March 21, 2024

Bass Oil Limited (ASX:BAS) is an Australian-listed oil & gas producer that holds a majority interest in eight permits in the Cooper Basin including the 100% owned Worrior and Padulla oil fields and a 55% interest in a South Sumatra Basin KSO. The Company is debt free and committed to creating value by leveraging the competitive strengths of its team, operating capability, reputation, and relationships in both Australia and Indonesia.

Highlights

- Bass to commence Kiwi 1 Extended Production Test (EPT) as soon as possible

- All regulatory approvals received and long lead equipment available

- Workover rig contract being finalised with mobilisation to site as soon as logistics allow – currently estimated end April

- The objectives of the test are to confirm the potential field size and gas composition

- The results are expected to be known within 60 days of commencement of the test with commercial gas offtake agreements to be negotiated thereafter

- A successful test at Kiwi may upgrade the gas potential of the surrounding area

Earthworks at the site will commence as soon as road access is re-established. This will then allow for the workover rig to be mobilised. Wild Desert Rig 4 has been identified as the rig to be used to complete the Kiwi well and it is anticipated to be mobilised around late April. The results of the test will likely be known within 60 days of commencement or around mid-year.

The Kiwi project represents a potential early entry into the Australian east coast gas market for Bass. Recent press commentary is firmly suggesting the gas market will soon be short of gas around the time Kiwi gas could become available.

Kiwi 1 was drilled in 2003 as an exploration well, resulting in a Triassic age, Callamurra Member gas discovery which flow tested at 9.6 million cubic feet per day on drill stem test. The discovery, which was drilled on a 2D seismic data set, was originally thought to contain a sub commercial quantity of gas. A 3D seismic survey was subsequently acquired over the area. Bass has interpreted the survey and upgraded the potential size of Kiwi discovery. This has resulted in a revised assessment of a mean Contingent Resource of 5.24 BCF and a 3C Contingent Resource of 11.5 BCF.

