June 04, 2024

International Lithium Corp. (TSXV: ILC) (OTCQB: ILHMF) (FSE: IAH) (the "Company" or "ILC")announces that it intends, subject to TSX Venture Exchange approval, to extend the term of 7,586,669 warrants expiring on June 30, 2024 for a period of two years. The share purchase warrants were issued pursuant to a private placement of 16,673,336 units accepted for filing by the TSXV on September 2, 2021. Following the extension, 7,586,669 warrants will now expire on August 11, 2026. The exercise price remains unchanged at $0.08.

About International Lithium Corp.

At ILC, our key mission in the next decade is to make money for our shareholders from lithium and other battery metals and rare metals while at the same time helping to create a greener, cleaner planet and less polluted cities. The world has seen significant governmental and public drive to move away from the energy market's historic heavy dependence on oil and gas. In addition, we have seen the clear and increasingly urgent wish by the USA and Canada and other major economies to safeguard their critical metals supplies and become more self-sufficient. Our Canadian projects, which contain lithium, rubidium and copper, are strategic in that respect.

We have announced separately that we regard Zimbabwe as an important strategic target market for ILC, and we hope to be able to make announcements over the next few weeks and months.

A key goal has been to become and remain a well-funded company to turn our aspirations into reality, and following the disposal of the Mariana project in Argentina in 2021 and the Mavis Lake project in Canada in January 2022, the Board considers that ILC is well placed in that respect with no debt and a respectable net cash position.

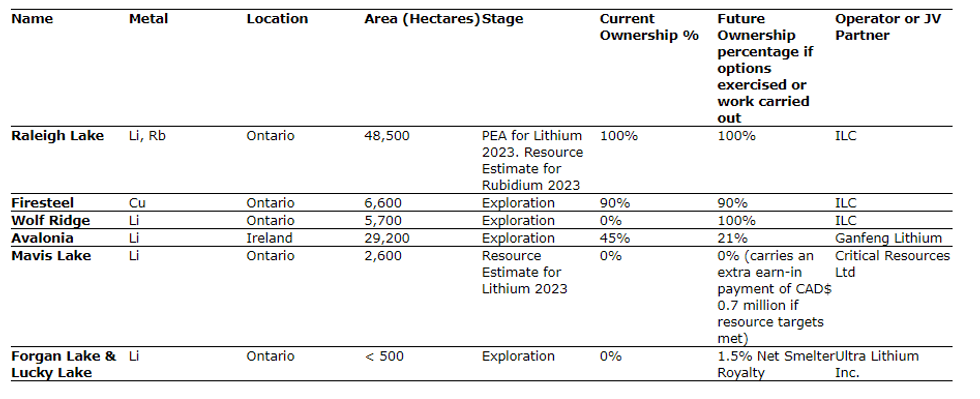

The Company's interests in various projects now consist of the following, and in addition, the Company continues to seek other opportunities:

The Raleigh Lake Project consists of 48,500 hectares (485 square km) of mineral claims in Ontario and is ILC's most significant project in Canada. Drilling has so far been on less than 1,000 hectares of our claims. A Preliminary Economic Assessment (PEA) was published for ILC's lithium at Raleigh Lake in December 2023, with a detailed economic analysis of ILC's separate rubidium resource still to come. Raleigh Lake is 100% owned by ILC, is not subject to any encumbrances, and is royalty-free. The project has excellent access to roads, rail and utilities.

With the increasing demand for high-tech rechargeable batteries used in electric vehicles and electrical storage as well as portable electronics, lithium has been designated "the new oil" and is a key part of a green energy sustainable economy. By positioning itself with projects with significant resource potential and solid strategic partners, ILC aims to be one of the lithium and rare metals resource developers of choice for investors and to continue building value for its shareholders in the '20s, the decade of battery metals.

On behalf of the Company,

John Wisbey

Chairman and CEO

For further information concerning this news release please contact +1 604-449-6520

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release or other releases contain certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information or forward-looking statements in this or other news releases may include the effect of results of anticipated production rates, the timing and/or anticipated results of drilling on the Raleigh Lake or Firesteel or Wolf Ridge or Avalonia projects, the expectation of resource estimates, preliminary economic assessments, feasibility studies, lithium or rubidium or copper or other metal recoveries, modeling of capital and operating costs, results of studies utilizing various technologies at the company's projects, budgeted expenditures and planned exploration work on the Company's projects, the increased value of shareholder investments, and assumptions about ethical behaviour by our joint venture partners or third party operators of projects. Such forward-looking information is based on assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled "Risks" and "Forward-Looking Statements" in the interim and annual Management's Discussion and Analysis, which are available at www.sedar.com. While management believes that the assumptions made are reasonable, there can be no assurance that forward-looking statements will prove to be accurate. Should one or more of the risks, uncertainties, or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. Forward-looking information herein and all subsequent written and oral forward-looking information are based on expectations, estimates and opinions of management on the dates they are made that, while considered reasonable by the Company as of the time of such statements, are subject to significant business, economic, legislative, and competitive uncertainties and contingencies. These estimates and assumptions may prove to be incorrect and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management's estimates or opinions change.

ILC:CA

Sign up to get your FREE

ILC Critical Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

22 January

ILC Critical Minerals

Developing a portfolio of critical metals assets to meet the global demand for clean energy

Developing a portfolio of critical metals assets to meet the global demand for clean energy Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

Latest News

Sign up to get your FREE

ILC Critical Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00