June 18, 2023

Iceni Gold Limited (ASX: ICL) (Iceni or the Company) is pleased to provide an exploration update on the Guyer Well Target Area.

Highlights

- Geological fieldwork, mapping and rock chip sampling continues along the 15km long Guyer trend.

- Anomalous assays from AC drilling, UFF soils and rock chip sampling, historic workings and gold nuggets have all assisted in identifying a clear exploration focus along the ridge at Guyer North for ~2.5kms.

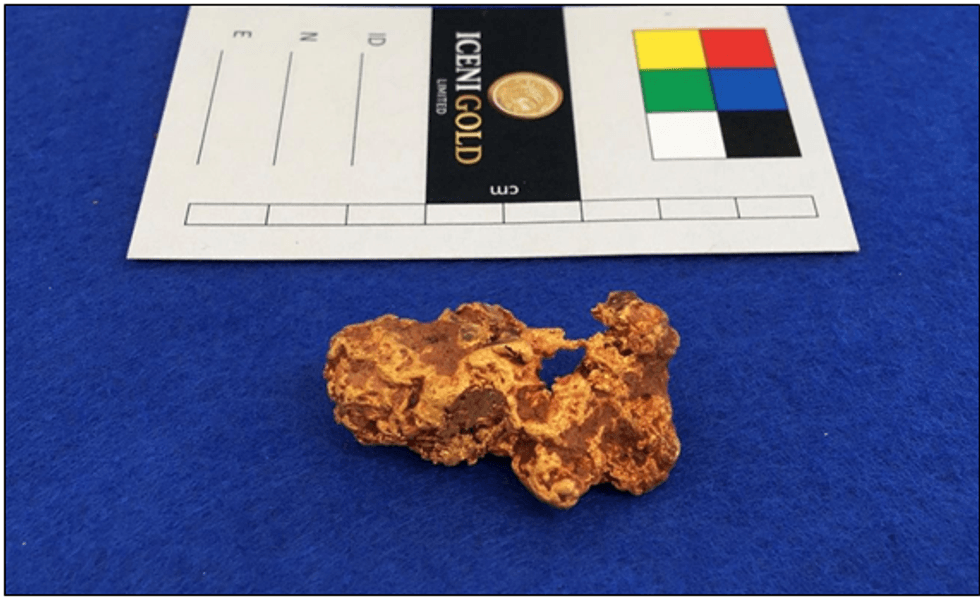

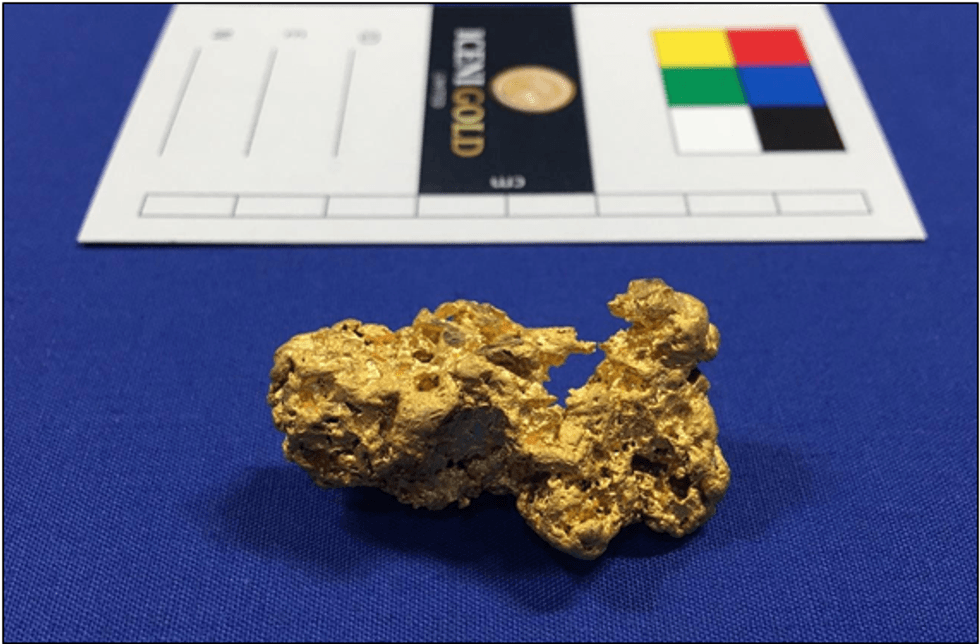

- The recent discovery of nugget GY-1 at nearly 1.5oz Au further supports the prospectivity of Guyer North.

- Prospecting has discovered over 780 gold nuggets along the Guyer Trend to date.

- More than 80 gold nuggets have been recovered during the last 4 weeks.

- The Guyer North drilling campaign is being designed and prepared for exploration drilling which is expected to commence within weeks.

