HIGHLIGHTS:

- 8.85m grading 25.0 g/t gold and 768 g/t silver

- 8.55m grading 5.52 g/t gold and 121 g/t silver

- 3.5m grading 5.41 g/t gold and 87 g/t silver

- 5.5m grading 11.1 g/t gold

- 2.9m grading 10.5 g/t gold

- 4.6m grading 5.78 g/t gold

- 5.75m grading 4.72 g/t gold

- Higher-grade intercepts demonstrate underground potential beyond the current open pit

- The success of this drill program called for additional step-out drilling. Results for these drill holes are expected in Q2, 2025

- La Colorada technical report update incorporating these results is expected in mid-2025

Heliostar Metals Ltd. (TSXV: HSTR) (OTCQX: HSTXF) (FSE: RGG1) ("Heliostar" or the "Company") is pleased to announce additional results from a 12,500-metre drilling program at the La Colorada Mine in Sonora, Mexico. La Colorada restarted production in early January 2025, and the current drill program is intended to expand the mineral reserves ahead of an updated technical report and expansion decision planned for mid-2025.

Heliostar CEO, Charles Funk, commented, "Heliostar closed the first quarter of 2025 with a US$27M (C$38M) cash balance, over half of which was generated from operating profits. This places the Company in a strong position to achieve our planned production and resource growth goals. Today's results reflect these growth plans and further cement our confidence in the future of La Colorada. They are expected to positively impact the economics of the mine when we update the La Colorada technical report in mid-2025. Our goal is for the study to support a decision to expand production to 50,000 to 100,000 ounces of gold per year. Additionally, the high-grades intersected demonstrate a potential underground future for the mine. We intend to target these deeper zones in more detail after we complete the technical report."

Drill Results Summary

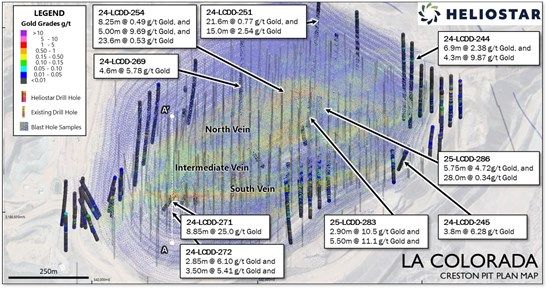

Mineralization at La Colorada's Creston Pit is predominantly hosted in three veins: the North, Intermediate and South Veins (Figure 1). These veins trend northeast-southwest to east-west, dip northward and are surrounded by halos of smaller mineralized vein zones. The Creston Pit has historically mined oxide gold and silver from all three of these veins. A current Probable Mineral Reserve of 312,000 ounces of gold grading 0.76 grams per tonne (g/t) gold and 5,074,000 ounces of silver at 10.1 g/t silver is defined at the Creston Pit1.

A technical review of expansion potential identified two opportunities for reserve growth. The near-surface extensions of known veins with little or no drill data and exploring the under-sampled mineralization beneath the pit. Both opportunities were defined using historical drilling, blast hole data, mining shapes, and the geological model.

Figure 1: Plan view of the Creston Pit showing historic drilling, blast hole samples and Heliostar drill holes.

Selected intercepts are labelled.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/247879_ef50e500f496a835_003full.jpg

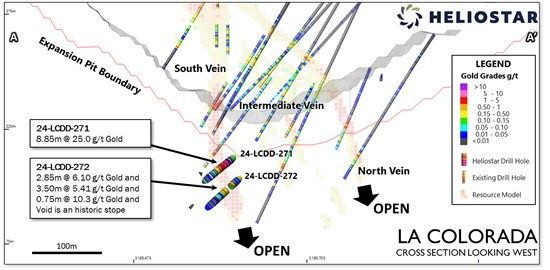

Figure 2: Cross-section view looking west at the western end of the Creston Pit. The section shows historic drilling and new Heliostar drill hole results below the planned pit boundary.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/247879_ef50e500f496a835_004full.jpg

Blast hole data clearly shows the potential for a continuation of veins at shallow depths. They contain elevated gold grades that continue to the edge of the pit walls, where they remain open for expansion (Figure 1). At depth, drill spacing is wider than the area above. Additional drilling allows for improved estimation of grade and continuity.

