithium prospectivity and follow on from preliminary work done by Labyrinth (see LRL ASX announcement dated 15 December 2022). Nickel, copper and gold occurrences across the package are well documented, but the full potential has not been tested.

As an exploration geoscientist, Chief Executive Officer, Jennifer Neild has seen the benefit of compiling for the Project:

- non-digital drilling data

- geophysical surveys

- structural mapping and

- soil/rock chip sampling.

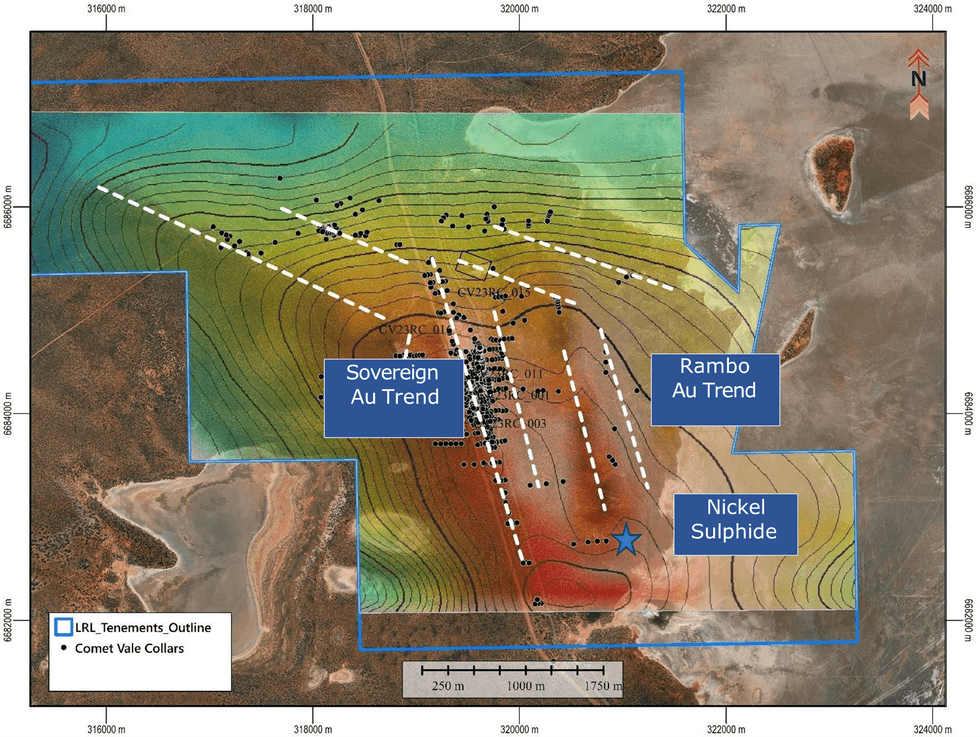

The methodology recently completed at Comet Vale has already highlighted several gold, nickel, copper and cobalt anomalies that needed boots on ground confirmation and have not been previously looked at by the Company.

The review established that very limited drilling has been conducted below 50m and that the project area has been exposed to virtually no modern exploration techniques.

The open pit and underground Resources at Comet Vale stand at 39,477oz at 3.3g/t and 56,233oz at 7.0g/t respectively (see LRL ASX announcement dated 11 April 2023).

Labyrinth Chief Executive Jennifer Neild said: “There are numerous significant historical workings along well-established gold trends which extend for several kilometres. But these workings remain very poorly tested below surface which is likely the result of having too much choice.

"Of particular interest is the “Rambo Trend”, which comprises a number of gold occurrences and is represented by a 2.3 km gravity anomaly. This anomalous trend runs parallel to the Sovereign Trend which hosts the existing resource. At the southern end exists a substantial Ni/Cr anomaly supported by Ni intercepts.

While we’re still very excited about exploration at our Labyrinth Project in the Abitibi Greenstone Belt, there is unprecedented value to unlock locally as hunting season begins in Quebec, Canada where we have limited regional exploration access but are busy compiling data to a similar standard.”

Ms Neild said the Comet Vale ground was also highly prospective for nickel sulphides, REEs and LCT pegmatites, with almost no work done to explore for these commodities.

To the north, Ardea Resources (ASX:ARL) has focused on EIS holes on its Highway nickel sulphide drilling (see ARL ASX release 21 August 2023). The same target stratigraphy exists at Comet Vale where elevated Ni, Co and Cu are common. Ardea also commissioned a CSA study which showed LCT prospectivity to the north and south of Comet Vale.

In light of this immense potential, Labyrinth has started a program of reconnaissance field work to validate historic occurrences and confirm targets. Key outcomes include:

- Mapping geology including veins of pegmatitic material and locating historic references to dykes at gold prospects

- Structural mapping, confirming fault orientations and timing relationships with gold bearing veins

- Confirming Ni/Cr trends which help identify nickel sulphide prospectivity

- Confirmation of historic drillholes not currently in database

- Environmental monitoring and rehabilitation work

- Delineating prospects of highest potential for future work

Click here for the full ASX Release

This article includes content from Labyrinth Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

10h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

22h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

23h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

23h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00