May 20, 2024

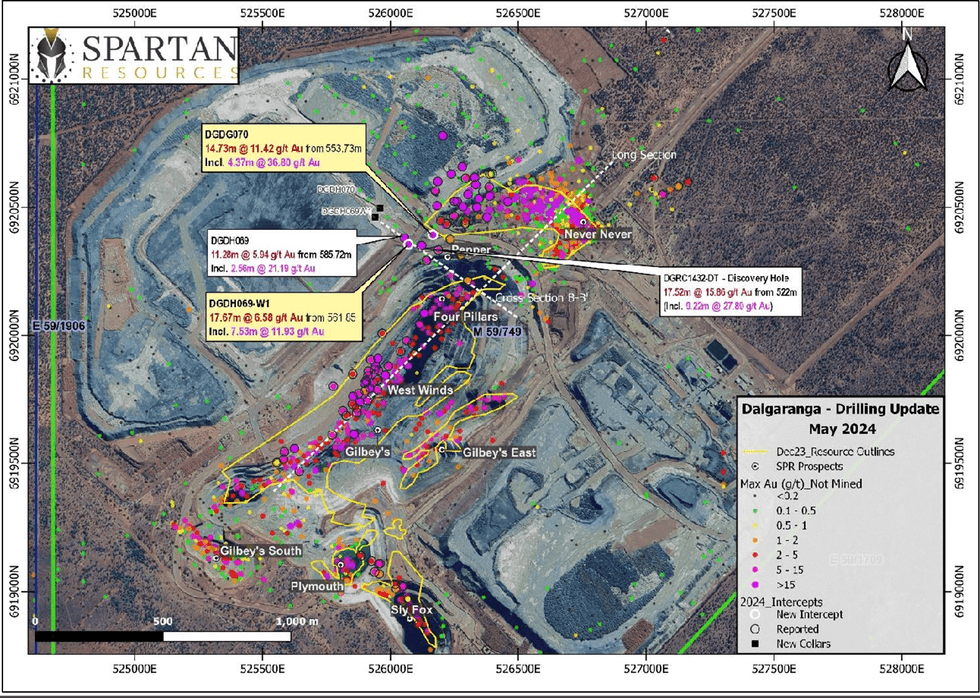

Latest high-grade assays from Pepper Gold Prospect, adjacent to the 0.95Moz Never Never Gold Deposit, show increasing ounces per vertical metre potential

Spartan Resources Limited (Spartan or Company) (ASX:SPR) is pleased to provide an update on exploration activities at its 100%-owned Dalgaranga Gold Project (“DGP”), located in the Murchison region of Western Australia.

Highlights:

- Pepper Gold Prospect – significant new intercepts expand high-grade discovery:

- 14.73m @ 11.42g/t gold from 553.73m down-hole, incl. 4.37m @ 36.80g/t (DGDH070):

- Intercept located approximately midway (~50m north) of the initial “Pepper” discovery hole DGRC1432-DT, which returned 17.52m @ 15.86g/t gold (previously announced)

- 17.67m @ 6.58g/t gold from 561.85m down-hole, incl. 7.53m @ 11.93g/t (DGDH069-W1)

- Intercept located down-dip of the Pepper discovery hole, midway between DGRC1432- DT and DGDH069, which returned 11.28m @ 5.94g/t gold (previously announced)

- Maiden Mineral Resource Estimate to be calculated for the Pepper Gold Prospect as part of the scheduled mid-year resource update for the Dalgaranga Gold Project.

- 14.73m @ 11.42g/t gold from 553.73m down-hole, incl. 4.37m @ 36.80g/t (DGDH070):

This release contains new assay results from recent surface drilling targeting the high-grade growing Pepper Gold Prospect.

Management Comment

Spartan Managing Director and Chief Executive Officer, Simon Lawson, said: “Our focus on drilling, closing the gaps and achieving significant outcomes in front of our established infrastructure continues to deliver in spades with our ongoing drilling success at the recently discovered Pepper Gold Prospect.

“Pepper is located less than 100m south of the high-grade 0.95Moz Never Never Gold Deposit and we couldn’t be happier to see the rapid emergence of another substantial high-grade body of mineralisation next to our flagship deposit with each new drill result.

“We are very confident that Pepper will become a standalone gold deposit and, to ensure that outcome, we will be completing a maiden Mineral Resource Estimate ("MRE”) for this exciting prospect as part of our foreshadowed mid-year MRE update for Dalgaranga.

“With the gold price continuing to hit new records, this is an exciting time to be making new high-grade gold discoveries. And, on the back of a well-supported capital raise, we are now moving rapidly towards developing the underground infrastructure required to chase and grow this high-grade system.

“With rigs still spinning around the clock, investors can look forward to more exciting drill results in the coming weeks, mid-year MRE update for Dalgaranga, the planned commencement of the underground exploration drill drive in the second half of 2024, and the expected publication of a maiden high-grade Ore Reserve for the Never Never Gold Deposit.

“The Spartan team also continues to progress a Feasibility Study to demonstrate what we believe will be powerful metrics from a growing set of high-grade gold structures and maybe even some more high- grade gold discoveries!”

Click here for the full ASX Release

This article includes content from Spartan Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00