The Company has completed seventy-two holes totalling 11,075 metres in the program to date. This release reports results for twenty-three new holes. The majority of the new drill holes targeted extensions of the North, Intermediate, and South Veins in areas where drilling is widely spaced yet within the current resource. They aim to add ounces to the overall El Creston resources and reserves.

Assay results show narrow to wide, low- to high-grade oxide gold intercepts. Targeted vein zones consistently return intercepts above the 0.16 g/t gold-equivalent cutoff grade of reserves within the Creston pit. The results may increase the tonnes and grade of mineralization in an updated pit shell. If so, that would add to the total reserves in an updated technical report.

Further, the success of the drill program to date has required modification of the remaining drill program plans. Numerous step-out drill holes have been added to follow-up on intercepts reported here. Results remain pending for these follow-up drill holes and are expected to be received in April and May.

Next Steps

Results from the current drill program are being incorporated into a resource model. They will support a reserve update to be published with a technical report in mid-2025.

This drill program is important because if it increases the volume of rock containing gold mineralization, it could improve the overall mine economics. Any zones of waste material with new gold intercepts from this program have the potential to reduce the overall strip ratio of the Creston pit expansion.

That, in turn, could reduce the up-front capital requirements for the restart and improve the economics of the Technical Report. This study will be the basis of a decision for the expansion of production at La Colorada.

The Company anticipates additional drilling results from the current program will be released in Q2, 2025.

La Colorada Mineral Reserves Statement

| Classification | Zone | AuEq Cut-off (g/t) | Tonnes (kt) | Gold Grade (g/t Au) | Silver Grade (g/t Ag) | Contained Gold (koz) | Contained Silver (koz) |

| Probable | El Crestón | 0.160 | 12,841 | 0.76 | 10.1 | 312 | 4,181 |

| Veta Madre | 0.175 | 1,905 | 0.70 | 3.1 | 43 | 189 | |

| La Chatarrera | 0.164 | 3,413 | 0.20 | 6.4 | 22 | 704 | |

| Total | 18,159 | 0.65 | 8.69 | 377 | 5,074 |

1. La Colorada Operations, Sonora, Mexico, NI 43-101 Technical Report (the "Report") is dated January 11, 2024, has an effective date of December 4, 2024.

Drilling Results Table

| HoleID | From (metres) | To (metres) | Interval (metres) | Au (g/t) | Ag (g/t) | % True Width | Comment |

