October 30, 2025

Tertiary Minerals plc (AIM: TYM) is pleased to announce that KoBold Metals Company ("KoBold") has successfully completed its Stage 1 Earn-In requirements on the Konkola West Copper Project ("Project") and has confirmed it will proceed to Stage 2 under the Earn-In Agreement ("Agreement") with cumulative exploration expenditure of up to US$6 million.

Highlights

- Completion of Stage 1 Earn-In requirements with 2 drill holes for an accumulative 4,153m of drilling, significantly surpassing the minimum drilling requirement of 2,000m.

- New Joint venture company to be incorporated.

- KoBold confirms its intention to proceed to Stage 2, which includes cumulative exploration expenditure of up to US$6 million.

- KoBold is currently undertaking extensive analysis of the two holes completed to date. This work includes full geochemical analysis, downhole geophysics, and stratigraphic interpretation, all of which will improve the targeting for the next phase of exploration.

- Location and depth of the next drill hole to be confirmed once all the data from previous drilling is reviewed and incorporated into the updated exploration model.

Drilling Summary

Hole KWDD001

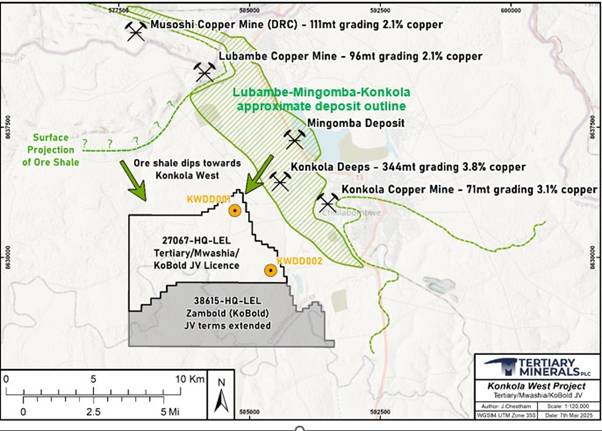

Hole KWDD001 was collared in the northeast of the licence area and targeted down-dip extensions of mineralisation to the southwest of Mingomba and Konkola Deeps (Figure 1). The drillhole was drilled to a depth of 2,711m but was terminated due to technical difficulties before reaching the targeted horizon (Ore Shale, Copperbelt Orebody Member). KWDD001 is believed to be the deepest mineral exploration drill hole to have ever been drilled in the Zambian Copperbelt and marks a significant milestone within the industry.

Hole KWDD002

Hole KWDD002 is collared on the eastern side of the licence area and is targeting down-dip extensions of known mineralisation southeast of the Konkola Mine (Figure 1). The drillhole was drilled to a depth of 1,802m but was recently terminated due to technical difficulties.

Notwithstanding the drilling difficulties, both drillholes have yielded invaluable geological information which is now being incorporated into KoBold's geological model for the Konkola region and will be used as part of the planning process for the Stage 2 drilling.

Earn-In Agreement

The Earn-In Agreement is between Tertiary Minerals (Zambia) Limited, its local partner, Mwashia Resources Limited, and Mwinilunga Exploration Limited, a subsidiary of KoBold.

Under the amended Earn-in Agreement, KoBold was required to drill two holes and carry out a minimum of 2,000m of drilling within 24 months of signing the Earn-in Agreement (prior to 19 December 2025) to achieve the Stage 1 Earn-In.

Following the completion of Stage 1 and KoBold having elected to proceed to Stage 2, a joint venture company between Tertiary Minerals Zambia, Mwashia Resources Limited and Mwinilunga Exploration Limited will be formed, where the participating interests in the joint venture company will be: 39%, 51%, and 10%, respectively.

In order to complete the requirements of Stage 2, KoBold is required to spend a cumulative amount of up to US$6 million on exploration expenditure within a further 24-month period. If these requirements are achieved, then KoBold will increase its participating interest, and the shareholdings in the joint venture company will then be: 20% Tertiary Minerals (Zambia) Ltd, 70% Mwinilunga Exploration Limited, and 10% Mwashia Resources Limited.

