March 31, 2025

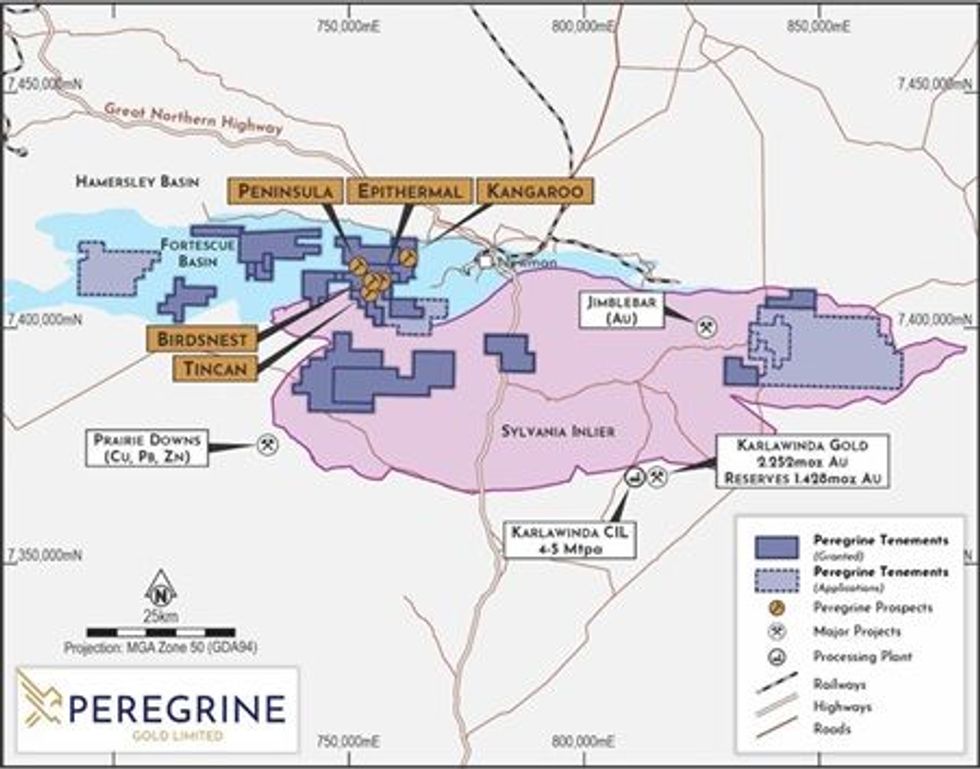

Peregrine Gold Limited (“Peregrine” or the “Company”) (ASX: PGD) is pleased to announce a Gradient Array Induced Polarisation (GAIP) survey will commence at the Birdsnest and Epithermal gold and base metals prospects located within the Company’s 100% owned Newman Gold Project (Figure 1).

HIGHLIGHTS

- Gradient Array Induced Polarisation survey to commence at the Birdsnest & Epithermal prospects located within the 100% owned Newman Gold Project

- Additional Dipole-Dipole Induced Polarisation survey to follow in order to refine geophysical targets for subsequent drill testing