| 24-LCDD-262 | 36.35 | 40.4 | 4.05 | 0.53 | 8.6 | 94 | South Vein |

| 24-LCDD-263 | Abandoned | ||||||

| 24-LCDD-264 | 165.05 | 178.4 | 13.35 | 0.34 | 43 | 74 | North Vein |

| 24-LCDD-265 | 8.35 | 11.1 | 2.75 | 0.34 | 6.2 | 28 | South Vein |

| and | 15.7 | 20.55 | 4.85 | 0.24 | 5.2 | 28 | South Vein |

| and | 76.9 | 92.3 | 15.4 | 0.19 | 2.8 | 44 | South Vein |

| 24-LCDD-266 | 22.3 | 28.95 | 6.65 | 0.50 | 2.5 | 82 | South Vein |

| 24-LCDD-267 | No significant intervals | ||||||

| 24-LCDD-268 | 15.85 | 28.1 | 12.25 | 0.40 | 4.8 | 15 | South Vein |

| and | 77.9 | 90.0 | 12.1 | 0.19 | 6.8 | 61 | South Vein |

| 24-LCDD-269 | 163.75 | 181.65 | 17.9 | 1.69 | 8.8 | 84 | North Vein |

| including | 167.7 | 172.3 | 4.6 | 5.78 | 16 | 84 | North Vein |

| 24-LCDD-270 | 24.55 | 33.4 | 8.85 | 1.89 | 82 | 89 | South Vein |

| including | 29.0 | 33.4 | 4.4 | 3.52 | 155 | 90 | South Vein |

| 24-LCDD-271 | 4.0 | 11.95 | 7.95 | 0.38 | 12 | 84 | Intermediate Vein |

| and | 50.0 | 58.85 | 8.85 | 25.0 | 768 | 71 | South Vein |

| 50.0 | 58.85 | 8.85 | 10.4 | 768 | 71 | Top-cut to 20 g/t gold | |

| and | 64.2 | 68.0 | 3.8 | 4.32 | 178 | 70 | South Vein |

| 24-LCDD-272 | 2.05 | 35.6 | 33.55 | 1.04 | 22 | 68 | Intermediate Vein |

| including | 6.0 | 8.85 | 2.85 | 6.10 | 135 | 68 | Intermediate Vein |

| and | 70.2 | 80.85 | 10.65 | 0.22 | 5.4 | 81 | South Vein |

| and | 90.8 | 94.3 | 3.5 | 5.41 | 88 | 79 | South Vein |

| 90.8 | 94.3 | 3.5 | 4.31 | 88 | 79 | Top-cut to 20 g/t gold | |

| including | 90.8 | 91.35 | 0.55 | 27.0 | 433 | 79 | South Vein |

| 90.8 | 91.35 | 0.55 | 20.0 | 433 | 79 | Top-cut to 20 g/t gold | |

| and | 103.65 | 104.4 | 0.75 | 10.3 | 255 | 79 | South Vein |

| and | 107.55 | 112.05 | 4.5 | 0.84 | 23 | 79 | South Vein |

| 24-LCDD-273 | 7.85 | 10.2 | 2.35 | 0.45 | 10 | 79 | Intermediate Vein |

| and | 48.0 | 69.75 | 21.75 | 2.37 | 62 | 87 | South Vein |

| 48.0 | 69.75 | 21.75 | 1.97 | 62 | 87 | Top-cut to 20 g/t gold | |

| including | 59.25 | 67.8 | 8.55 | 5.52 | 121 | 87 | South Vein |

