February 05, 2023

Titan Minerals Limited (Titan or the Company) (ASX:TTM) is pleased to provide results from the remaining six drill holes from its maiden eight hole diamond drilling campaign at the Copper Ridge Porphyry prospect at the Linderos Project in southern Ecuador.

Key Highlights include:

- Additional long intervals of porphyry copper style mineralisation intersected from surface in diamond drilling at Copper Ridge, with significant results including:

- Hole CRDD22-006:

- 72m grading 0.4% Cu Eq1 from 21m, and

- 51m grading 0.4% Cu Eq from 373m, and

- 22m grading 0.5% Cu Eq from 524m

- Within a broader intersection of 558m grading 0.2% Cu Eq from surface to end of hole, ending in mineralisation.

- 72m grading 0.4% Cu Eq1 from 21m, and

- Hole CRDD22-004:

- 186m grading 0.3% Cu Eq from 196m, which also contains a gold rich zone of 80m grading 0.4% Cu Eq from 286m

- Within a broader intersection of 344m grading 0.2% Cu Eq from 38m to end of hole, ending in mineralisation.

- Hole CRDD22-007:

- 88m grading 0.3% Cu Eq from 266m

- Within a broader intersection of 172m grading 0.2% Cu Eq from 196m to end of hole, ending in mineralisation.

- Hole CRDD22-006:

- Higher tenor porphyry mineralisation intersected in CRDD22-003 (76m grading 0.5% Cu Eq2) and CRDD22-006 (22m grading 0.5% Cu Eq) provide evidence that Copper Ridge has potential to host higher-grade copper and gold mineralisation.

Titan’s CEO Melanie Leighton commented:

“These results wrap up the first drill program at our Copper Ridge prospect within our Linderos Project where outcropping porphyry copper style mineralisation has been discovered, with drilling now confirming a substantial copper-gold porphyry system from surface.”

“This initial of program of eight holes has returned highly encouraging results and our analysis highlights the potential for both lateral and depth extensions, as we vector into what we believe is the core of the porphyry system.”

“Future drill plans are being designed to intersect the earlier-phase, higher-grade copper-gold porphyry mineralisation and we are excited to soon be underway with our next phase of drilling at Copper Ridge.”

“It’s important to appreciate that copper grades returned from this initial campaign of drilling compare favourably with peer porphyry deposits which are currently advancing through development and earmarked for large-scale production in the near future.”

“Most notably, SolGold’s Alpala porphyry deposit contains a global resource of 3.2Bt grading 0.49% Cu Eq (0.35% Cu, 0.23g/t Au, 1.0g.t Ag) for 9.9Mt of copper, 21.7Moz gold and 92Moz silver, and a proposed mining cut-off grade of 0.21% Cu Eq3, with its higher-grade core commencing at a depth of 600m.”

“Titan shareholders can expect strong news flow in what promises to be a very busy and exciting 2023.”

Linderos Project– Copper Ridge Porphyry Prospect Remaining Drilling Results

In November 2022, Titan completed a maiden campaign of eight diamond drill holes totalling 3,700m at the Copper Ridge Porphyry prospect (Copper Ridge) on its Linderos Project in southern Ecuador. Drilling was designed to target porphyry mineralisation highlighted by surface mapping, soil and channel sample geochemistry, and limited shallow historical drilling undertaken at the prospect.

Assay results have been received for the remaining six diamond drill holes, adding further wide intersections of disseminated and vein hosted copper-molybdenum±gold±silver mineralisation from surface to approximately 500 metres vertical.

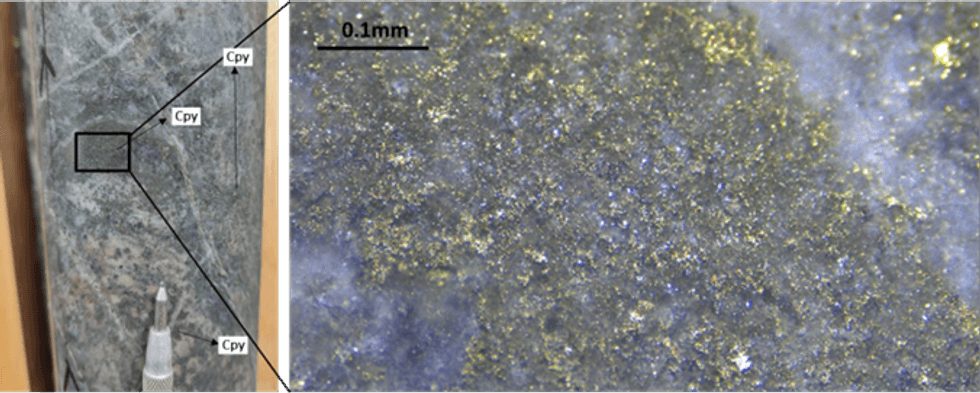

Mineralisation is hosted within a diorite porphyry, with vein hosted and disseminated chalcopyrite- pyrite-pyrrhotite-molybdenite, and secondary biotite plus green-grey sericite and pervasive quartz- alkali feldspar defining an early to transitional potassic alteration.

Pleasingly, six out of the eight diamond drillholes were mineralised to the end of hole, highlighting strong potential for lateral and depth extensions.

Evidence that the Copper Ridge porphyry has the potential to host higher-grade copper and gold mineralisation is supported by intersections including 76m grading 0.5% Cu Eq from 132m in CRDD22- 003 and 22m grading 0.5% Cu Eq from 524m in CRDD22-006.

Click here for the full ASX Release

This article includes content from Titan Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TTM:AU

The Conversation (0)

31 March 2022

Titan Minerals

Developing Ecuador’s Underexplored High-Grade Mineral Deposits

Developing Ecuador’s Underexplored High-Grade Mineral Deposits Keep Reading...

6h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00