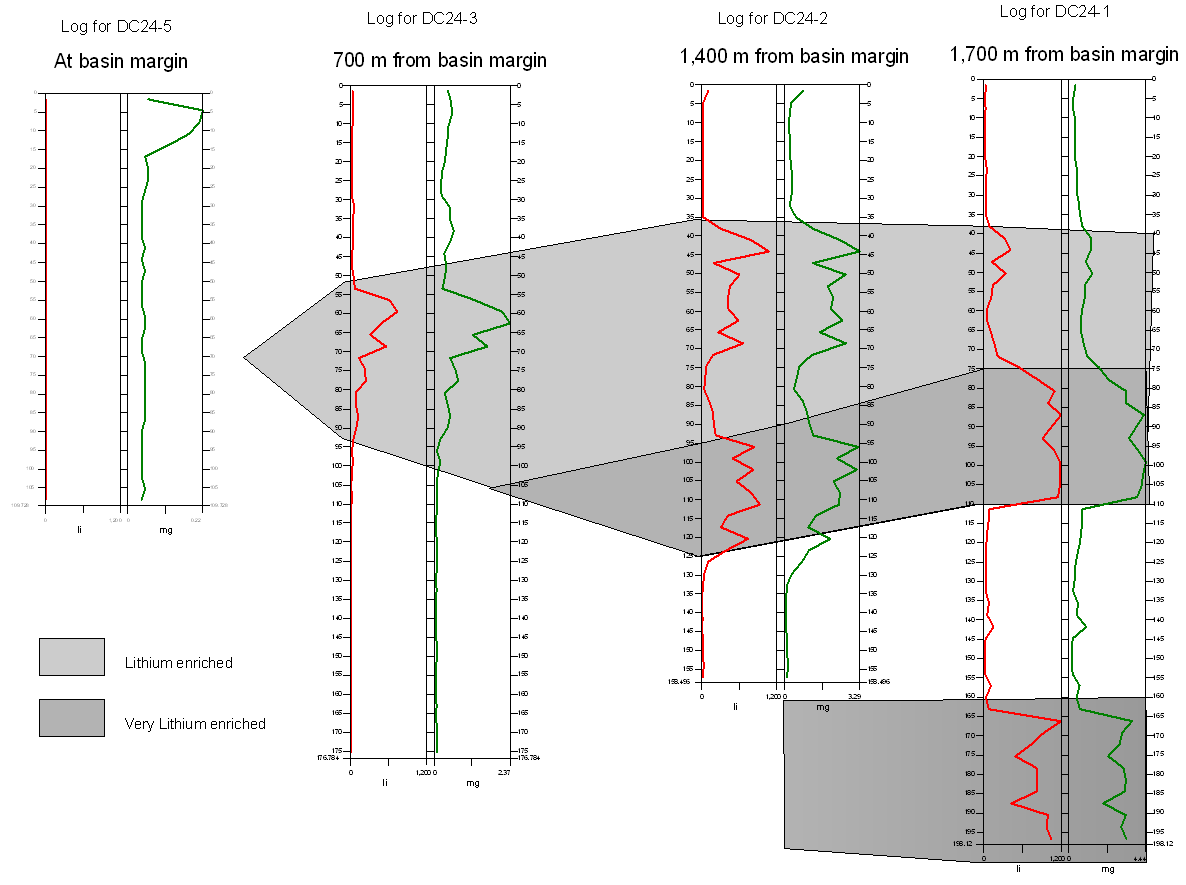

GMV Minerals Inc. (the "Company" or "GMV") (TSXV:GMV)(OTCQB:GMVMF) is pleased to announce that preliminary results from the four drill holes completed on the Daisy Property are very encouraging with a thickening in the claystone horizons and increasing in the grade towards the south. The southern-most hole, DC24-1 intersected three distinct claystone horizons totaling 48.7 m of lithium enrichment starting 76.2 m down hole

All holes were 5.5-inch RC holes drilled vertically.

Drill Hole | From (m) | To (m) | Thickness (m) | Li (ppm) |

DC24-1 | 76.2 | 109.7 | 33.5 | 1,085 |

Incl | 85.3 | 109.7 | 24.4 | 1,125 |

And | 164.6 | 170.7 | 6.1 | 1,170 |

And | 189.0 | 198.1 | 9.1 | 1,004 |

DC24-2 | 39.6 | 45.7 | 6.1 | 942 |

And | 100.6 | 112.8 | 12.2 | 773 |

DC24-3 | 54.9 | 61 | 6.1 | 676 |

DC24-5 | No significant values | |||

DC24-4 was not drilled.

No significant uranium values were encountered.

Ian Klassen President states "We are very pleased with the results showing a thickening and increasing grade to the south on our 100% controlled Daisy Creek Property. The 48.7 m of total claystone in DC24-1 with values >1,000 ppm is economically interesting, and the grades are increasing towards the deeper parts of the basin. These values well exceed the cut-off grade for most claystone projects in Nevada and similar to some that have been taken to feasibility studies in the Clayton Valley (see table below). Claystones typically have an SG of 1.7 gm/cc such that each cubic meter contains 1.7 tonnes of rock. Drill holes DC24-1, 2, and 3 are separated by 300 to 1,000 m meaning substantial tonnages can be inferred quickly from each drill hole."

Company | Project | Tonnes (millions) | ppm Li |

American Lithium | TLC Project | 2052 | 809 |

Pan American Energy | Horizon Li | 2,800 | 669 |

Spearmint Resources | McGee | 470 | 830 |

Noram Lithium | Zeus | 586 | 957 |

RC samples were collected into premarked bags from 10' runs, collected and dried before transporting them to the independent certified ALS Global's laboratory in Elko Nevada. They were further dried, crushed and pulverized using CRU-31, SPL-21 and PUL-31 procedures. The pulps were then shipped to ALS Global's laboratory in North Vancouver and were processed using ME-MS41 aqua regia digestion and mass spectrometry analysis. Six Certified Reference Standards, CDN-Li1, were submitted, checked in re-runs with internal laboratory standards together with selected samples and returned acceptable results.

Figure 1. The image shows lithium and magnesium analyses down hole (meters) for the four drill holes completed, schematically distributed from the basin margin on the left to towards the deeper basin on the right.

Dr. D.R. Webb, Ph.D., P.Geo., P.Eng. is the Q.P. for this release within the meaning of NI 43-101 and has reviewed the technical content of this release and has approved its content.

About GMV Minerals Inc.

GMV Minerals Inc. is a publicly traded exploration company focused on developing precious metal assets in Arizona. GMV, through its 100% owned subsidiary, has a 100% interest in a Mining Property Lease commonly referred to as the Mexican Hat Property, located in Cochise County, Arizona, USA. The project was initially explored by Placer Dome (USA) in the late 1980's to early 1990's. GMV is focused on developing the asset and realizing the full mineral potential of the property through near term gold production. The Company's NI 43-101 resource estimate (Inferred) is 36,733,000 tonnes grading 0.58 g/t gold at a 0.2 g/t cut-off, containing 688,000 ounces of gold. In 2023, GMV acquired a total of 165 lode claims covering 3,408 acres in Lander County, Nevada where it is exploring highly prospective claims for lithium.

ON BEHALF OF THE BOARD OF DIRECTORS

________________________________________

Ian Klassen, President

For further information please contact:

GMV Minerals Inc.

Ian Klassen

Tel: (604) 899-0106

Email: Klassen@gmvminerals.com

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include estimates and statements that describe the Company's future, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties as described in the Company's filings with Canadian securities regulators. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: GMV Minerals, Inc.

View the original press release on accesswire.com