December 05, 2023

Galan Lithium Limited (ASX: GLN) (Galan or the Company) is pleased to provide an update on the progress of construction activities at the 100% owned Hombre Muerto West (HMW) Phase 1 lithium brine project, with the aim of delivering lithium chloride production in H1, 2025.

Highlights:

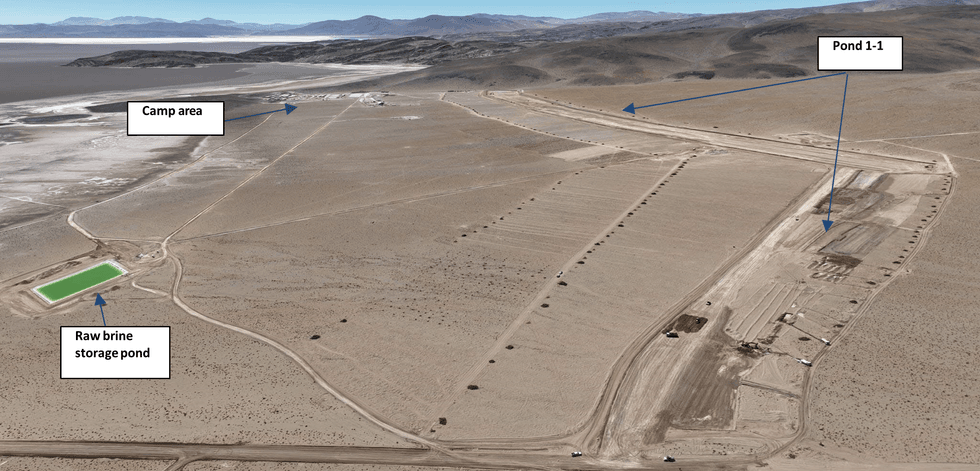

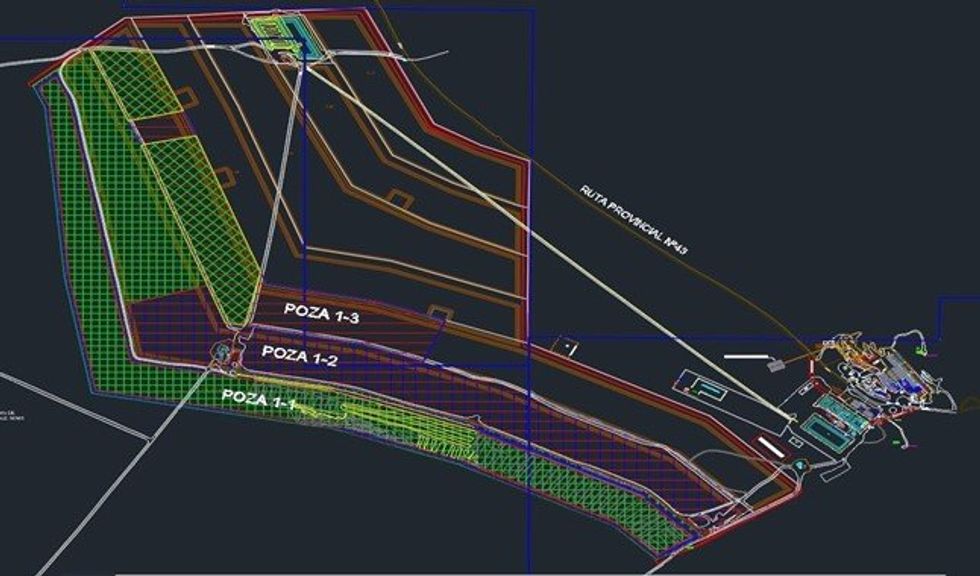

- Pond 1 construction progressing to schedule; advance rate now at 65% completion

- Liners on-site; installation scheduled to commence late December 2023

- Fill of pond 1 expected in Q1, 2024; evaporation process to commence this summer

- Preparation works for Ponds 2 and 3 underway, including topsoil removal

- New camp and infrastructure progressing well with all final modules materially in place

- Glencore technical due diligence has commenced

As previously announced, the HMW project was separated into four production phases. The initial Phase 1 DFS focused on the production of 5.4ktpa LCE of a lithium chloride concentrate by H1,2025, as governed by the approved production permits. The Phase 2 DFS targets 21ktpa LCE of a lithium chloride concentrate in 2026, followed by Phase 3 production of 40ktpa LCE by 2028 and finally a Phase 4 production target of 60ktpa LCE by 2030. Phase 4 will include lithium brine being sourced from HMW and Galan’s other 100% owned project in Argentina, Candelas.

Galan’s Managing Director, Juan Pablo (JP) Vargas de la Vega, commented:

“I arrived on site this week and am very pleased with the significant progress being made on site and most impressed with the dedicated personnel we have in place. Galan has assembled a cohesive team of highly competent people, with the necessary specialist experience and knowledge to build the ponds and infrastructure required to successfully deliver the first production phase of the HMW project. Pond 1 construction works have been progressing well and in accordance with expectations. We are sharply focused on our objective to commence brine evaporation this summer. We also remain enthusiastic and confident about development of Phase 1 HMW and achieving first production H1, 2025.”

Below are a selection of recent photos evidencing the progress being made on site.

Click here for the full ASX Release

This article includes content from Galan Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLN:AU

The Conversation (0)

20 April 2025

Galan Lithium

Developing high-grade lithium brine projects in Argentina

Developing high-grade lithium brine projects in Argentina Keep Reading...

24 August 2025

Successful Due Diligence Ends - $20M Placement To Proceed

Galan Lithium (GLN:AU) has announced Successful Due Diligence Ends - $20m Placement To ProceedDownload the PDF here. Keep Reading...

01 August 2025

Final At-The-Market Raise for 2025

Galan Lithium (GLN:AU) has announced Final At-The-Market Raise for 2025Download the PDF here. Keep Reading...

30 July 2025

Quarterly Activities and Cash Flow Report

Galan Lithium (GLN:AU) has announced Quarterly Activities and Cash Flow ReportDownload the PDF here. Keep Reading...

25 July 2025

Incentive Regime for HMW Project in Argentina

Galan Lithium (GLN:AU) has announced Incentive Regime for HMW Project in ArgentinaDownload the PDF here. Keep Reading...

24 July 2025

Trading Halt

Galan Lithium (GLN:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

7h

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00