February 05, 2023

Titan Minerals Limited (Titan or the Company) (ASX:TTM) is pleased to provide results from the remaining six drill holes from its maiden eight hole diamond drilling campaign at the Copper Ridge Porphyry prospect at the Linderos Project in southern Ecuador.

Key Highlights include:

- Additional long intervals of porphyry copper style mineralisation intersected from surface in diamond drilling at Copper Ridge, with significant results including:

- Hole CRDD22-006:

- 72m grading 0.4% Cu Eq1 from 21m, and

- 51m grading 0.4% Cu Eq from 373m, and

- 22m grading 0.5% Cu Eq from 524m

- Within a broader intersection of 558m grading 0.2% Cu Eq from surface to end of hole, ending in mineralisation.

- 72m grading 0.4% Cu Eq1 from 21m, and

- Hole CRDD22-004:

- 186m grading 0.3% Cu Eq from 196m, which also contains a gold rich zone of 80m grading 0.4% Cu Eq from 286m

- Within a broader intersection of 344m grading 0.2% Cu Eq from 38m to end of hole, ending in mineralisation.

- Hole CRDD22-007:

- 88m grading 0.3% Cu Eq from 266m

- Within a broader intersection of 172m grading 0.2% Cu Eq from 196m to end of hole, ending in mineralisation.

- Hole CRDD22-006:

- Higher tenor porphyry mineralisation intersected in CRDD22-003 (76m grading 0.5% Cu Eq2) and CRDD22-006 (22m grading 0.5% Cu Eq) provide evidence that Copper Ridge has potential to host higher-grade copper and gold mineralisation.

Titan’s CEO Melanie Leighton commented:

“These results wrap up the first drill program at our Copper Ridge prospect within our Linderos Project where outcropping porphyry copper style mineralisation has been discovered, with drilling now confirming a substantial copper-gold porphyry system from surface.”

“This initial of program of eight holes has returned highly encouraging results and our analysis highlights the potential for both lateral and depth extensions, as we vector into what we believe is the core of the porphyry system.”

“Future drill plans are being designed to intersect the earlier-phase, higher-grade copper-gold porphyry mineralisation and we are excited to soon be underway with our next phase of drilling at Copper Ridge.”

“It’s important to appreciate that copper grades returned from this initial campaign of drilling compare favourably with peer porphyry deposits which are currently advancing through development and earmarked for large-scale production in the near future.”

“Most notably, SolGold’s Alpala porphyry deposit contains a global resource of 3.2Bt grading 0.49% Cu Eq (0.35% Cu, 0.23g/t Au, 1.0g.t Ag) for 9.9Mt of copper, 21.7Moz gold and 92Moz silver, and a proposed mining cut-off grade of 0.21% Cu Eq3, with its higher-grade core commencing at a depth of 600m.”

“Titan shareholders can expect strong news flow in what promises to be a very busy and exciting 2023.”

Linderos Project– Copper Ridge Porphyry Prospect Remaining Drilling Results

In November 2022, Titan completed a maiden campaign of eight diamond drill holes totalling 3,700m at the Copper Ridge Porphyry prospect (Copper Ridge) on its Linderos Project in southern Ecuador. Drilling was designed to target porphyry mineralisation highlighted by surface mapping, soil and channel sample geochemistry, and limited shallow historical drilling undertaken at the prospect.

Assay results have been received for the remaining six diamond drill holes, adding further wide intersections of disseminated and vein hosted copper-molybdenum±gold±silver mineralisation from surface to approximately 500 metres vertical.

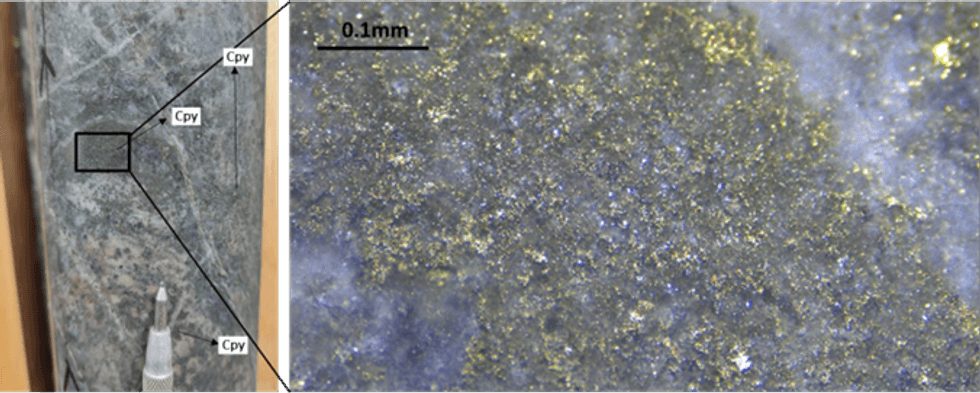

Mineralisation is hosted within a diorite porphyry, with vein hosted and disseminated chalcopyrite- pyrite-pyrrhotite-molybdenite, and secondary biotite plus green-grey sericite and pervasive quartz- alkali feldspar defining an early to transitional potassic alteration.

Pleasingly, six out of the eight diamond drillholes were mineralised to the end of hole, highlighting strong potential for lateral and depth extensions.

Evidence that the Copper Ridge porphyry has the potential to host higher-grade copper and gold mineralisation is supported by intersections including 76m grading 0.5% Cu Eq from 132m in CRDD22- 003 and 22m grading 0.5% Cu Eq from 524m in CRDD22-006.

Click here for the full ASX Release

This article includes content from Titan Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TTM:AU

The Conversation (0)

31 March 2022

Titan Minerals

Developing Ecuador’s Underexplored High-Grade Mineral Deposits

Developing Ecuador’s Underexplored High-Grade Mineral Deposits Keep Reading...

5h

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold Corporation (NYSE:EGO,TSX:ELD) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that would create a larger, diversified gold and copper producer with two major development projects set to enter production in 2026Under the deal, Eldorado... Keep Reading...

6h

Stellar AfricaGold Intersects Multiple Gold-Bearing Zones and Confirms Structural Controls at Tichka Est, Morocco - Drilling Resumed on January 30, 2026

(TheNewswire) Vancouver, BC TheNewswire - February 3rd, 2026 Stellar AfricaGold Inc. ("Stellar" or the "Company") (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold... Keep Reading...

21h

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

22h

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

22h

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

02 February

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00