Technical Director David Nixon commented:

“This new 1.5oz gold nugget, GY-1, is the largest nugget recovered thus far along the 15km long Guyer trend. The nugget was discovered in a saddle along the ridge at Guyer North and shows some signs of transport but retains enough surface features to indicate it hasn’t travelled far. The specimen GY-1 provides further support for the prospectivity of the Guyer North target area.

There is sufficient evidence of gold mineralisation localised along the Guyer North Ridge to justify drill testing.

A drilling campaign is being designed to test across the Guyer North target and along its ~2.5km strike” and will commence within weeks.

During the previous 4 weeks over 80 nuggets have been recovered, bringing the total to date to over 780 nuggets found along the Guyer Trend.

*Visual estimates of mineral abundance or pXRF analyses should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations.

Guyer Well Target Area

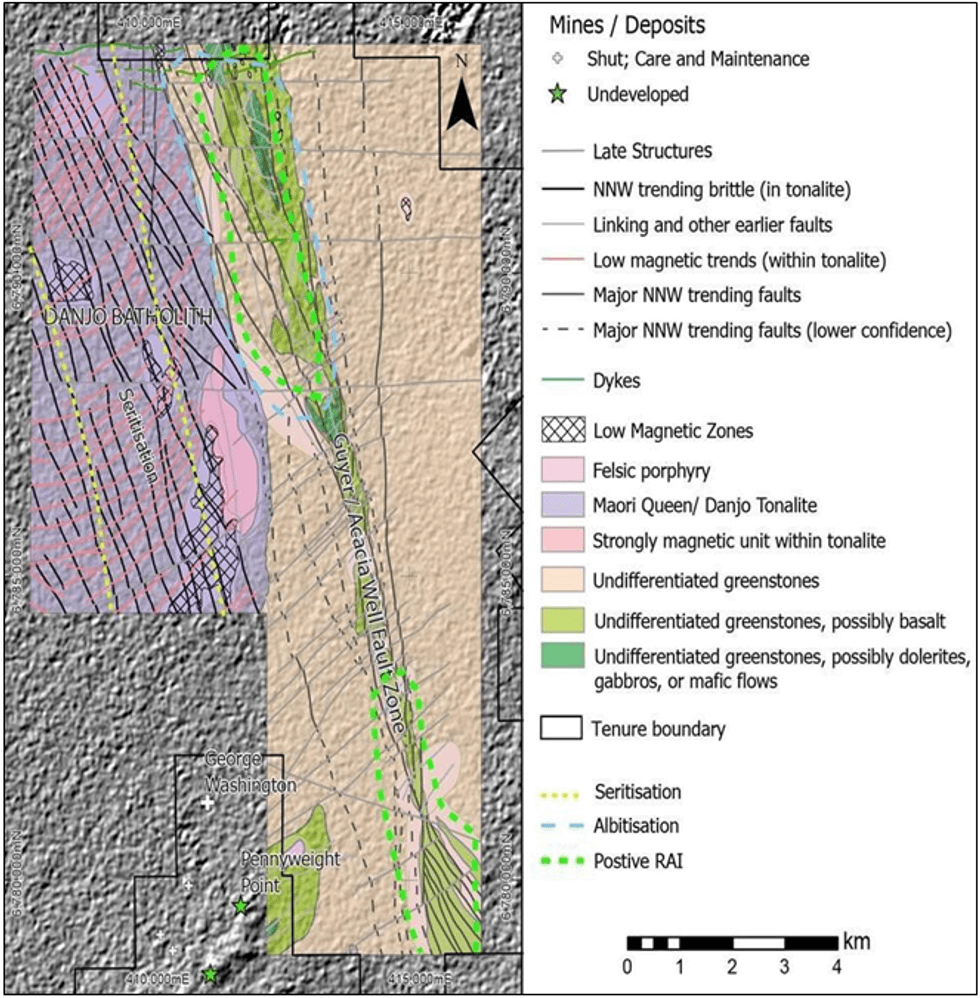

The Guyer Well target area lies in the southeastern part of Iceni’s tenure. It lies over a north-northwest striking belt of mafic greenstone sequences, bounded to the west by the Danjo Batholith and to the east by felsic volcanics.

The eastern part of the Guyer Well target area is cut by the north-northwest trending Guyer Fault. The Guyer Fault/Shear is interpreted to be a splay of the main Celia Fault. 15kms of strike of the prospective Guyer Fault is controlled by Iceni within the 14 Mile Well Project.

Much of the central and southern portions of the Guyer Well target area is blanketed by transported cover. The cover sequences consist of palaeochannels covered by sheetwash and alluvial channels with minor residual soils. The northeastern part of the Guyer Well target area occurs over lacustrine clays and sediments associated with Lake Carey.

Click here for the full ASX Release

This article includes content from Iceni Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ICL:AU

The Conversation (0)

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00