September 25, 2025

First assay results from latest 7,750m programme confirm extensions to orebody and further high-grade zones

Blencowe Resources Plc (LSE: BRES) is pleased to announce the first batch of assay results from its Stage 7 drilling programme at its Orom-Cross graphite project in Northern Uganda. This campaign, the largest in the Company's history, included geotechnical holes, infill drilling and exploration drilling across both the Camp Lode and Northern Syncline deposits, as well step-out and deep drilling at the newly identified Beehive deposit.

Assays are being processed in batches for each component of the programme and will be reported regularly as results are returned. The first results, from the eight geotechnical holes drilled primarily to support pit design, have returned strong graphite grades.

These results confirm extensions to mineralisation and highlight high-grade zones within the existing deposits, further underscoring Orom-Cross's unique combination of high grade, shallow ore and large-scale potential.

Highlights:

Camp Lode

- Hole CLGT03: 27.54m @ 8.68% TGC, including 1.3m @ 18.98% TGC and 1.3m @ 13.46%TGC

- → Confirms high-grade extensions to the orebody to the south-east.

- Hole CLGT02: 3.96m @ 9.08% TGC at depth.

- Shallow intersections in CLGT01 and CLGT04 confirm near-surface mineralisation and potential to extend the pit to the north.

Significance: Adds higher-grade tonnes to the Camp Lode resource and optimises mine scheduling for early production phases.

Northern Syncline

- Hole NSGT02: 27.98m @ 4.61% TGC, including 5.57m @ 8.10% TGC (majority <30m depth).

- Hole NSGT04: 12.37m @ 6.09% TGC.

Significance: Confirms shallow, high-grade mineralisation continuity in infill zones which are critical for low-cost, open-pitable production.

Drilling Programme Integration

- Geotechnical data will feed directly into Definitive Feasibility Study ("DFS") pit wall design and mine scheduling.

- All results will be incorporated into the JORC Resource upgrade, which is expected to deliver a material increase in Reserves to support large-scale mining over life of mine.

- Additional assays from infill, step-out and deep drilling (Beehive deposit) programmes are expected shortly.

Construction of a Permanent Camp

Work is now underway on building a permanent camp at Orom-Cross which is expected to support further exploration in 2026 and provide facilities for contractors during the construction of the mine. This permanent camp represents the first tangible permanent structures on site which underlines the progress being made. With the DFS expected to be completed in Q4 2025 the next steps thereafter will be project funding and then construction of the mine.

Executive Chairman Cameron Pearce commented:

"The results confirm high-grade extensions to both Camp Lode and Northern Syncline, while reinforcing the advantage of shallow, easily mined ore that underpins our low-cost production profile.

All this data will be fed directly into both our JORC Resource upgrade and the Definitive Feasibility Study, which is due for completion in Q4 2025. Increasing ore reserves at higher grades is a critical step and we expect this to not only enhance the mine plan but also translate into a considerable uplift to project economics and NPV.

Orom-Cross already benefits from a unique combination of attributes, including abundant low cost national-grid hydropower, established roads and infrastructure, and independent test work from both Wuhan University and American Energy Technologies confirming some of the highest SPG purities recorded (up to 99.99% GC). This underscores the exceptional quality of Orom-Cross graphite and its suitability for premium battery-grade markets. Together, these factors give Orom-Cross a rare blend of scale, quality and deliverability that make it a truly bankable graphite opportunity.

With assays now beginning to come through and more results to follow we look forward to a steady flow of updates, including the JORC upgrade and the DFS. These milestones will showcase Orom-Cross as a standout global graphite project, provide the platform to move directly into financing discussions, and ultimately set the stage for a major value re-rating as we continue to de-risk."

