October 25, 2023

Global Oil & Gas Limited (ASX: GLV) (Global or Company) is pleased to provide the following report on its activities during the quarter ending 30 September 2023.

Peruvian Project

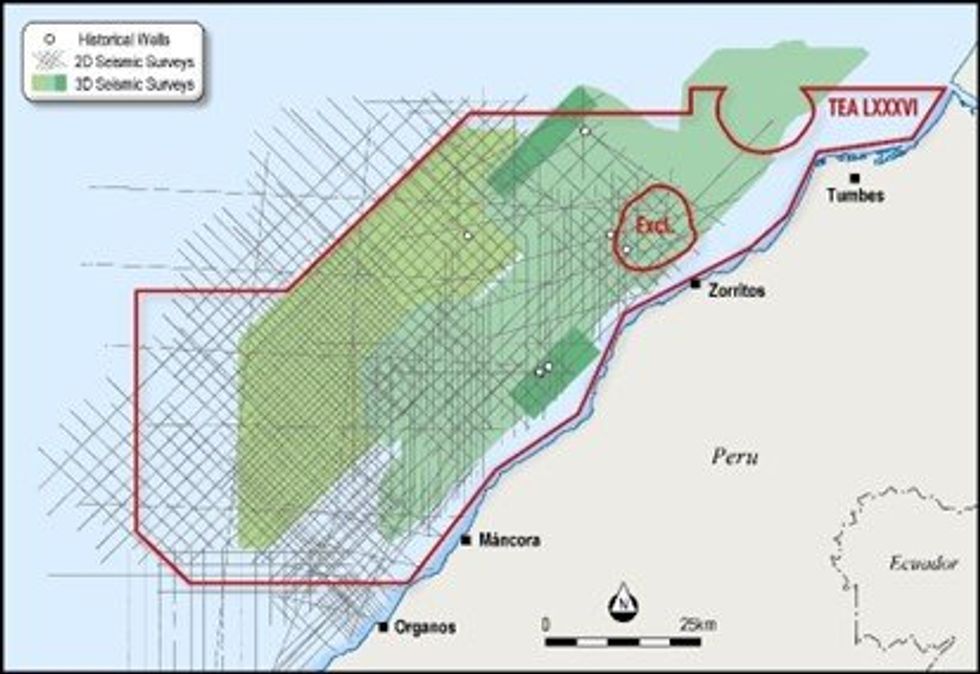

Global Oil and Gas Limited announced during the quarter that it had executed a Technical Evaluation Agreement LXXXVI (TEA) with the Peruvian National Agency of Hydrocarbons, Perupetro, for a 4,858km2 oil and gas exploration block offshore Peru. The Company now holds 80% of the TEA with project partner, US based oil and gas exploration company Jaguar Exploration, Inc. (Jaguar), holding the remaining 20%.

The oil and gas block is located in the Tumbes-Progreso basin, in water depths that range from 100m to 1,500m. Immediately to the south is the Talara Basin which is one of the most productive basins in Peru having already produced more than 1.6 billion barrels.

The block is surrounded by, and incorporates, multiple historic and currently producing oil and gas fields. The southeast of the block borders the Alto-Pena Negra oil field which is one of Peru’s most productive fields, currently producing around 3,000 barrels of oil per day (bopd) with total historical production of more than 143 million barrels of oil.

In the northeast, the block incorporates the excised 27.8 million barrel Corvina oil field which generated past production rates of up to 4,000 barrels of light oil per day (28.45⁰ API).

The southern border of the TEA is also only 70km from the Talara crude oil refinery which received production from the Corvina field.

Exploration Opportunity

In the early 1970's three exploration wells, drilled on poor quality 2D seismic, all encountered oil shows. Since then, additional 2D seismic and four (3,800 km2) 3D seismic surveys have been acquired but only one well has been drilled based on these new data. That well which did not reach the primary basin’s reservoir encountered gas shows and is now a valuable calibration point. It is rare to have the opportunity to explore a basin system with a proven and prolific petroleum system where the 3D has already been acquired and paid for but remains essentially undrilled.

The historical discoveries are located in shallow waters offering an opportunity to tap into relatively inexpensive targets, however, the most western part of the block also hosts other prospects in deeper waters (400m to 800m).

Global’s partner in the block, Jaguar, has recognised the value of utilising the historical seismic data and has already identified various prospects and leads within the block that can potentially be classified as Prospective Resources.

Of particular interest, are the Bonito prospect, delineated by a 82km2 late fold anticline (~500m of closure), and the Tiburon prospect, a broad buttress and fold ~140km2 (~150m of closure).

Click here for the full ASX Release

This article includes content from Global Oil & Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

30 January

Angkor Resources Announces AGM Results and Appointment of New Director

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - (January 30, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the voting results from its Annual General Meeting of Shareholders (the "Meeting"), held on Thursday, January 29, 2026, including the... Keep Reading...

30 January

Syntholene Energy Announces Co-Listing in the United States on OTCQB Market Under Symbol SYNTF

Co-Listing Expands U.S. Investor Access and Visibility in World's Largest Aviation and Capital MarketsSyntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces that its common shares have been approved for quotation and have commenced... Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Kinetiko Energy (KKO:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

Is Now a Good Time to Invest in Oil Stocks?

Investing in oil stocks can be a lucrative endeavor, but determining the right time to enter a sector known for volatile swings can be tricky.Over the past five years, the oil market’s inherent volatility has been on clear display. Major declines in consumption brought on by the COVID-19... Keep Reading...

28 January

Quarterly Activities/Appendix 4C Cash Flow Report

MEC Resources (MMR:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

December 2025 Quarterly Report and Appendix 4C

BPH Energy (BPH:AU) has announced December 2025 Quarterly Report and Appendix 4CDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00