February 20, 2023

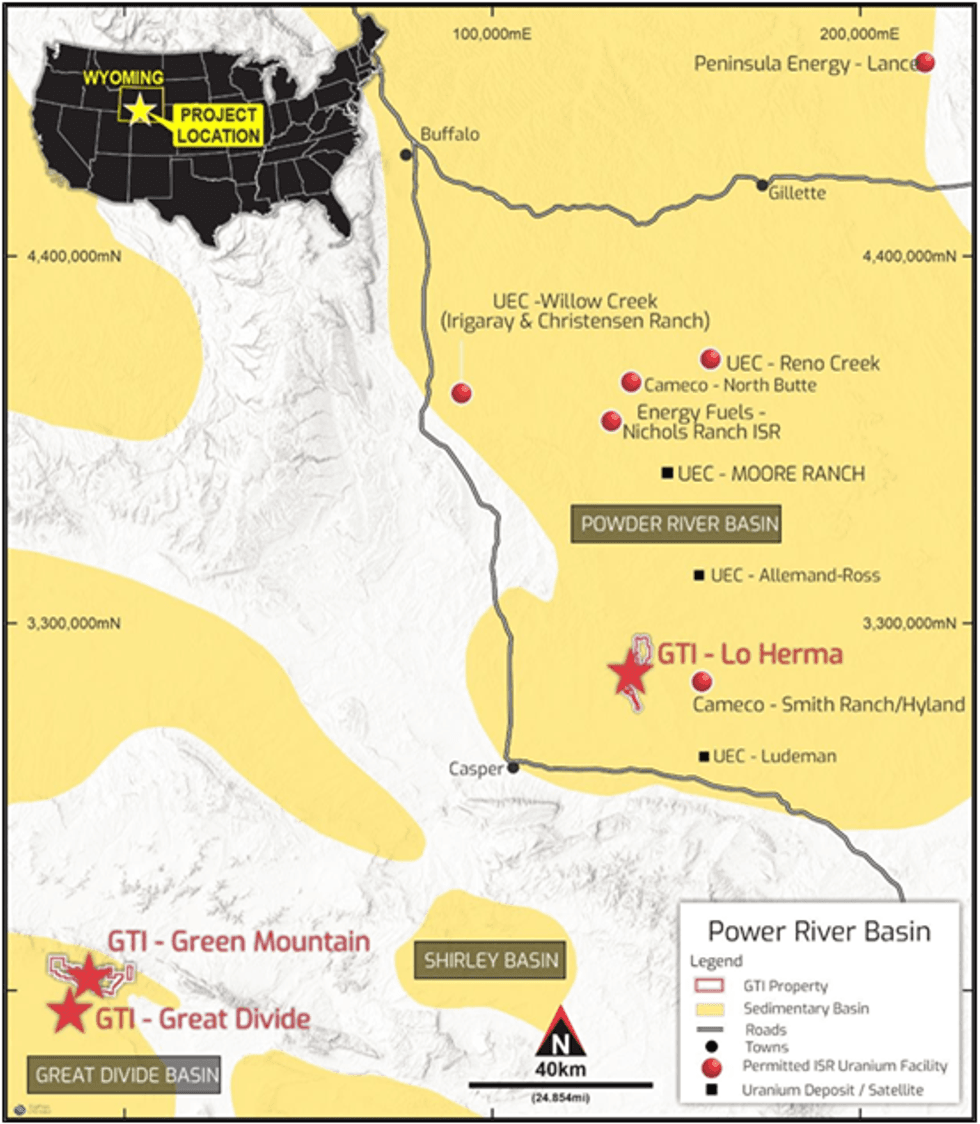

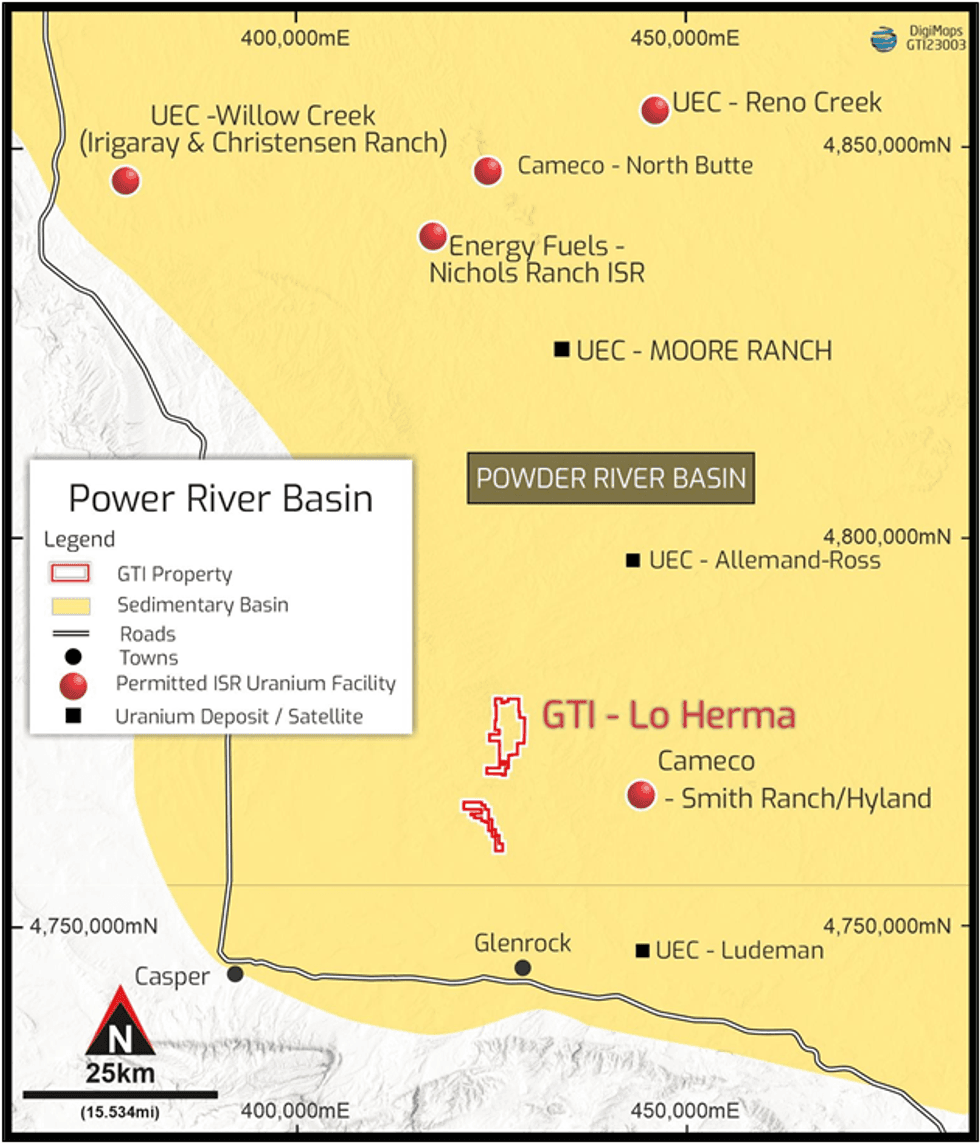

GTI Energy Ltd (GTI or Company) is pleased to advise that it has secured unpatented mineral lode claims covering circa 8,000 acres (~3,500 hectares), known as the Lo Herma Project, in Wyoming’s prolific Powder River Basin uranium district (Figures 1 & 2) (Lo Herma Project).

Highlights

- Significant mineral claims secured via staking of ~8,000 acres in Wyoming’s prolific Powder River Basin, ISR uranium district

- Claims located within 10 miles of Cameco’s Smith Ranch-Highland ISR uranium production plant – the largest production site in Wyoming

- Located in proximity to 5 permitted ISR uranium production facilities & several satellite uranium deposits, all within ~50 miles

- Cameco’s president and CEO said demand for nuclear power is driving the “best fundamentals ever seen” for the nuclear fuel market1

