November 25, 2024

Assay Results for the Remaining Sixteen Holes Have Been Received. Significant intercepts include 8m at 4.86 g/t Au from 34m

Riversgold Limited (ASX: RGL, Riversgold or the Company) is pleased to announce that it has received the final batch of assay results from the November aircore (AC) drilling undertaken during Riversgold’s fourth aircore program at the Northern Zone Intrusive Hosted Gold Project, located 25km east-south-east of the Kalgoorlie Super Pit in Western Australia (refer to Figure 2 for location).

Highlights:

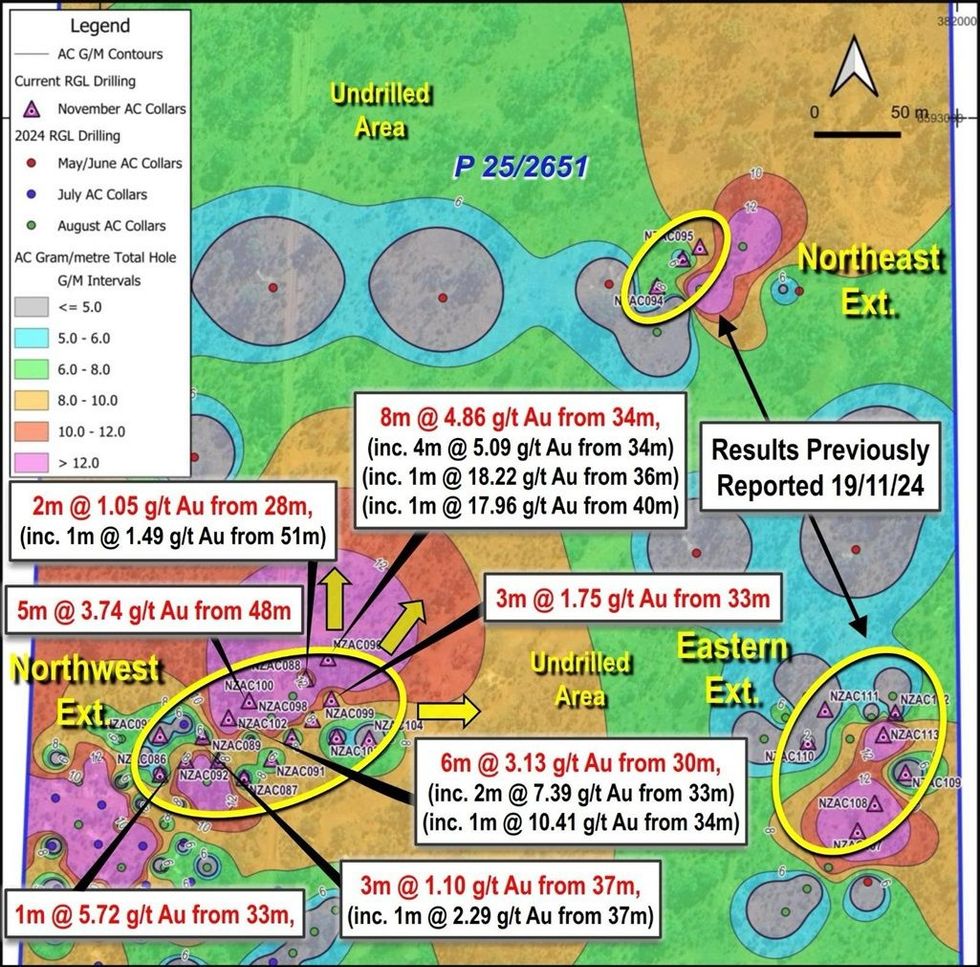

- Further significant shallow gold intercepts for the remaining aircore (AC) drillholes at Northern Zone, located 25km east of Kalgoorlie, include:

- 8m at 4.86 g/t Au from 34m (NZAC090)

- inc. 4m at 5.09 g/t Au from 34m

- inc. 1m at 18.22 g/t Au from 36m

- inc. 1m at 17.96 g/t Au from 40m

- 6m at 3.13 g/t Au from 30m (NZAC097)

- inc. 2m at 7.39 g/t Au from 33m

- inc. 1m at 10.41 g/t Au from 34m

- 5m at 3.74 g/t Au from 31m (NZAC100)

- 1m at 5.72 g/t Au from 33m (NZAC092)

- 3m at 1.75 g/t Au from 33m (NZAC099)

- 8m at 4.86 g/t Au from 34m (NZAC090)

- Continuation of the high-grade oxide zone within the 600m wide porphyry system has been expanded (see Figure 1)

- Results of these drill holes continue to confirm and enlarge the shallow gold mineralisation associated with the Northern Zone porphyry

- The dynamic Leapfrog gold model for Northern Zone will be updated with these latest results in the coming weeks, which will inform and guide future drill campaigns

- A mineralisation report is expected at the end of the month, with a Mining Lease application to be submitted thereafter

- Possible ore processing scenarios have been demonstrated by the recent success of Black Cat Syndicate Ltd1, at their Myhree open pit, located only 7km to the north of Northern Zone

David Lenigas, Chairman of Riversgold, said: “The Northern Zone Gold Project continues to bash out great gold intercepts and grow the footprint, and demonstrates excellent grades at relatively shallow depths over good widths within the overall 600m wide porphyry. We are particularly encouraged by the recent success of Black Cat’s Myhree open pit operations1 only 7km up the road from Northern Zone and we are assessing if similar operations can be achieved with Northern Zone after we convert the tenement to a Mining Lease – which is work in progress post the imminent completion of the mineralisation report.”

Following on from our successful aircore programs completed in May, July and September 2024, Riversgold engaged drilling contractor, Australian Aircore Drilling (Mick Shorter), to undertake a fourth aircore program for a further 26 holes in early November 2024. A further 1,545m of AC drilling (refer Appendix 1 for all drill data information and significant intercepts, Table 1, 2 and 3) was completed at Northern Zone in the most recent drilling campaign bringing the total number of metres drilled this year to 8,971m of AC drilling and 1,363m of reverse circulation drilling.

The AC holes were drilled using a blade to drilling refusal. The cuttings were logged by RGL geologists, and both the detailed logging and assays continue to show that a significant gold mineralisation event has taken place within the project area.

These excellent results (14 of 16 holes intersecting gold mineralisation) continue to successfully target the mineralised porphyry over an increasing footprint within the tenement. The expansion of the high-grade zone in the northwestern extensional area and the extension of anomalous gold mineralisation in eastern and north- eastern areas continues to validate the broader geological model. Gold mineralisation remains open in multiple directions and will require further modelling and drill testing. We will continue to further our understanding of the Project before proceeding with a maiden Mineral Resource Estimate (MRE).

Click here for the full ASX Release

This article includes content from Riversgold Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

15h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

20h

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

22h

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

22h

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

23h

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00