April 11, 2022

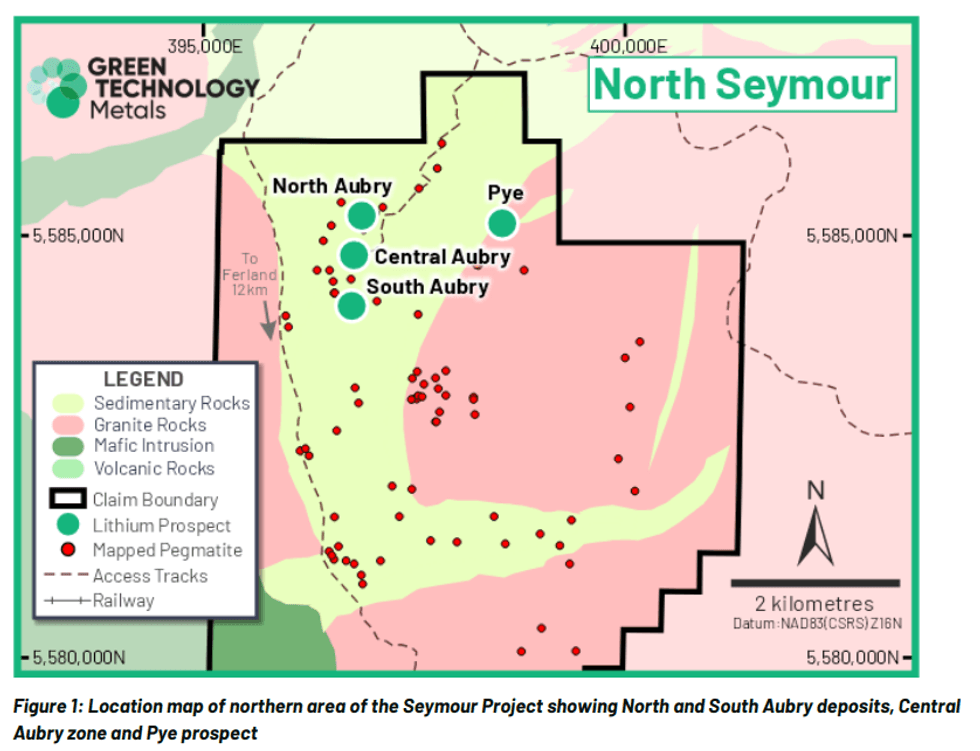

Green Technology Metals Limited (ASX: GT1) (GT1 or the Company) is pleased to provide further assay results from the Phase 1 diamond drilling program at its Seymour Lithium Project in Ontario, Canada.

HIGHLIGHTS

- Assays received for further six holes from Phase 1 step-out drilling of North Aubry deposit at flagship Seymour Project.

- Additional thick, high-grade extensional intercepts of North Aubry deposit including:

- GTDD-22-0016 for 34.3m @ 1.32% Li2O from 244.0m

- GTDD-22-0003 for 19.2m @ 2.20% Li2O from 231.8m (incl. 9.7m @ 2.95% Li2O)

- GTDD-22-0010 for 10.0m @ 1.89% Li2O from 313.0m (incl. 5.3m @ 2.85% Li2O)

- GTDD-22-0015 for 9.0m @ 1.34% Li2O from 238.0m

- GTDD-22-0012 for 2.3m @ 1.21% Li2O from 238.0m

- Further northern step-out drilling of North Aubry deposit in planning.

- Phase 1 assays returned to date (nine holes) indicate substantial potential upside to the existing Seymour Mineral Resource estimate of 4.8 Mt @ 1.25% Li2O 1 .

- Updated Mineral Resource estimate for Seymour (to incorporate all Phase 1 results including residual pending assays for seven holes) on track for completion during Q2 CY2022.

- Phase 2 (Central Aubry zone) and Phase 3 (Pye prospect) drilling at Seymour now well progressed, with a total of 8 holes for 1,201 metres having been drilled to date across both areas.

“The Phase 1 drilling program at Seymour continues to deliver excellent outcomes. The latest set of assays have returned further thick, high-tenor intercepts that significantly extend the known boundaries of the North Aubry deposit. These results are expected to drive a substantial increase to the existing Seymour resource this quarter. Both the northern and down-dip extents of the North Aubry pegmatite are also open to further expansion, which we plan to pursue in coming months.” - GT1 Chief Executive Officer, Luke Cox

Further thick, high-grade extensional intercepts at North Aubry

The Phase 1 drilling program at Seymour was designed to evaluate potential along-strike and down-dip extensions of the North Aubry deposit that were open and untested. This maiden program is complete with 16 holes having been drilled for a total of 5,826 metres.

Click here for the full ASX Release

This article includes content from Green Technology Metals Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GT1:AU

Sign up to get your FREE

Green Technology Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 September 2025

Green Technology Metals

Delivering the next lithium hub in North America

Delivering the next lithium hub in North America Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Green Technology Metals (GT1:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

07 January

EDC Extends LOI for Seymour Lithium Project of up to C$100m

Green Technology Metals(GT1:AU) has announced EDC Extends LOI for Seymour Lithium Project of up to C$100mDownload the PDF here. Keep Reading...

30 November 2025

Altris Engineering Appointed to Optimise & Lead Seymour DFS

Green Technology Metals (GT1:AU) has announced Altris Engineering Appointed to Optimise & Lead Seymour DFSDownload the PDF here. Keep Reading...

17 November 2025

Ontario Lithium Project Development Update

Green Technology Metals(GT1:AU) has announced Ontario Lithium Project Development UpdateDownload the PDF here. Keep Reading...

31 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Green Technology Metals(GT1:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

Latest News

Sign up to get your FREE

Green Technology Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00