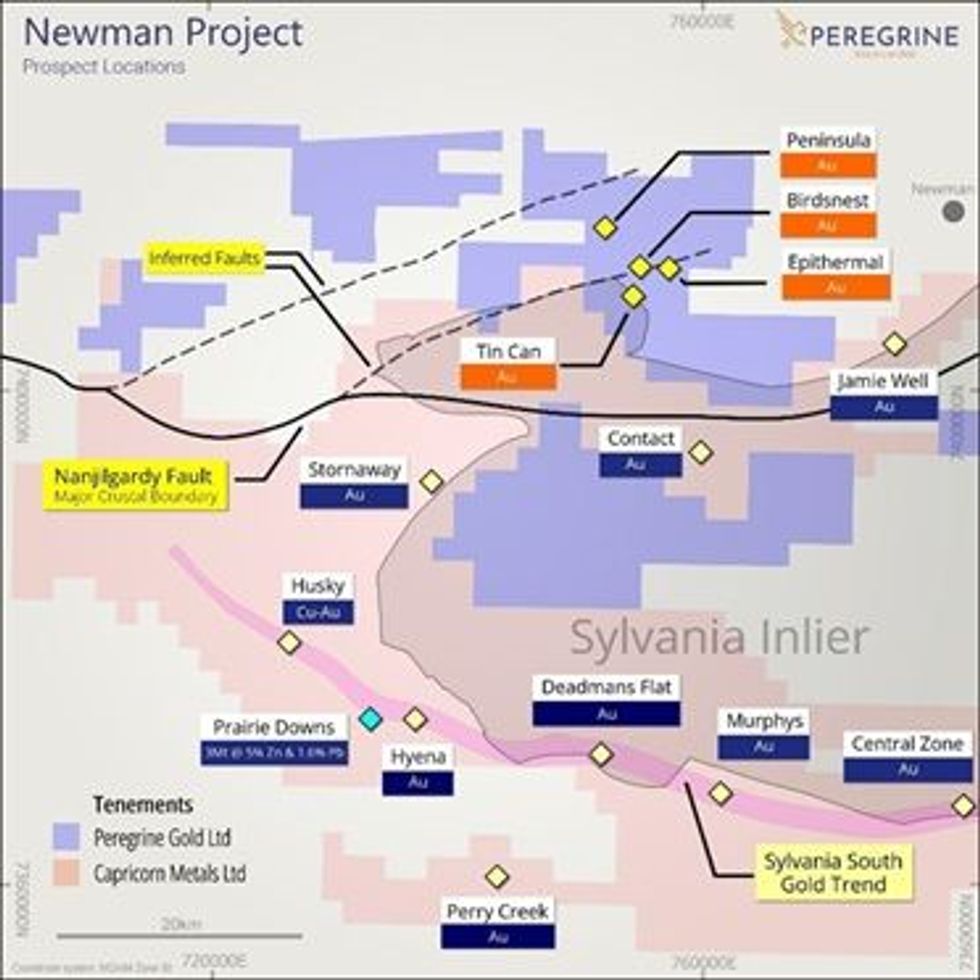

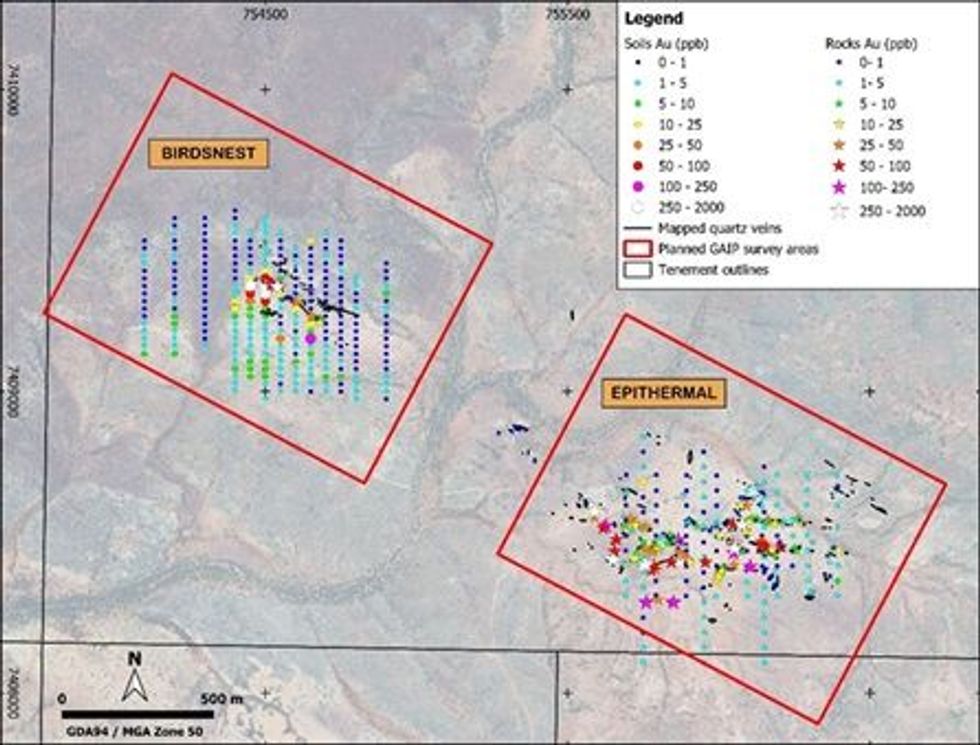

The Birdsnest and Epithermal Prospects are situated proximal to the bounding contact of the Sylvania Inlier and north of the Nanjilgardy Fault, both of which are highly prospective zones for gold mineralisation (Figure 2). The GAIP survey data is expected to provide useful layers of geophysical information to assist Peregrine’s interpretation of sub-surface geology and structure, provide feedback for further drill targeting of existing gold and base metal mineralised trends and potentially identify new target zones in other parts of the prospect areas.

The GAIP surveys will produce plan view maps of Induced Polarisation (IP) chargeability and resistivity anomalies relating to potential sulphide minerals associated with gold and/or base metal mineralisation within approximately 100m from surface within the GAIP survey grid areas. The planned GAIP survey grid areas are both 1.2km long (NW-SE) by 900m wide (NE- SW) (Figure 3).

The GAIP transmitter electrodes and receiver survey lines will be oriented NE-SW across the grid areas, which is perpendicular to the general geological strike. IP receiver lines will be spaced 100m apart, with receiver electrodes spaced 50m apart along the IP receiver survey lines.

Pending GAIP survey results, follow-up Dipole-Dipole IP (DDIP) surveying across priority GAIP anomalies identified at these prospects may be considered in order to produce cross section images of IP chargeability and resistivity to a maximum depth from surface of approximately 350m along the DDIP survey lines, which will provide feedback on the depth and orientation of the GAIP anomaly sources and thereby allow more accurate drill targeting of IP anomalies in the future.

The Company has engaged experienced IP contractor Khumsup Geophysics to undertake the surveys in early April and are scheduled to take between 2 to 3 weeks to complete with final reporting to be released in May. Subject to these results, the Company will immediately commence drill planning activities.

Geophysical consultants from Resource Potentials Pty Ltd have assisted with the IP survey planning and will QC the survey data, provide preliminary updates during the survey period and then process, interpret and model the final IP survey data, as well as assist with follow-up exploration planning as needed.

Click here for the full ASX Release

This article includes content from Peregrine Gold Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00