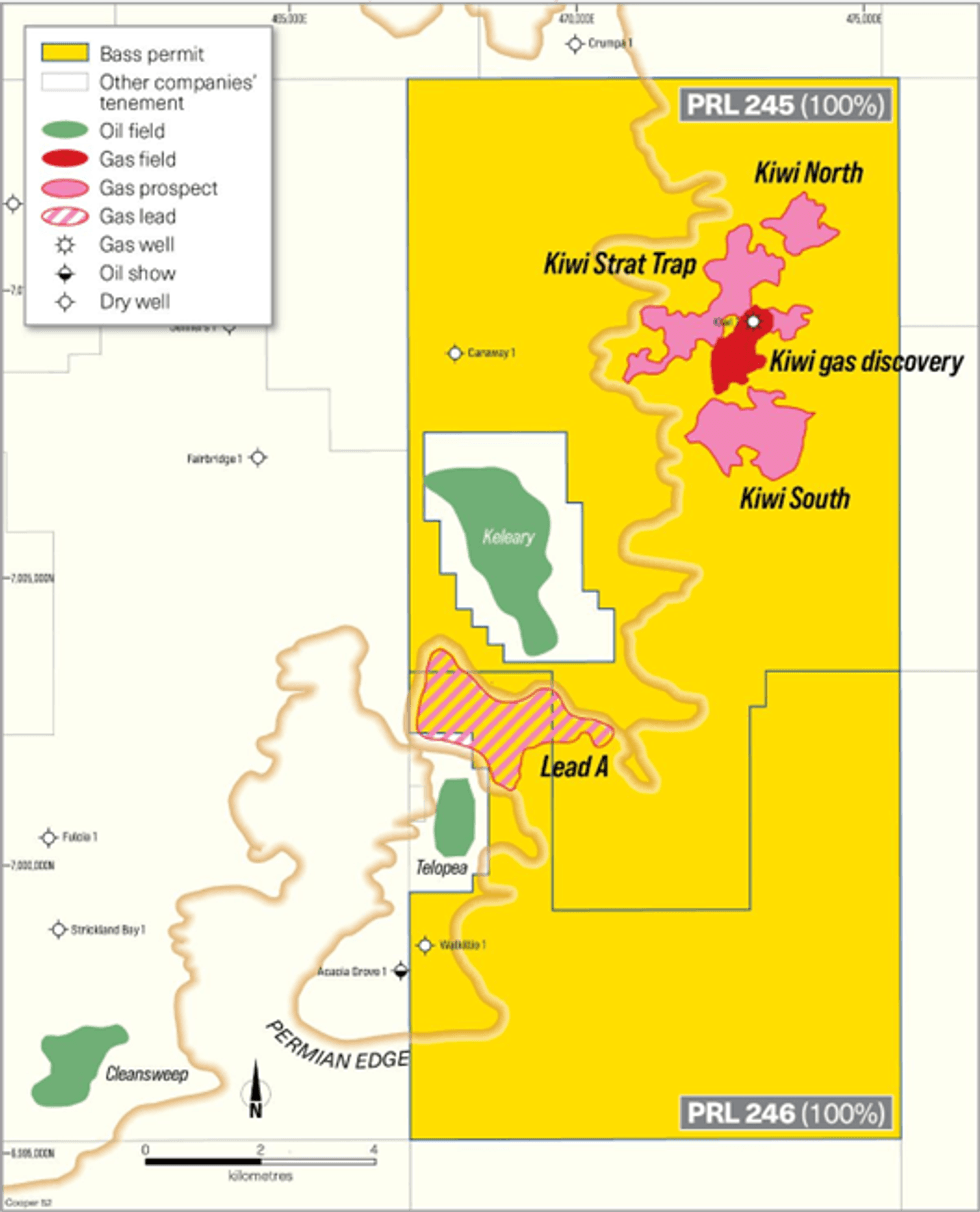

Bass has increased confidence that Kiwi contains a commercial volume of gas, providing the pathway for the Company to enter the eastern states' gas market. The Company has also identified other prospects and leads, on trend with the Kiwi that, as a result of a successful test, may be significantly upgraded (Figure 1).

Bass Oil Managing Director, Mr Tino Guglielmo, commented:

“The Kiwi 1 EPT is a key milestone for Bass’ growth plans in the Australian gas market. The main objective of this test is to gather the data required to confirm commerciality and to upgrade the potential of the surrounding prospects and leads.”

“We have received a number of enquires from third party gas wholesalers interested in contracting gas from Kiwi and we will be running these negotiations in parallel to enable us to monetise the gas once the test is finalised and it demonstrates the commercial potential of the field.”

This announcement has been authorised for release by the Board of Directors of Bass Oil Limited.

Click here for the full ASX Release

This article includes content from Bass Oil Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

06 February

Syntholene Energy Corp. Announces $2.0 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it intends to complete a non-brokered private placement of... Keep Reading...

05 February

Angkor Resources Celebrates Indigenous Community Land Titles and Advances Social Programs, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 5, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") is pleased to announce that nine Indigenous community land titles have been formally granted to Indigenous communities in Ratanakiri Province, Cambodia, following a... Keep Reading...

05 February

Syntholene Energy Corp Strengthens Advisory Board with Former COO of Icelandair Jens Thordarson

Mr. Thordarson brings two decades of expertise in operations, infrastructure development, and large-scale business transformation in the aviation industrySyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces the nomination of Jens... Keep Reading...

04 February

The Future of Aviation is Synthetic: Syntholene CEO Highlights Growing Demand for E-Fuel

The global aviation industry is entering a period of rapid transition as airlines seek low-carbon fuel alternatives that meet both performance and regulatory demands. It’s a market Syntholene Energy (TSXV:ESAF,OTCQB:SYNTF) is aiming to supply through its breakthrough synthetic fuel, or... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00