May 30, 2024

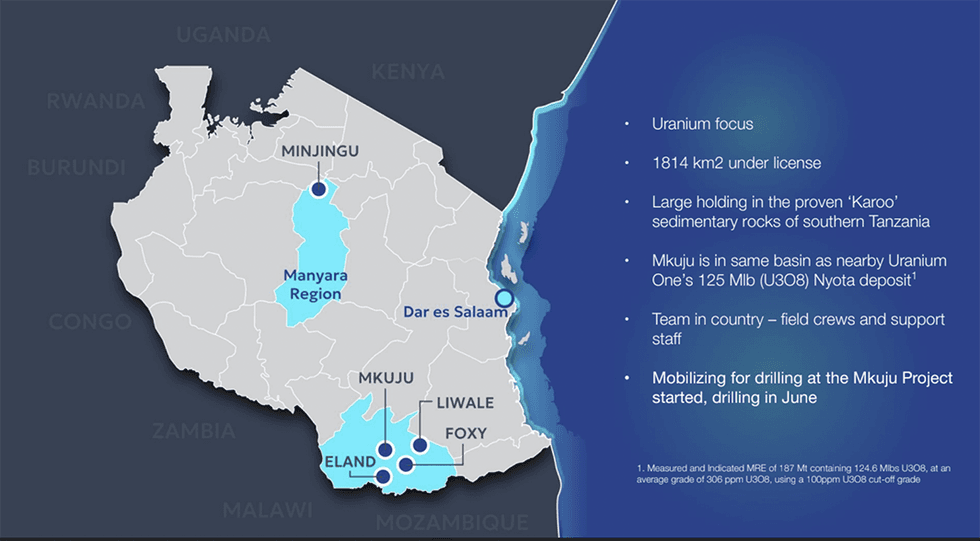

Gladiator Resources (ASX:GLA) focuses on uranium assets covering 1,811 square kilometres located in Tanzania. The company’s key projects include – Mkuju, Minjingu, Liwale, Foxy and Eland. The flagship Mkuju has the potential to host world-class uranium deposits given its proximity to the Nyota deposit, which contains 124.6 million pounds (Mlbs) U3O8. Nyota is regarded as one of the largest uranium deposits in the world.

The company is planning a 2024 drill program at Mkuju focusing on the South West Corner (SWC), Mtonya and Likuyu North targets. The 2024 drilling program will commence with initial core drilling at the SWC target, where 2023 trenching revealed up to 7,139 parts per million (ppm) U3O8. Drilling at Mtonya and Likuyu North aims to explore potential extensions and new zones of the existing uranium deposits.

The Mkuju project spans over 725 sq kms and is located 20 kms south of Uranium One’s Nyota deposit, regarded as one of the largest uranium deposits in the world. Nyota hosts a measured and indicated mineral resource estimate of 187 metric tons (MT) at 306 ppm U3O8, containing 124.6 Mlbs U3O8. The deposit is being developed by global uranium company Uranium One. The Nyota deposit and the Mkuju project are underlain by sediments of the lower Karoo, which are considered highly prospective for uranium.

Company Highlights

- Gladiator Resources is an ASX-listed exploration and mining company focused on uranium. The company operates eight exploration projects, mainly in Tanzania, covering a total area of 1,811 sq kms.

- The company’s key projects include – Mkuju, Minjingu, Liwale, Foxy and Eland.

- Gladiator’s primary short term focus is on advancing the Mkuju project, located only 20 kms south of Uranium One’s Nyota deposit, regarded as one of the largest uranium deposits in the world.

- The 2024 drill program at Mkuju will focus on the South West Corner (SWC) initially, where trench assay results received Dec/Jan 2023/24 confirmed high-grade uranium in sandstone, 1000’s ppm U3O8 in places.

- Further work is also planned at Mtonya and Likuyu North – also located within the promising Mkuju area.

- Tanzania is endowed with many uranium-bearing deposits and is known for its mining-friendly policies. The government offers attractive tax policies and quick permitting processes to encourage investment in the sector.

- The presence in relatively attractive uranium mining jurisdictions such as Tanzania positions the company to capitalize on opportunities in the uranium sector and deliver superior returns to its shareholders.

This Gladiator Resources profile is part of a paid investor education campaign.*

Click here to connect with Gladiator Resources (ASX:GLA) to receive an Investor Presentation

GLA:AU

The Conversation (0)

29 May 2024

Gladiator Resources

Capitalizing on the uranium momentum with prolific assets in Tanzania

Capitalizing on the uranium momentum with prolific assets in Tanzania Keep Reading...

11 November

Drilling Commenced for Sybella-Barkly Uranium and Rare Earth

Basin Energy (BSN:AU) has announced Drilling commenced for Sybella-Barkly uranium and rare earthDownload the PDF here. Keep Reading...

11 November

Generation Uranium Eyes Discovery Near 43 Million Pound Lac 50 Uranium Deposit

At the 51st annual New Orleans Investment Conference, Chris Huggins, CEO of Generation Uranium (TSXV:GEN,OTCQB:GENRF), shared how the company is positioning itself in one of Canada’s most promising uranium belts. “We have a property called the Yath. It's a uranium grassroots project that is in... Keep Reading...

10 November

Powering North America’s Critical Minerals Future

Lithium. Uranium. Vanadium. Titanium. Iron.These are the essential building blocks of the clean energy era — powering electric vehicles, renewable energy storage, defense technologies and advanced manufacturing. They’re also at the heart of a new industrial race that’s reshaping investment,... Keep Reading...

10 November

US Reinstates Uranium as Critical Mineral, Boosting Domestic Producers

The US government has officially added uranium back to the nation’s list of critical minerals in a bid to strengthen domestic energy security and reduce reliance on foreign sources. The final 2025 List of Critical Minerals, released by the US Geological Survey (USGS), identifies 60 minerals... Keep Reading...

Latest News

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00