August 15, 2024

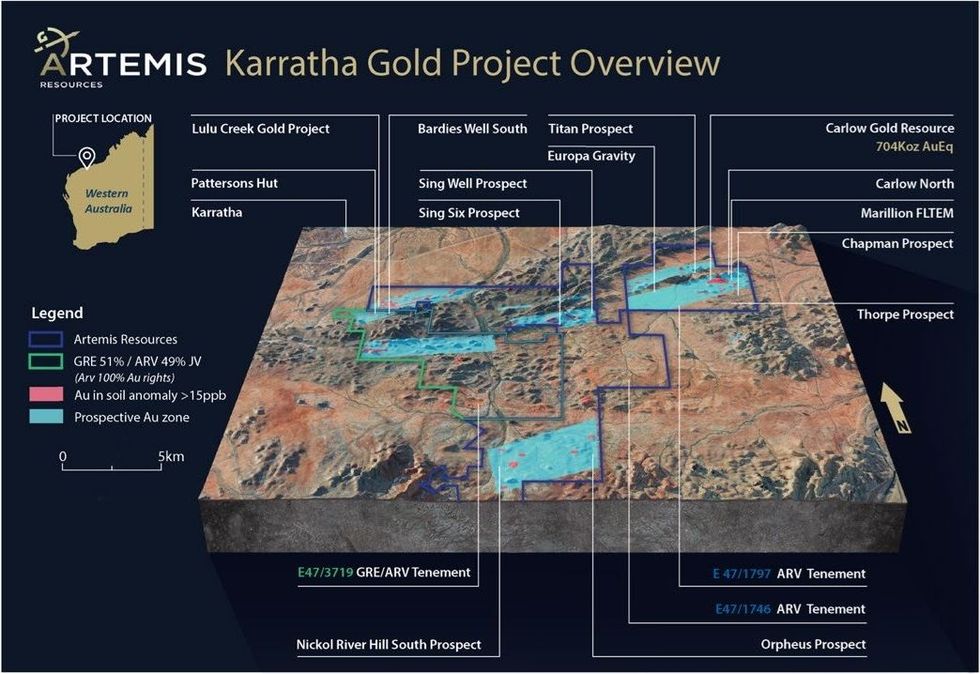

Artemis Resources Limited (‘Artemis’ or the ‘Company’) (ASX/AIM: ARV) is pleased to report the discovery of exceptionally high grade gold in veins at the Titan prospect as part of its recent ground reconnaissance program at its Karratha Gold Project, in the Pilbara region of Western Australia.

Highlights:

- High grade gold reported in veins at Titan prospect with abundant visible gold at surface

- Titan prospect tracked for ~ 700m and remains open

- Rock chips samples report high grade gold assay results including;

- 24AR07-004, 005, 008 - > 10,000 g/t Au*

- 24AR11-002 – 6,520 g/t Au

- 24AR07-169 – 10.2 g/t Au

- Copper assay results return high values including;

- 24AR07-184 – 23.8% Cu

- 24AR07-183 – 14.55% Cu

- 10.4 oz gold bar produced from material extracted from Titan prospect

- Tenement review of Carlow project area results in mapping of further gold veins

- New areas of gold mineralisation discovered across tenements

- Pathway open for potential larger scale regional discovery

Executive Director George Ventouras commented: “We remain excited by the gold prospectivity that our tenements continue to deliver. The re-focus of exploration efforts and strategy on a tenement wide scale is continuing to deliver evidence of multiple new zones for gold mineralisation, which we believe could contain the potential for large scale deposits. The next steps will allow us to refine these zones, delineate bona-fide prospects and work towards more targeted exploration efforts.”

Ground reconnaissance recently completed as a follow up to the previous reported work has delivered further gold occurrences in areas that were previously only lightly explored. This work was designed to map the prospective surface veins and identify additional fertile structures that may contain gold & copper mineralisation. Not only did the ground team identify and trace several large-scale vein trends, they were also successful in identifying a vein zone with abundant coarse visible gold at the Titan prospect.

Click here for the full ASX Release

This article includes content from Artemis Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00