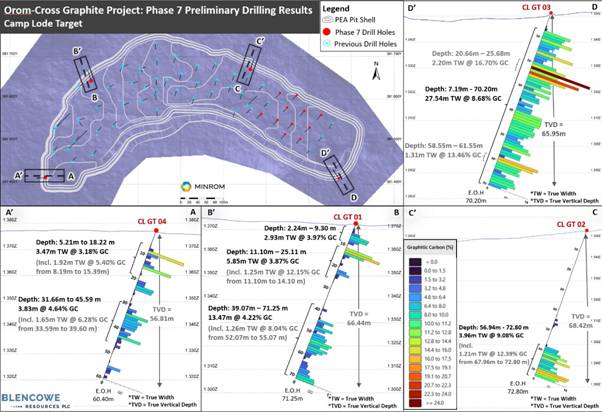

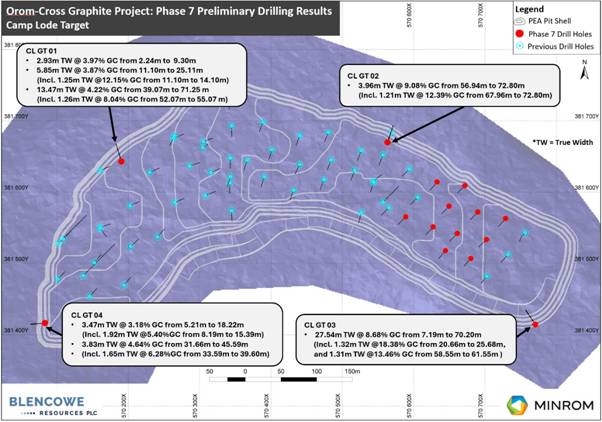

Preliminary drill results Camp Lode

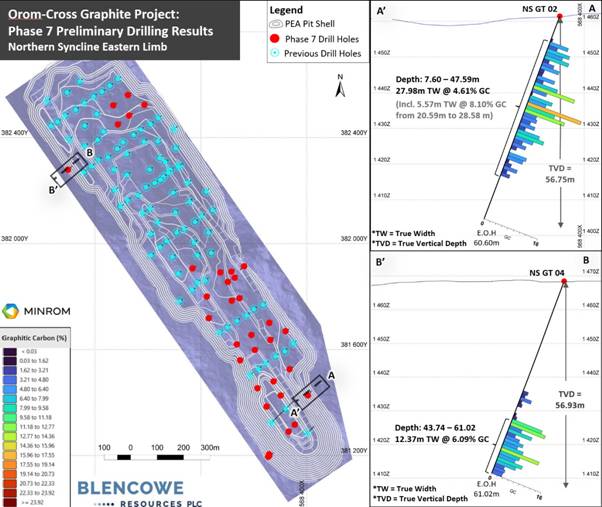

Preliminary drill results Northern Syncline

Further Drilling Detail

The Company drilled four geotechnical holes in each of the Northern Syncline and Camp Lode deposits. While primarily designed for geotechnical assessment to inform pit wall design, all holes were sampled for assays and incorporated into resource database.

At Camp Lode, these holes have indicated a possible extension to the orebody in the south-east, with hole CLGT03 intersecting 27.54m @ 8.68%GC including 2 separate intersections of 1.3M with grades of 18.98%GC and 13.46%GC respectively. These represent very high grades of graphite in comparison to the overall Orom-Cross resource. An additional intersection from hole CLGT02 of 3.96m @ 9.08%GC at depth and intersections near surface in holes CLGT01 and CLGT04 indicate potential to extend the pit to the north.

Similarly, at Northern Syncline hole NSGT02 intersected 27.98m @ 4.61%GC (including 5.57m @ 8.10%GC) and NSGT04 with 12.37m @ 6.09%GC. The intersection from NSGT02 occurs within the area of the completed infill drilling with the majority of the intersection occurring within 30 meters of the surface. The ability to mine substantial volume of graphite from shallow depths contributes to Orom-Cross having operating costs sitting within the lowest percentile of graphite projects worldwide, and this is considered a major advantage as Blencowe drives towards first production.

The results from all eight holes will be included within the resource model updates. The assay labs are continuing to prioritise the Orom-Cross samples and the Company expects further results of the infill program shortly.

For further information please contact:

Blencowe Resources Plc Sam Quinn | Tel: +44 (0)1624 681 250 |

Investor Relations Sasha Sethi | Tel: +44 (0) 7891 677 441 |

Tavira Financial Jonathan Evans | Tel: +44 (0)20 3192 1733 |

Twitter https://twitter.com/BlencoweRes

LinkedIn https://www.linkedin.com/company/72382491/admin/

Background

Orom-Cross Graphite Project

Orom-Cross is a potential world class graphite project both by size and end-product quality, with a high component of more valuable larger flakes within the deposit.

A 21-year Mining Licence for the project was issued by the Ugandan Government in 2019 following extensive historical work on the deposit and Blencowe is finalising the Definitive Feasibility Study phase as it drives towards first production.

Orom-Cross presents as a large, shallow open-pitable deposit, with a maiden JORC Indicated & Inferred Mineral Resource deposit of 24.5Mt @ 6.0% Total Graphite Content. Development of the resource is expected to benefit from a low strip ratio and free dig operations, thereby ensuring lower operating and capital costs.

Sign up to get your FREE

Lahontan Gold Corp. Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 January

Lahontan Gold Corp.

Near-term gold production pathway in the highly prolific Walker Lane district in Nevada

Near-term gold production pathway in the highly prolific Walker Lane district in Nevada Keep Reading...

27 January

Top 5 Canadian Graphite Stocks (Updated January 2026)

Graphite stocks and prices have experienced volatility in recent years recently due to bottlenecks in demand for electric vehicles, as graphite is used to create lithium-ion battery anode materials. One major factor experts are watching is the trade war between China and the US.China introduced... Keep Reading...

09 December 2025

Greenland Government Grants Exploitation Licence for Amitsoq

GreenRoc Strategic Materials Plc (AIM: GROC), a company focused on the development of critical mineral projects in Greenland, is delighted to announce that the Government of Greenland has granted an Exploitation Licence for the Amitsoq Graphite Project to Greenland Graphite a/s ("Greenland... Keep Reading...

30 November 2025

Altech - Board Renewal and Strategic Focus

Altech Batteries (ATC:AU) has announced Altech - Board Renewal and Strategic FocusDownload the PDF here. Keep Reading...

27 November 2025

Major JORC Resource & Reserve Upgrade at Orom-Cross

Blencowe Resources Plc (LSE: BRES) is pleased to announce the completion of the updated JORC 2012 Mineral Resource and Ore Reserve Statement ("JORC") for its 100%-owned Orom-Cross Graphite Project in Uganda. This upgrade incorporates all the infill drilling undertaken in 2025 across the Camp... Keep Reading...

06 November 2025

Amitsoq Update - Graphite pilot processing plant

GreenRoc Strategic Materials Plc (AIM: GROC), a company focused on the development of critical mineral projects in Greenland, is pleased to announce that it has signed a purchase agreement with a leading manufacturing company in China for a line of graphite processing mills and has also signed a... Keep Reading...

Latest News

Sign up to get your FREE

Lahontan Gold Corp. Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00