| 59.25 | 67.8 | 8.55 | 4.50 | 121 | 87 | Top-cut to 20 g/t gold | |

| 24-LCDD-274 | 103.8 | 126.15 | 22.35 | 0.21 | 6.5 | 67 | North Vein |

| and | 137.4 | 147.6 | 10.2 | 0.39 | 6.4 | 67 | North Vein |

| 25-LCDD-275 | 20.4 | 23.35 | 2.95 | 2.07 | 166 | 75 | Intermediate Vein |

| and | 29.25 | 33.75 | 4.5 | 0.40 | 9.0 | 89 | Intermediate Vein |

| and | 88.85 | 101.85 | 13.0 | 0.57 | 8.8 | 42 | Intermediate Vein |

| and | 120.55 | 128.1 | 7.55 | 0.72 | 13 | 100 | South Vein |

| 25-LCDD-276 | 104.7 | 135.95 | 31.25 | 0.53 | 4.2 | 49 | North Vein |

| and | 155.15 | 170.25 | 15.1 | 0.45 | 2.4 | 49 | North Vein |

| 25-LCDD-277 | No significant intervals | ||||||

| 25-LCDD-278 | 6.25 | 9.0 | 2.75 | 1.06 | 63 | 100 | South Vein |

| and | 14.1 | 33.0 | 18.9 | 0.61 | 31 | 100 | South Vein |

| 25-LCDD-279 | 0.0 | 5.6 | 5.6 | 0.72 | 30 | 100 | Intermediate Vein |

| and | 62.0 | 83.85 | 21.85 | 0.63 | 9.6 | 99 | South Vein |

| 25-LCDD-280 | 130.05 | 135.6 | 5.55 | 0.26 | 57 | 88 | North Vein |

| and | 141.85 | 145.9 | 4.05 | 0.27 | 54 | 88 | North Vein |

| 25-LCDD-281 | Abandoned | ||||||

| 25-LCDD-282 | 11.15 | 16.5 | 5.35 | 0.67 | 39 | 33 | Intermediate Vein |

| 25-LCDD-283 | 60.5 | 66.2 | 5.7 | 1.51 | 20 | 90 | Intermediate Vein |

| and | 82.15 | 99.65 | 17.5 | 1.90 | 6.8 | 84 | Intermediate Vein |

| 82.15 | 99.65 | 17.5 | 1.53 | 6.8 | 84 | Top-cut to 23 g/t gold | |

| including | 89.05 | 91.95 | 2.9 | 10.5 | 15 | 84 | Intermediate Vein |

| 89.05 | 91.95 | 2.9 | 8.32 | 15 | 84 | Top-cut to 23 g/t gold | |

| and | 107.0 | 110.0 | 3.0 | 1.92 | 21 | 85 | Intermediate Vein |

| and | 127.0 | 132.5 | 5.5 | 11.1 | 23 | 88 | Intermediate Vein |

| 127.0 | 132.5 | 5.5 | 9.14 | 23 | 88 | Top-cut to 23 g/t gold | |

| and | 165.1 | 173.0 | 7.9 | 0.20 | 1.0 | 96 | South Vein |

| and | 179.95 | 191.85 | 11.9 | 0.23 | 2.2 | 96 | South Vein |

| 25-LCDD-284 | 52.0 | 61.0 | 9.0 | 1.87 | 3.2 | 84 | Intermediate Vein |

| including | 53.0 | 55.4 | 2.4 | 6.14 | 6.1 | 84 | Intermediate Vein |

