January 30, 2024

Labyrinth is revisiting the enormous opportunity that still exists closer to home

Labyrinth Resources Limited (ASX: LRL) (‘Labyrinth’ or ‘the Company’) is pleased to report on the Company’s activities for the December 2023 quarter. This includes an in-house evaluation of the current projects and opportunities that have not been explored previously.

Key Points

- Towards the end of the previous quarter, a reconnaissance field program completed in September 2023 with 34 rock chip samples of pegmatite and copper, nickel, and gold prospective rock from across the wider Comet Vale tenure are now complete and undergoing QAQC1;

- In late November a 386 sample soil program was completed on the western Comet Vale tenements looking at gold-base metal and Li-Cs-Ta potential2;

- At the beginning of the quarter, Labyrinth completed the final CAD $500,000 (plus interest) owing to G.E.T.T Gold Inc. (TSXV: GETT) (‘GETT’) related to the acquisition of the Company’s Quebec projects;

- The final payment to GETT entitles the Company to acquire title of the Labyrinth and Denain Projects;

- Post quarter, Labyrinth announced the successful negotiation amending the terms the Project Acquisition agreement with respect to the obligation to deliver a 450 ounce Physical Gold Payment by 31 December 20233;

- The payment will reduce to a 200 ounce payment with the remaining 250 ounces to be paid upon profitable production at Labyrinth Mine;

- Post quarter, Labyrinth announced the intention to divest Labyrinth Gold Project to Gold Projects WA Pty Ltd (‘GPWA’) for a cash consideration of USD $3,500,0004; and

- Labyrinth received a significant tax refund of circa $470k post quarter end in relation to Canadian resource expenditure5.

COMET VALE

During the quarter, considerable focus has been placed on the divestment of Labyrinth Gold Project in Canada, however targeting and planning of exploration activities is well underway at Comet Vale.

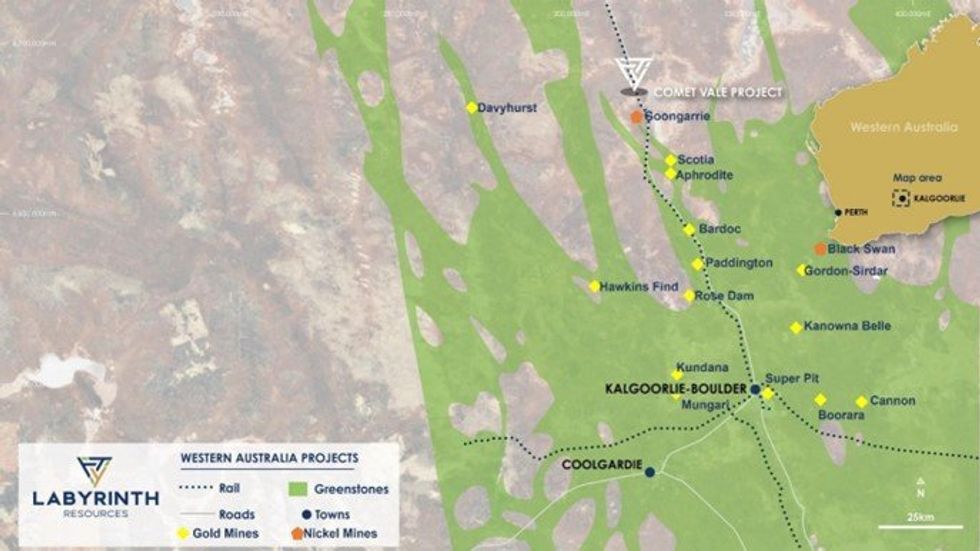

In the previous quarter, LRL announced the commitment to refocus exploration activities at Comet Vale Project near Menzies, Western Australia. The project is a joint venture project between Labyrinth (51%) and Sand Queen Gold Mines Pty Ltd (49%).

During 2023, LRL had begun the first genuine surface exploration project for 15 years, despite the project hosting extensive high-grade gold, copper and nickel laterite. The 18 hole RC drilling program took place in April 2023 targeting the down dip extensions of the Sand George Lodes with favourable results6. Just prior to this, an updated Mineral Resource Estimate was completed on the Comet Vale Underground (‘UG’) and Open Pit (‘OP’) historic resource (see Table 1 and 2)7.

Click here for the full ASX Release

This article includes content from Labyrinth Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

10h

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

13h

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

27 February

American Eagle Announces $23 Million Strategic Investment Backed by Eric Sprott

Highlights:The investment adds a third strategic investor, when combined with investments by mining companies South32 Group Operations PTY Ltd. and Teck Resources LimitedThe Offering funds significantly expanded drill programs for 2026 and 2027 at the Company's NAK copper-gold porphyry project... Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00