July 17, 2022

GALENA MINING LTD. (“Galena” or the “Company”) (ASX: G1A) is pleased to announce that the construction progress at its Abra Base Metals Mine (“Abra” or the “Project”) has reached 73% complete as of 30 June 2022. Significant equipment arrivals over the last month include the remaining mill equipment, secondary and tertiary cone crushers, and the remaining LNG tanks. The completion of the installation of 16,000 solar panels also delivers another significant construction milestone.

Managing Director, Tony James commented, “Construction activities are rapidly progressing with concrete poured at 2,378m3 (95% complete) and structural steel installation already up to 237 tonnes (42% complete). Arrival of key overseas supplied equipment being the remaining mill equipment, secondary and tertiary cone crushers, and LNG tanks has certainly reduced risk and energised the remaining work programs.

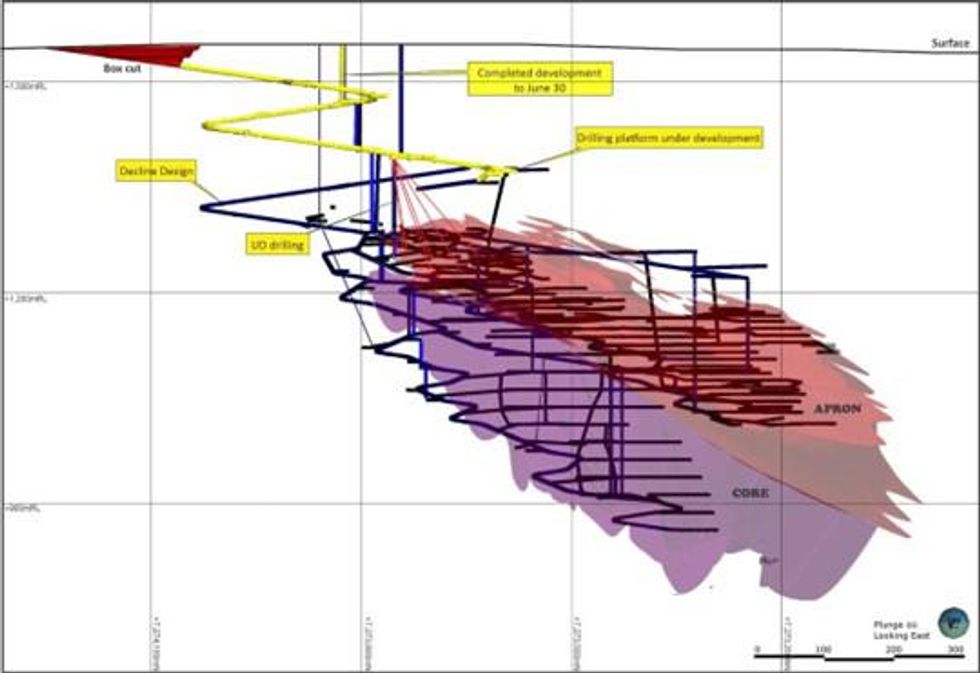

Decline mining delays occurred over 12 days in June, when the decline intercepted an un-grouted drill hole, which produced water, requiring an increase in pumping capacity. This was quickly rectified, and the mine plans were updated to keep the mining schedule aligned with the plant construction and commissioning timeframe. Underground grade control drilling continued in June in preparation for ore mining as planned”.

Figure 1 – Abra mine construction site (photo: 28 June 2022)

Update on Abra Project progress

Overall progress continues to remain in line for Project completion followed by first commercial production in Q1 CY2023. The processing plant engineering, procurement and construction has reached 79% complete. Remaining items on the key equipment order list shown in Table 1 which are currently not received are the flotation cells and the regrind mill. The flotation cells are completed and are waiting shipping from China and the regrind mill is currently shipping from Germany and is expected in Melbourne by 12th August. The regrind mill is being shipped to Melbourne so that Glencore Technology can finalise assembly with some Australian components. The arrival of key items since the last update has enabled GR Engineering to consolidate their remaining work schedules and plans.

Mine decline development was delayed in June for 12 days when the west decline intercepted an un-grouted diamond drill hole forcing an upgrade in the mine dewatering capacity. A total of 128m was developed prior to the delay, taking the west decline down to 1,357mRL which is 44m vertically above the orebody. During the delay the mine installed its primary ventilation fan on the surface and upgraded the underground power reticulation. Once this work was completed, the hole was plugged, and mining resumed.

A revised mining plan has been completed and put in place to ensure that following this development delay, mining targets remain in line with the plant completion and commissioning timeframe.

In surface bulk earthworks, good progress was made on the tailing’s storage facility (“TSF”) during June. The final works package associated with the remaining non-processing infrastructure is progressing as planned.

Owners' costs and contingencies remain within budget.

Figure 2 - Progress of the Abra underground mine development to the 1 July (yellow).

Click here for the full ASX Release

This article includes content from GALENA MINING LTD., licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

19 February

Mercado Minerals Provides Exploration Update on Copalito; Reveals New Vein Discoveries

Mercado Minerals Ltd. (CSE: MERC) ("Mercado" or the "Company") is pleased to report continued progress from ongoing exploration activities at its flagship Copalito Project ("Copalito" or the "Project"). The Company's technical team in Mexico has been actively mapping, sampling, and advancing... Keep Reading...

16 February

How Rick Rule Reinvested His Silver Gains: 5 Silver Stocks He Owns

Over the past year, the spot price of silver has surged past a 40 year record and into triple-digit territory, reaching a high of US$121 per ounce this past January.For silver investors who bought into the physical market when the price was low, this first leg of the silver bull market has... Keep Reading...

16 February

Silver Institute: Market Heading for Sixth Straight Deficit in 2026

Silver surged past US$100 per ounce for the first time in January before retreating below the US$80 level, marking a volatile start to 2026 as the precious metal faces renewed investor appeal.In its latest annual outlook, published on February 10, the Silver Institute notes that the rally comes... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00