January 15, 2025

Augustus Minerals (ASX: AUG; Augustus or the Company) is pleased to announce the results of rock chips collected during a field trip to the St Patrick’s Well prospect within the recently acquired Music Well project.

Assays have been received from rock chips collected in December 2024 at the St Patrick’s Well Prospect.

- 10 rock chips were collected at St Patrick’s Well, with all samples of vein quartz assaying greater than 0.9g/t Au, including:

- 30.4g/t Au (ARK000063),

- 20.4g/t Au (ARK000061),

- 4.1g/t Au (ARK000059),

- 2.8g/t Au (ARK000071).

- The new rock chips support the previous rock chips which included1:

- 25.1g/t Au (IMCA000013

- 20.5g/t Au (SP2104088)

- 14.4g/t Au (FSMWR090)

- 7.86g/t Au (FSMWR085)

- 6.21g/t Au (SP2104089)

- Review of the historic wide spaced RAB/Aircore drilling (WAMEX Report a060944)1 within and to the west of St Patrick’s Well prospect shows gold anomalism extending for 3km, parallel to the mineralised structural trends from Wonder and Celtic mines in the west.

- Next Steps at St Patrick’s Well:

- Geological mapping and AC/RC drilling.

- An artificial intelligence/machine learning (AI) enhanced targeting study is in progress. Results of this study are expected in Q1 2025.

Andrew Ford, GM Exploration

“The exciting results from the Augustus geology team’s first visit to the St Patrick’s Well prospect have not only confirmed the validity of previous data collected by MWGM but also defined several new promising vein trends.

“Defining structures related to gold mineralisation on adjacent tenure within similar granitic rocks that also relate to mineralisation within Augustus tenure significantly improves the prospectivity of this underexplored project.

St Patrick’s Well is just one of several priority targets defined at Music Well that will be followed-up with on-ground exploration and drilling”.

Background

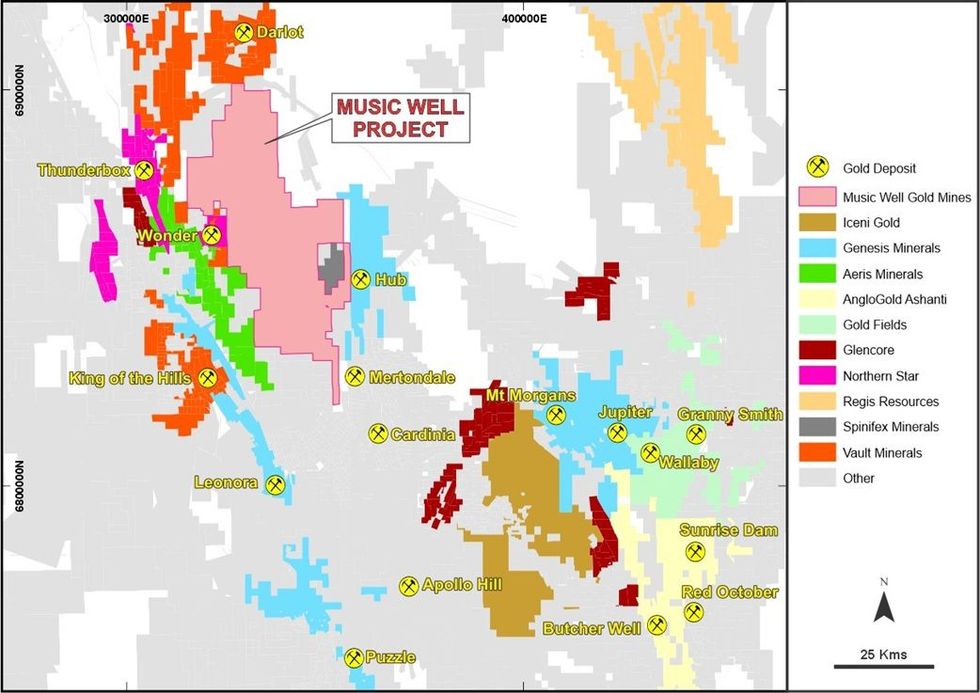

Augustus Minerals Limited (ASX: AUG) holds one of the largest exploration packages in the region covering an area of 1,345km2 comprising the Music Well Gold Project (“Project”) located 35km north of Leonora in the Leonora / Laverton Greenstone Belt of Western Australia (Figures 1 and 2).

The outstanding gold endowment of the Leonora-Laverton District is illustrated by the numerous operating gold mines including the Darlot Gold Mine (~12km to the north), the King of the Hills Mine (~20km to the west), the Leonora Gold Camp (~30km to the southwest), and the Thunderbox Gold Mine (~20km to the west).

Click here for the full ASX Release

This article includes content from Augustus Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AUG:AU

Sign up to get your FREE

Augustus Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 July 2023

Augustus Minerals

Vast Land Package for Critical and Precious Metals Exploration in Australia

Vast Land Package for Critical and Precious Metals Exploration in Australia Keep Reading...

25 February

Drilling to Commence at Music Well

Augustus Minerals (AUG:AU) has announced Drilling to Commence at Music WellDownload the PDF here. Keep Reading...

28 January

Quarterly Activities/Appendix 5B Cash Flow Report

Augustus Minerals (AUG:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

11 January

Heritage Approval for Drilling at Music Well

Augustus Minerals (AUG:AU) has announced Heritage Approval for Drilling at Music WellDownload the PDF here. Keep Reading...

15 December 2025

CEO Resignation

Augustus Minerals (AUG:AU) has announced CEO ResignationDownload the PDF here. Keep Reading...

18 November 2025

Exploration Update - Soil Sampling Results

Augustus Minerals (AUG:AU) has announced Exploration Update - Soil Sampling ResultsDownload the PDF here. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Sign up to get your FREE

Augustus Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00