| and | 69.2 | 74.6 | 5.4 | 0.52 | 3.2 | 84 | Intermediate Vein |

| and | 128.0 | 150.7 | 22.7 | 0.53 | 2.1 | 84 | South Vein |

| 25-LCDD-285 | 45.3 | 50.2 | 4.9 | 0.36 | 27 | 87 | Intermediate Vein |

| and | 79.45 | 100.75 | 21.3 | 0.28 | 9.8 | 84 | Intermediate Vein |

| and | 109.65 | 123.55 | 13.9 | 0.24 | 2.7 | 87 | Intermediate Vein |

| and | 130.15 | 140.1 | 9.95 | 0.38 | 5.0 | 99 | Intermediate Vein |

| and | 190.2 | 201.0 | 10.8 | 1.25 | 0.7 | 92 | South Vein |

| including | 199.05 | 201.0 | 1.95 | 5.94 | 1.1 | 94 | South Vein |

| 25-LCDD-286 | 38.05 | 43.8 | 5.75 | 4.72 | 10 | 92 | Intermediate Vein |

| including | 38.05 | 43.8 | 5.75 | 2.41 | 10 | 92 | Top-cut to 23 g/t gold |

| and | 67.5 | 95.45 | 27.95 | 0.35 | 7.7 | 95 | Intermediate Vein |

| and | 163.9 | 171.15 | 7.25 | 0.59 | 5.1 | 91 | South Vein |

| 25-LCDD-287 | 8.15 | 17.4 | 9.25 | 1.02 | 2.5 | 79 | Intermediate Vein |

| and | 28.05 | 39.7 | 11.65 | 0.63 | 6.3 | 74 | Intermediate Vein |

| and | 56.5 | 61.45 | 4.95 | 0.33 | 3.0 | 68 | Intermediate Vein |

| and | 116.0 | 146.75 | 30.75 | 0.18 | 1.4 | 86 | South Vein |

| 25-LCDD-288 | 13.4 | 17.0 | 3.6 | 0.46 | 15 | 91 | Intermediate Vein |

| and | 48.5 | 70.1 | 21.6 | 0.33 | 2.5 | 77 | Intermediate Vein |

| and | 120.75 | 125.5 | 4.75 | 0.58 | 1.0 | 99 | South Vein |

| and | 130.9 | 150.65 | 19.75 | 0.99 | 5.9 | 99 | South Vein |

| including | 132.0 | 133.1 | 1.1 | 10.1 | 50 | 99 | South Vein |

| 25-LCDD-289 | 10.5 | 23.05 | 12.55 | 0.55 | 17 | 95 | North Vein |

| and | 56.95 | 64.0 | 7.05 | 2.62 | 8.8 | 92 | Intermediate Vein |

| including | 56.95 | 58.9 | 1.95 | 8.76 | 14 | 92 | Intermediate Vein |

| and | 125.0 | 133.65 | 8.65 | 0.15 | 5.0 | 84 | Intermediate Vein |

| and | 169.3 | 179.4 | 10.1 | 0.82 | 4.1 | 82 | Intermediate Vein |

Table 2: Significant Drill Intersections

Drilling Coordinates Table

| Hole ID | Northing (NAD27 CONUS Zone 12N) | Easting (NAD27 CONUS Zone 12N) | Elevation (metres) | Azimuth (°) | Inclination (°) | Length (metres) |