In addition, a provision of the Earn-In Agreement has been made to ensure that KoBold's newly granted adjacent Large Exploration Licence, 38615-HQ-LEL, will also be held under the terms of the Earn-in Agreement for the benefit of all the parties.

Richard Belcher, Managing Director of Tertiary Minerals plc, commented:

"We are delighted that KoBold has completed Stage 1 of the Earn-In Agreement requirements and has opted to proceed to Stage 2, despite the technical drilling challenges in this groundbreaking exploration programme. This marks a major milestone not only for the Project but the collaboration between our respective companies with the formation of a new joint venture company. Such a move underlines the continuing commitment and strategic importance of this Project within the world- renowned Central African Copperbelt.

"The continuation of exploration under the Earn-In Agreement provides significant upside for Tertiary to any future Project advancement while limiting downside in terms of risk and capital expenditure. The Company looks forward to continuing this relationship and I look forward to providing further updates in due course."

Mfikeyi Makayi, Chief Executive Officer, KoBold Metals Africa, commented:

"We have learned a lot from the first two holes drilled at the Konkola West property that will go into planning future work on the licence area. We are pleased to have fulfilled Stage 1 of our Earn-In Agreement and look forward to continuing to work with Tertiary and Mwashia in Stage 2 of our Earn-In Agreement."

Figure 1. Location map of the Konkola West Copper Project and collar position of the two drill holes.

Project Summary

Konkola West (Licences 27067-HQ-LEL and 38615-HQ-LEL) is located approximately 5km to the southwest of KoBold's Mingomba deposit and 3km southwest of Konkola Deep Mine, which forms part of the Lubambe-Mingomba-Konkola group of copper deposits of the Zambian Copperbelt. The aim of the drill programme is to test the potential continuations of mineralisation being mined at the World-Class Musoshi, Lubambe and Konkola Mines (combined pre-mining endowment of over 775Mt grading 2-3% copper). KoBold's Mingomba project, is reported by KoBold to be one of the largest undeveloped copper deposits in the world. KoBold is using its propriety AI-driven models of the regional geology to support its mineral exploration targeting.

Further Information:

Tertiary Minerals plc: | |

Richard Belcher, Managing Director | +44 (0) 1625 838 679 |

SP Angel Corporate Finance LLP Nominated Adviser and Broker | |

Richard Morrison/Jen Clarke | +44 (0) 203 470 0470 |

AlbR Capital Limited Joint Broker | |

Lucy Williams/Duncan Vasey | +44 (0) 207 469 0930 |

Market Abuse Regulation

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulation (EU) No. 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ('MAR'). Upon the publication of this announcement via Regulatory Information Service ('RIS'), this inside information is now considered to be in the public domain.

Cautionary Note Regarding Forward-Looking Statements

The news release may contain certain statements and expressions of belief, expectation or opinion which are forward looking statements, and which relate, inter alia, to the Company's proposed strategy, plans and objectives or to the expectations or intentions of the Company's directors. Such forward-looking statements involve known and unknown risks, uncertainties, and other important factors beyond the control of the Company that could cause the actual performance or achievements of the Company to be materially different from such forward-looking statements. Accordingly, you should not rely on any forward-looking statements and, save as required by the AIM Rules for Companies or by law, the Company does not accept any obligation to disseminate any updates or revisions to such forward-looking statements.

Competent Persons Statement

The technical information in this release has been compiled and reviewed by Dr. Richard Belcher (CGeol, EurGeol) who is a qualified person for the purposes of the AIM Note for Mining and Oil & Gas Companies. Dr. Belcher is a chartered fellow of the Geological Society of London and holds the European Geologist title with the European Federation of Geologists.

About Tertiary Minerals plc

Tertiary Minerals plc (AIM: TYM) is an AIM-traded mineral exploration and development company whose strategic focus is on energy transition metals. The Company's projects are all located in stable and democratic, geologically prospective, mining-friendly jurisdictions. Tertiary's current principal activities are the discovery and development of copper and precious metal mineral resources in Nevada and in Zambia.

The Conversation (0)

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00