July 12, 2023

Ora Gold Limited (“Ora” or the “Company”, ASX: OAU) is pleased to announce another high-grade gold intercept from diamond core at Crown Prince (M51/886).

Highlights:

- Further high-grade gold results returned from OGGDD537 which was drilled at the South-Eastern Ore Body (SEB) of Crown Prince Gold Prospect

- The intercept includes:

- 6.4m @ 26.39 g/t Au from 127.4m incl. 2.8m @ 58.53g/t Au from 131.7m

- This intercept was returned from the hinge zone of the newly delineated SEB anticline, below a zone of exceptional gold grades seen in recent RC Holes (ASX announcement, 28 June 2023)

- The intersection supports the Company’s interpretation for SEB mineralisation where high-grade gold mineralization remains open at depth with the best grades and thicknesses occurring in the hinge zone of a SSW plunging anticline

- This intercept is located 53m along strike to the north-east from the high-grade intersection reported in OGGDD536 (ASX Announcement 4 July 2023)

- The lode consists of quartz-carbonate-chlorite-sericite with sporadic veinlets of pyrite, arsenopyrite, pyrrhotite and traces of galena

- Additional RC drilling between 50m and 200m vertical depth and diamond drilling to 300m vertical depth will be undertaken shortly at SEB. This will further underpin a resource estimate for the new zone of mineralisation (i.e. SEB) at Crown Prince.

The Crown Prince south-east extension (SEB) zone continues to develop as a key growth area for gold resources at the prospect.

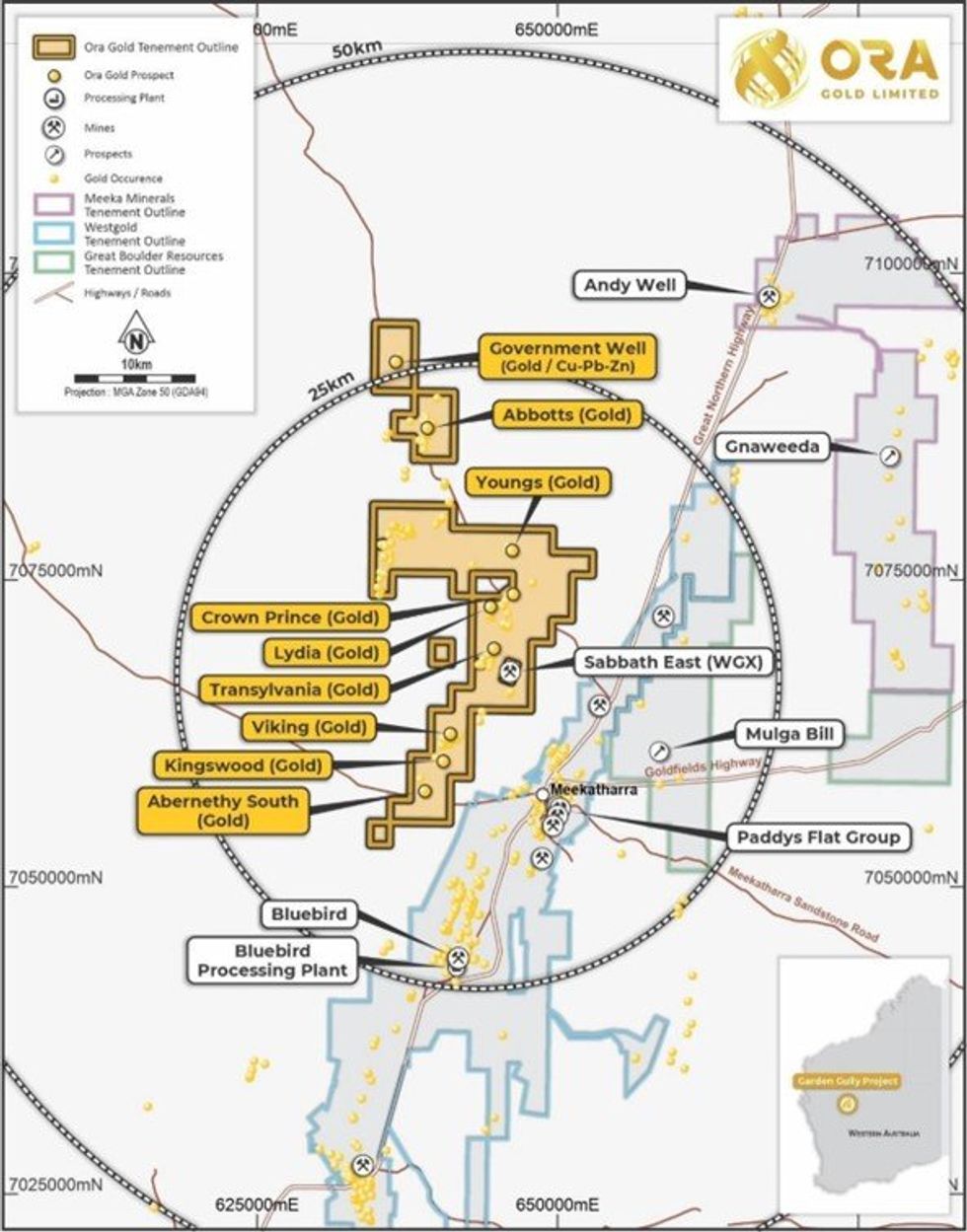

The Crown Prince Prospect is a high-grade gold deposit within Ora Gold’s Garden Gully Project. Crown Prince is located 22km north-west of Meekatharra in Western Australia via the Great Northern Highway and the Mt Clere Road (Figure 1).

Ora Gold’s CEO Alex Passmore commented: “We are very pleased to report more high-grade results from our diamond drill program at Crown Prince. Results from OGGDD537 were eagerly awaited given the strong alteration seen in drill core as described in recent announcements. This result confirms down dip continuity of mineralisation in this area, supports our interpretation of the SEB structure, and is a substantial strike extension from the high-grade intercept in OGGDD536 that we announced recently”.

Assay results from the second diamond hole drilled at SEB have returned additional high grade gold results (Table 1, Appendix 1, Figures 2-3 & Photo 1). Samples from the remaining holes have been delivered to Intertek in Perth and assays are pending.

The results in this release indicate the presence of a down dip extension of high-grade gold mineralisation at SEB and support the structural interpretation for mineralised shoots at Crown Prince (Figure 2). Mineralised envelopes are contorted and folded between northerly trending shears. MOB mineralization occurs in a steep south-east plunging anticline. SEB mineralization is hosted within a steep south westerly plunging anticline. The two zones are separated by a northerly trending shear zone (Figure 2).

All hole details and sampling information are included in Table 1. Assay results received to date with more than 0.1ppm Au are included in Appendix 1.

Click here for the full ASX Release

This article includes content from Ora Gold Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

22m

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

17h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00