| 24-LCDD-265 | 3185570 | 542775 | 389.8 | 000 | -47 | 113.4 |

| 24-LCDD-266 | 3185676 | 542725 | 274.8 | 180 | 10 | 96.05 |

| 24-LCDD-267 | 3185754 | 543056 | 438.3 | 187 | -40 | 69.5 |

| 24-LCDD-268 | 3185555 | 542750 | 392.4 | 000 | -45 | 102.85 |

| 24-LCDD-269 | 3185954 | 542540 | 331.2 | 179 | -60 | 298.3 |

| 24-LCDD-270 | 3185622 | 542401 | 206.7 | 202 | -32 | 75.35 |

| 24-LCDD-271 | 3185633 | 542396 | 207.2 | 220 | -31 | 124.45 |

| 24-LCDD-272 | 3185664 | 542415 | 206.5 | 217 | -36 | 147.7 |

| 24-LCDD-273 | 3185636 | 542403 | 205.9 | 200 | -54 | 114.05 |

| 24-LCDD-274 | 3185816 | 542788 | 248.7 | 000 | +2 | 159.3 |

| 25-LCDD-275 | 3185715 | 542439 | 215.5 | 180 | -56 | 167.0 |

| 25-LCDD-276 | 3185949 | 542700 | 315.6 | 180 | -83 | 225.35 |

| 25-LCDD-277 | 3185853 | 542315 | 353.9 | 180 | -56 | 258.6 |

| 25-LCDD-278 | 3185618 | 542414 | 209.0 | 180 | 0 | 55.15 |

| 25-LCDD-279 | 3185683 | 542515 | 198.1 | 180 | -20 | 105.0 |

| 25-LCDD-280 | 3185810 | 542265 | 360.0 | 178 | -50 | 325.7 |

| 25-LCDD-281 | 3185886 | 542389 | 346.7 | 178 | -47 | 149.35 |

| 25-LCDD-282 | 3185786 | 542515 | 220.3 | 180 | -85 | 124.6 |

| 25-LCDD-283 | 3185843 | 542685 | 237.6 | 169 | -57 | 246.35 |

| 25-LCDD-284 | 3185822 | 542751 | 244.4 | 179 | -62 | 191.4 |

| 25-LCDD-285 | 3185839 | 542715 | 240.5 | 173 | -61 | 240.25 |

| 25-LCDD-286 | 3185837 | 542701 | 239.5 | 180 | -48 | 205.05 |

| 25-LCDD-287 | 3185758 | 542735 | 251.1 | 215 | -60 | 150.15 |

| 25-LCDD-288 | 3185817 | 542726 | 242.4 | 180 | -58 | 180.5 |

| 25-LCDD-289 | 3185895 | 542775 | 305.9 | 193 | -60 | 292.25 |

Table 3: Drill Hole Details

Quality Assurance / Quality Control

Core was drilled with PQ, HQ, and NQ tools, and the drill core was sawn in half, with one half submitted for analysis and one half retained as a record. Core samples were shipped to ALS Limited in Hermosillo, Sonora, Mexico, for sample preparation and for analysis at the ALS laboratory in North Vancouver. The Hermosillo and North Vancouver ALS facilities are ISO/IEC 17025 certified. Gold was assayed by a 30-gram fire assay with an atomic absorption spectroscopy finish, and overlimits were analyzed by a 30-gram fire assay with a gravimetric finish.

Control samples comprising certified reference and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's quality assurance / quality control protocol.

Statement of Qualified Person

Gregg Bush, P.Eng. and Stewart Harris, P.Geo., the Company's Qualified Persons, as such term is defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects, have reviewed the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Mr. Bush is employed as Chief Operating Officer of the Company, and Mr. Harris is employed as Exploration Manager of the Company.

Technical Report Reference

1 La Colorada Operations, Sonora, Mexico, NI 43-101 Technical Report (the "Report") is dated January 11, 2024, has an effective date of December 4, 2024, and was prepared for Heliostar Metals Inc. by Mr. Todd Wakefield, RM SME, Mr. David Thomas, P.Geo., Mr. Jeffrey Choquette, P.E., Mr. Carl Defilippi, RM SME, and Ms. Dawn Garcia, CPG. The Report can be found under the Company's profile on SEDAR+ (www.sedarplus.ca) and on Heliostar's website (www.heliostarmetals.com).

About Heliostar Metals Ltd.

Heliostar is a gold mining company with production from operating mines in Mexico. This includes the La Colorada Mine in Sonora and the San Agustin Mine in Durango. The Company also has a strong portfolio of development projects in Mexico and the USA. These include the Ana Paula project in Guerrero, the Cerro del Gallo project in Guanajuato, the San Antonio project in Baja Sur and the Unga project in Alaska, USA.

FOR ADDITIONAL INFORMATION PLEASE CONTACT:

| Charles Funk President and Chief Executive Officer Heliostar Metals Limited Email: charles.funk@heliostarmetals.com Phone: +1 844-753-0045 | Rob Grey Investor Relations Manager Heliostar Metals Limited Email: rob.grey@heliostarmetals.com Phone: +1 844-753-0045 |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward-looking statements or information. These forward-looking statements or information relate to, among other things, this places the Company in a strong position to achieve our planned production and resource growth goals. Today's results reflect these growth plans and further cement our confidence in the future of La Colorada. They are expected to positively impact the economics of the mine when we update the La Colorada technical report in mid-2025. Our goal is for the study to support a decision to expand production to 50,000 to 100,000 ounces of gold per year. Additionally, the high grades intersected demonstrate a potential underground future for the mine. We intend to target these deeper zones in more detail after we complete the technical report. The Company anticipates additional drilling results from the current program will be released in Q2, 2025.

Forward-Looking statements and forward-looking information relating to the terms and completion of the Facility, any future mineral production, liquidity, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the receipt of necessary approvals, price of metals; no escalation in the severity of public health crises or ongoing military conflicts; costs of exploration and development; the estimated costs of development of exploration projects; and the Company's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect the Company's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political, and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements or forward-looking information and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: precious metals price volatility; risks associated with the conduct of the Company's mining activities in foreign jurisdictions; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding exploration and mining activities; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of public health crises; the economic and financial implications of public health crises, ongoing military conflicts and general economic factors to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption "Risk Factors" in the Company's public disclosure documents. Readers are cautioned against attributing undue certainty to forward-looking statements or forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/247879