Gold Price Update: Q1 2023 in Review

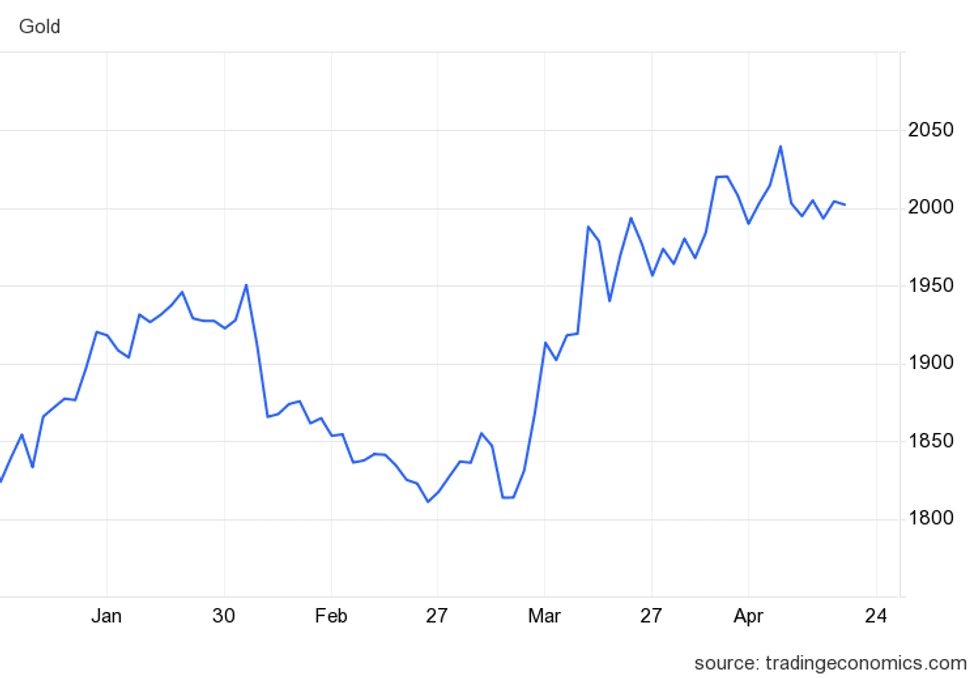

Gold went on a run in the first quarter of 2023, getting comfortable above the US$2,000 per ounce level. Here's a look at the events that moved the metal in Q1.

Gold has seen a thunderous start to 2023 — thanks to significant economic disruptions, it's jumped in value while continuing to play a key role as a safe haven.

The precious metal's run has created tremendous opportunities for gold bulls, especially as it appears to be stabilizing above the US$2,000 per ounce mark, with experts pointing to potentially higher points this year.

Here the Investing News Network (INN) provides a recap of what happened in the gold market in the first three months of 2023.

Narrative changing after disappointing 2022

Greg Taylor, chief investment officer at Purpose Investments, told INN that many investors were disappointed with gold last year due to its flat performance, even with high levels of inflation.

“(Investors) just got really frustrated with it and it hadn't really worked. Now it's starting to work and people are taking another look at it,” Taylor said.

The expert added that since the US dollar was up and enjoyed a strong period last year, it “offset a lot of the inflation reasons for people to own gold.”

But heading into this year, Taylor said, the gold investment cycle has seen new life.

The financial expert explained that even as central banks prepare to pause or slow the pace of their rate hikes, inflation remains higher than they would like.

“We're starting to hear more and more concerns that there's potential stagflation,” Taylor said. “When you get stagflation, that's the perfect snare for gold.”

More investors appreciating gold in 2023

Shree Kargutkar, managing partner at Sprott (TSX:SII,NYSE:SII), told INN that despite gold's success so far in 2023, he still doesn’t think most investors have exposure to the yellow metal.

“I would say the average investor today is not really invested in gold. Rather, the average investor today is a speculator as far as the bullion is concerned,” Kargutkar said.

The Sprott expert explained that holdings in precious metals bullion exchange-traded funds have declined approximately 15 percent from their peak in the second half of 2020.

“People have actually been reducing their allocation to gold. And the average investor has been spectating for admission,” Kargutkar said.

When discussing the role of gold in an investor’s portfolio, Taylor cautioned that he doesn’t think gold should take a dominant role. “But having a sleeve of real asset exposure in the 5 to 10 percent range is probably not a bad, bad percentage to look at,” he said.

For his part, Kargutkar said the recent move in gold could create a bigger spotlight for the asset class. “My guess is it will probably make people want to perhaps take a second look at the metal as an important constituent of a portfolio,” he said.

US banking crisis boosts gold's safe-haven appeal

Gold’s tremendous rise can be attributed to a variety of factors in the global economic spectrum, but a major driver has been the fallout from US banking issues.

Silicon Valley Bank and Signature Bank faced serious bank runs after losing the confidence of their users, leading to two of the biggest bank collapses in US history.

This chaos was accompanied by the emergency rescue acquisition of Credit Suisse (NYSE:CS) by UBS (NYSE:UBS), which was in part organized by Swiss authorities.

The pressure points these events created caused panic to settle into the economic landscape, allowing gold to fulfill its role as a safe haven for the investing class.

Gold first crossed the US$2,000 level in March, and has found some stability above the coveted price mark.

Market watchers eyeing the Fed's next move

Aside from banking issues, gold continues to be affected by moves from the US Federal Reserve.

Following its meeting in March, the central bank announced a 25 basis point rate hike, saying it remains committed to its goal of curbing inflation. Investors are now watching closely to see what it will do at its next meeting in May.

Economists polled by Reuters are expecting to see another 25 basis point interest rate increase from the central bank, despite recent data points from the consumer price index and the producer price index.

Both price markers show inflationary pressures are easing — in fact, the March drop in the producer price index was the biggest decline since the start of the pandemic in early 2020. Even so, inflation is still far from the Fed's target of 2 percent.

At the same time, the Fed may not be able to hike much further. Its latest meeting minutes indicate that it expects a “mild recession” in the second half of 2023, spurred by the banking crisis outlined earlier.

“Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years,” the central bank states in its meeting recap.

The Fed's next meeting runs from May 2 to 3.

Investor takeaway

After what many deemed a weaker year for gold in 2022, 2023 has been incredibly bullish for the precious metal.

EY's Theo Yameogo told INN it’s important to remember the nature of the market, and how these jumps have come and gone in the past. “It's just a reminder that this is cyclical,” he said.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- VIDEO — Chris Vermeulen: Gold, Silver, Miners to Hit Major Bottom; Multi-Year Rally to Follow ›

- Maria Smirnova: Gold Outlook Strong in 2023, Silver Swing Factor to Watch ›

- David Morgan: Gold Fever? Banking Crisis Impact for Metals and Miners ›

- Gold Price 2022 Year-End Review ›