June 19, 2025

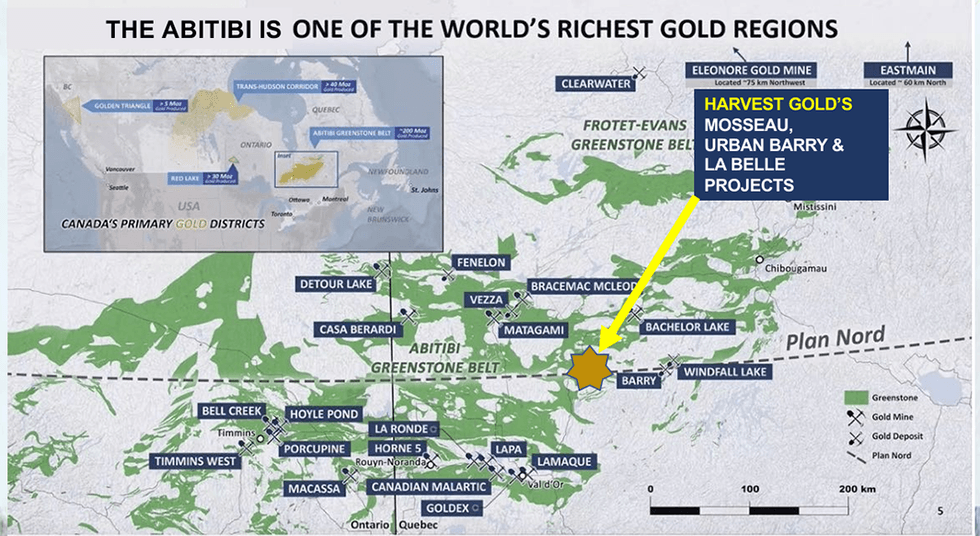

Harvest Gold (TSXV:HVG) is a Canadian junior explorer focused on advancing a portfolio of gold projects in Quebec’s prolific Abitibi Greenstone Belt—one of the world’s most productive gold regions, with over 200 million ounces of historical output. Its Mousseau, Urban Barry, and LaBelle properties are strategically positioned within and near the Urban Barry Greenstone Belt, a rapidly emerging gold camp attracting significant exploration activity and investment from majors such as Gold Fields and Osisko Mining.

The Urban Barry Belt hosts major deposits like Windfall (now owned by Gold Fields) and Bonterra’s Gladiator and Barry, making it a hotspot for gold discovery. In a region increasingly dominated by majors, Harvest Gold offers rare early-stage exposure through three large, independently held land packages with road access, infrastructure, and newly cleared ground—setting the stage for high-impact exploration and potential acquisition.

Harvest Gold is backed by Crescat Capital, a prominent institutional investor with a strong track record of supporting early-stage discoveries. Crescat’s investment was driven by the endorsement of their strategic advisor, Dr. Quinton Hennigh, a globally recognized exploration geologist. His confidence in the company’s land positioning and geological model is a powerful validation of Harvest’s potential.

Company Highlights

- Flagship Mousseau Project: Large-scale, advanced-stage exploration property with multiple confirmed gold-bearing shear zones.

- Tier-one address: All projects located in Quebec’s Urban Barry Greenstone Belt where Gold Fields recently acquired Osisko Mining’s world-class Windfall deposit and much of the rest of the Urban Barry belt.

- Institutional Backing: Crescat Capital, with renowned Advisor, geologist Dr. Quinton Hennigh, owns approximately 19 percent of Harvest Gold.

- Skilled Technical Team: Leadership includes seasoned geologists and executives with proven discovery and development track records.

- Favourable Jurisdiction: Operates in Quebec, a politically stable, mining-friendly province with excellent infrastructure and low exploration costs.

- Strategic Timing: Recent forest fires have unveiled new outcrops, offering rare exploration advantages. Gold is trading at an all-time high.

This Harvest Gold profile is part of a paid investor education campaign.*

Click here to connect with Harvest Gold (TSXV:HVG) to receive an Investor Presentation

HVG:CC

Sign up to get your FREE

Harvest Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

16 January

Harvest Gold

Advancing the large-scale Mousseau Gold Project in Quebec’s World-class Abitibi Region

Advancing the large-scale Mousseau Gold Project in Quebec’s World-class Abitibi Region Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Harvest Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00