May 11, 2022

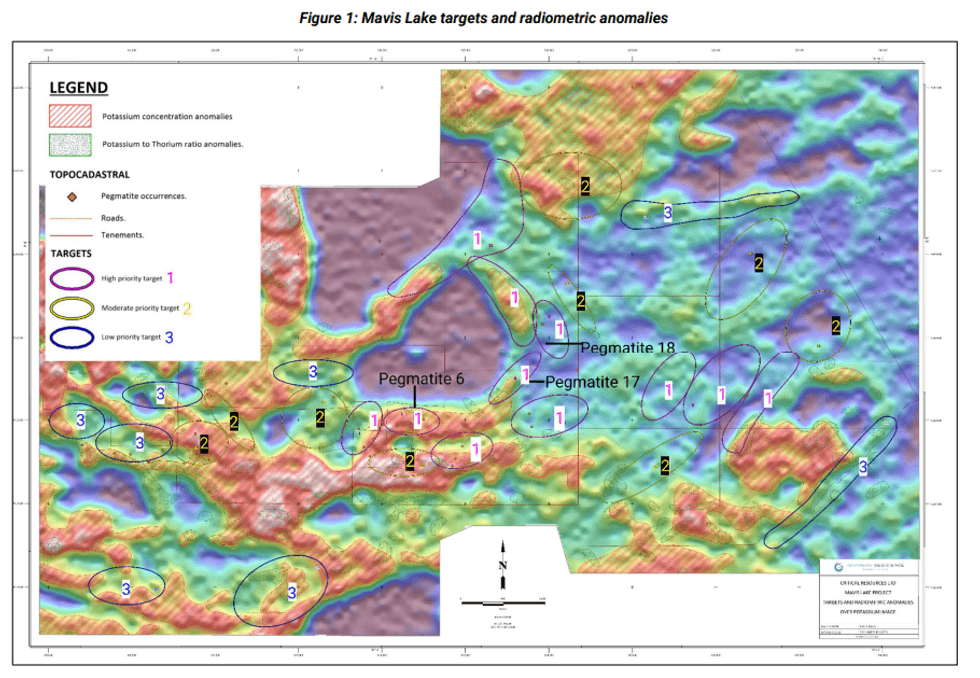

Critical Resources Limited (ASX:CRR) (“Critical Resources” or the “Company”), is pleased to advise that it has received interpretation of the airborne survey flown over the company’s Mavis Lake Lithium Project ("the Project”) in Ontario, Canada in October 2021. The interpretation has provided a significant basis for the potential of a further 28 new drill targets across the property.

Highlights

- 28 new target areas identified from litho-structural interpretation including 11 high priority targets

- Exploration works on new targets will be undertaken to develop a drilling strategy to expand on the current 5,000m program

- Current drilling program is approximately 20% complete of which the first 8 of 9 holes have intersected visual spodumene with estimates of spodumene content up to 40%.1, 2

- New targets provide further growth potential at Mavis Lake

The Company is pleased to announce it has received a highly positive litho-structural interpretation from the geophysical airborne survey flown across the Mavis Lake property in late 2021. The interpretation is based on magnetic, radiometric and VLF electromagnetic data.

Drilling is ongoing at the Project with the ~5,000m drill program approximately 20% complete. Of the first 9 holes 8 holes have intersected visual spodumene with estimates of spodumene content up to 40%.1, 2

Critical Resources Managing Director Alex Biggs said:

“In conjunction with the recent drilling success at Mavis Lake, confirming further growth potential is extremely encouraging. The interpretation of the geophysical data in combination with visual results from the current program are critical in the development of future drilling campaigns and gaining further confidence in Mavis Lake’s potential”.

Geophysical Data Interpretation

Litho-structural interpretation at a scale of 1:10 000 over the Mavis Lake project area was completed using flown magnetic/radiometric/VLF and DEM survey with the help of other supportive data and information from previous exploration efforts. Due to significant forest/forest soil cover over the project area, the structural interpretation was based primarily on the aero magnetics and to some extent also on VLF data. Radiometric, DEM, satellite data have been studied and analysed, however, these make a minor contribution to the interpretation.

1 See ASX announcements dated 28 April 22, 04 May 22 and 11 May 22

2 In relation to the disclosure of visual mineralisation, the Company cautions that visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analysis. Laboratory assay results are required to determine the widths and grade of the visible mineralisation reported in preliminary geological logging. The Company will update the market when laboratory analytical results become available.

The interpretation was primarily concerned with the identification of pegmatite bodies, prospective for lithium mineralisation. With no significant property contrasts between the pegmatites and the typical host rocks, (direct) targeting lithium bearing pegmatites with geophysics is difficult. The targeting strategy was therefore focused on indirect leads: a) lithological associations (proximity to granitoid bodies, associations with mafic/ultramafic sequences) b) structural context and structural complexity (looking for structures and traps that may act as conduits for Li-bearing fluids to flow and precipitate) c) reduction of the search area by eliminating strongly magnetic sequences and looking for distinct magnetic lows, consistent with presumed felsic lithology. In general, preferred were areas of significant structural deformation/fragmentation that produce favourable conditions for pegmatite precipitation and formation of structures that may act as fluid conduits.

Based on information derived from the geophysical data, a total of 28 target areas have been selected for follow up. The target areas require follow-up surface mapping, geochemical surveys and reconnaissance drilling to obtain further information about the underlying geology. The 28 targets have been ranked as high, moderate and low priority, with little to no difference between high and moderate priority. These areas are seen in the following two figures, with numerical values (High – 1, Moderate – 2 and Low – 3) placed in each target area to highlight their respective priority.

Click here for the full ASX Release

This article includes content from Critical Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CRR:AU

The Conversation (0)

21 June 2022

Critical Resources

High-grade Lithium Portfolio, in a Tier 1 Location, Aligned with the World’s Green Energy Transition

High-grade Lithium Portfolio, in a Tier 1 Location, Aligned with the World’s Green Energy Transition Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00