LO HERMA PROJECT – LOCATION & BACKGROUND

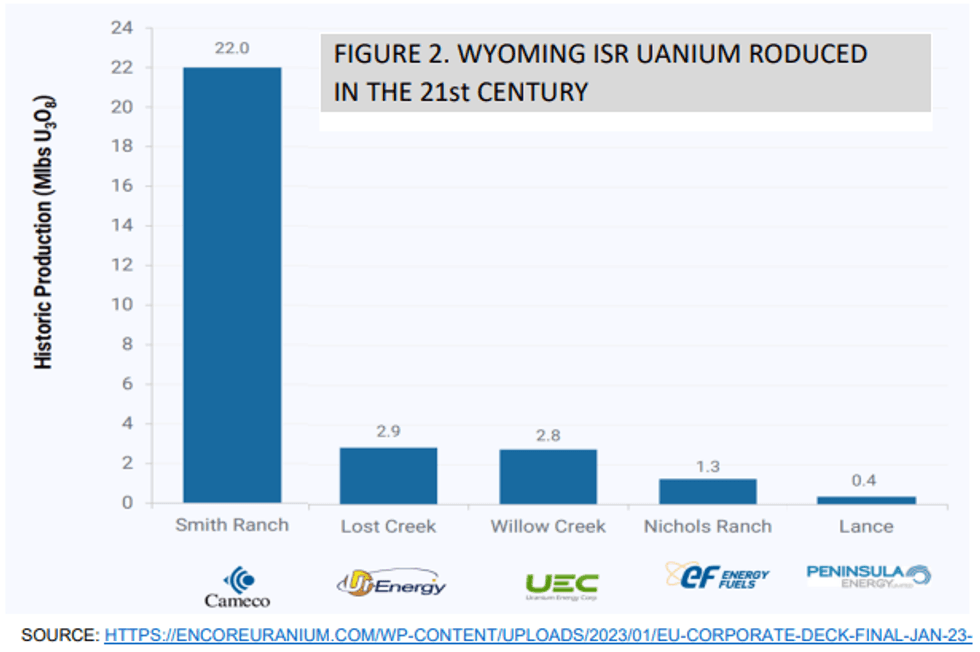

The Lo Herma Project (Lo Herma or Project) is located in Converse County, Powder River Basin (PRB), Wyoming. The project lies approximately 15 miles north of the town of Glenrock (WY) and within ~50 miles of five (5) permitted ISR production facilities. These facilities include UEC’s Willow Creek (Irigaray & Christensen Ranch) & Reno creek ISR plants, Cameco’s Smith Ranch-Highland ISR facilities and Energy Fuels Nichols Ranch ISR plant (Figure 1). The Powder River Basin has an extensive ISR uranium production history and has been the backbone of Wyoming uranium production since the 1970s. Cameco’s Smith Ranch-Hyland operation has been the largest uranium production contributor, by a significant margin, in recent times (Figure 2).

GTI is expanding and diversifying its Wyoming uranium asset portfolio at a time when demand for nuclear power is driving the “best fundamentals ever seen” for the nuclear fuel market, according to Tim Gitzel, Cameco’s president and CEO1.

GTI Executive Director Bruce Lane commented “We are extremely excited about the potential of the newly staked Lo Herma property in Wyoming’s Powder River Basin. The project is located in Wyoming’s most prolific production district within 10 miles of Wyoming’s largest ISR uranium production site at Cameco’s Smith Ranch-Highland. We believe that Lo Herma has the potential to become a significant asset for GTI as we continue to build and diversify our Wyoming uranium portfolio.”

NEW CLAIMS SECURED AT THOR

GTI has successfully staked additional Lode Claims covering ~250 acres at the Thor project in the Great Divide Basin. The new claims abut the eastern section of the existing Thor claims & south of Thor’s state sections (Figure 3). The new claims are positioned on well mineralised trends identified during GTI’s drilling campaigns and are expected to allow GTI to extend the existing interpreted trend lengths into the new claim area.

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTR:AU

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 December 2025

American Uranium

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming Keep Reading...

11 August 2025

Snow Lake Completes Due Diligence and Confirms Placement

GTI Energy (GTR:AU) has announced Snow Lake Completes Due Diligence and Confirms PlacementDownload the PDF here. Keep Reading...

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

GTI Energy (GTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 July 2025

Lo Herma Drilling Permit & Contract Confirmed

GTI Energy (GTR:AU) has announced Lo Herma Drilling Permit & Contract ConfirmedDownload the PDF here. Keep Reading...

14 July 2025

Company Update - Name Change to 'American Uranium Limited'

GTI Energy (GTR:AU) has announced Company Update - Name Change to 'American Uranium Limited'Download the PDF here. Keep Reading...

10 July 2025

Placement Shares Issued & Drilling Approval Expected August

GTI Energy (GTR:AU) has announced Placement Shares Issued & Drilling Approval Expected AugustDownload the PDF here. Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00