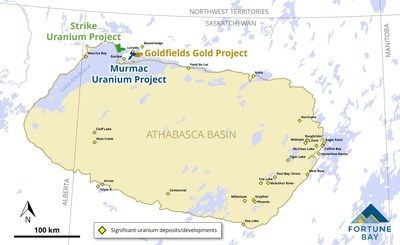

Fortune Bay Corp. (TSXV: FOR) (FWB: 5QN) ("Fortune Bay" or the "Company") is pleased to announce initial drill targets for its 100% owned Murmac Uranium Project ("Murmac" or the "Project") located in northern Saskatchewan (see Figures 1 and 2).

Highlights:

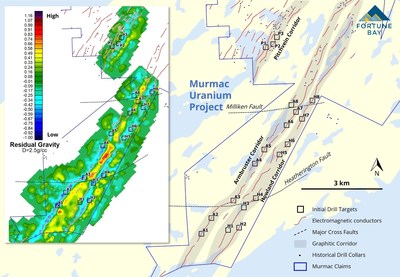

- Nineteen (19) initial drill targets have been identified following completion of airborne electromagnetic ("EM") and ground gravity surveying (Figure 3).

- The targets represent favorable geophysical and geological features typically associated with high-grade basement-hosted uranium deposits related to the Athabasca Basin. Targets include discrete gravity lows located along prominent EM conductors proximal to numerous radioactive and uranium surface showings and/or favorable structural features.

- Drilling is expected to commence in the coming days with approximately 2,500 meters planned in eight to ten drill holes. The program is expected to be results-driven and may be modified based on results from drilling.

Dale Verran , CEO for Fortune Bay, commented, "We are pleased to announce an initial set of drill targets for Murmac which have the potential to yield a discovery of high-grade, basement-hosted uranium mineralization related to the Athabasca Basin. The maiden drilling program, scheduled to commence shortly, is planned to test an initial eight to ten targets along three prospective corridors. We look forward to reporting drill results for Murmac, in addition to results from the ongoing drilling at the Strike Uranium Project."

Murmac Drill Targeting

Background

The Project is located within the original uranium mining district of Canada , lying between the historical Gunnar and Lorado Uranium Mines. The Project was explored for Beaverlodge-style uranium mineralization predominantly during the period 1960 to 1980. Historical exploration work focused on ground prospecting and sampling, followed by trenching and/or drill testing. Numerous high-grade (> 1% U 3 O 8 ) uranium occurrences were discovered (see News Release dated September 28, 2021 ) demonstrating a significant endowment of uranium in the area. The numerous conductive units (graphite-bearing metasediments) were never systematically explored for high-grade, basement-hosted uranium mineralization typical of the Athabasca Basin and its margins. Due to their physical properties, the conductive units predominantly manifest as valleys and topographical lows, covered by overburden and small shallow lakes. These "blind" conductors have therefore not been amenable to historical surface prospecting and warrant drill testing where favorable targets have been identified. The Athabasca Basin margin is located approximately five kilometres to the south of the Project, indicating vertical proximity to the basal unconformity (now eroded) and good preservation potential for basement-hosted mineralization.

Drill Targeting

- Targeting at Murmac has encompassed detailed review of historical data which have been integrated with newly acquired datasets, which include a VTEM™ (Versatile Time Domain Electromagnetic) survey completed in April 2022 and a ground gravity survey completed in June 2022 . Targeting is currently focused exclusively in areas where gravity survey data have been acquired. The Company plans to carry out additional gravity surveying to continue coverage over the conductive units to the northeast and northwest.

- Multiple linear conductor traces spanning the entire length of the project area (approximately 12 kilometres) have been identified from the VTEM TM survey, and three of these conductor packages (named the Pitchvein, Armbruster and Howland Corridors) have been prioritized. Targets along these conductors were selected based on the nature and amplitude of the electromagnetic anomaly, gravity features, topography and surface exposure, magnetic features, structural setting and historical scintillometer survey and geochemical sampling results. Target locations are shown in Figure 3.

- The southern portions of the Armbruster and Howland Corridors have been subjected to historical surface prospecting and geophysics, but very little exploratory drilling. Only seven holes have been drilled on the southernmost seven kilometres of each of these two corridors. This area is characterised by more extensive overburden cover where historical surface prospecting efforts would have had limited value.

- The Pitchvein Corridor was first explored in the 1950's by Pitchvein Mines, who carried out surface prospecting and diamond core drilling. Exploration continued in the period 1978 to 1982 by SMDC who carried out further ground geophysics and drilling, with assessment reports documenting intersections including 1.01% U 3 O 8 over 2.0 metres (56.0 to 58.0 metres in drill hole CKI-9) and 2.19% U 3 O 8 over 0.5 metres (68.0 to 68.5 metres in drill hole CKI-10) in quartzite horizons within graphitic sediments. All the historical exploration and drill data have been captured by Fortune Bay and have been used to support prioritization of three drill targets on the southern portion of this corridor.

Drilling Program and Operational Details

Drilling of the initial target areas is expected to commence in the coming days following completion of drilling at the Strike Uranium Project. The Company has the required permits for the planned exploration activities.

Qualified Person and Data Quality

The technical and scientific information in this news release has been reviewed and approved by Dale Verran , M.Sc., P.Geo., Chief Executive Officer of the Company, who is a Qualified Person as defined by NI 43-101. Mr. Verran is an employee of Fortune Bay and is not independent of the Company under NI 43-101.

Unless otherwise stated, the historical results (including drill results) contained within this news release have not been verified and there is a risk that any future confirmation work and exploration may produce results that substantially differ from the historical results. The Company considers these results relevant to assess the mineralization and economic potential of the property. The historical drill results obtained by SMDC in drill holes CKI-9 and CKI-10 can be found within the Saskatchewan Mineral Assessment Database (SMAD) references 74N07-0310 and 74N07-0311.

About Fortune Bay

Fortune Bay Corp. (TSXV:FOR, FWB: 5QN) is an exploration and development company with 100% ownership in two advanced gold exploration projects in Canada , Saskatchewan (Goldfields Project) and Mexico , Chiapas (Ixhuatán Project), both with exploration and development potential. The Company is also advancing the 100% owned Strike and Murmac uranium exploration projects, located near the Goldfields Project, which have high-grade potential typical of the Athabasca Basin. The Company has a goal of building a mid-tier exploration and development Company through the advancement of its existing projects and the strategic acquisition of new projects to create a pipeline of growth opportunities. The Company's corporate strategy is driven by a Board and Management team with a proven track record of discovery, project development and value creation.

On behalf of Fortune Bay Corp.

"Dale Verran"

Chief Executive Officer

902-334-1919

Cautionary Statement Regarding Forward-Looking Information

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions, and expectations. They are not guarantees of future performance. Words such as "expects", "aims", "anticipates", "targets", "goals", "projects", "intends", "plans", "believes", "seeks", "estimates", "continues", "may", variations of such words, and similar expressions and references to future periods, are intended to identify such forward-looking statements. Fortune Bay Corp. ("Fortune Bay" or the "Company") cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond Fortune Bay's control. Such factors include, among other things: risks and uncertainties relating to metal prices, changes in planned work resulting from weather, COVID-19 restrictions, availability of contractors, logistical, technical or other factors, the possibility that results of work will not fulfill expectations and realize the perceived potential of Fortune Bay's mineral properties, uncertainties involved in the interpretation of drilling results and other tests, the possibility that required permits may not be obtained in a timely manner or at all, risk of accidents, equipment breakdowns or other unanticipated difficulties or interruptions, the possibility of cost overruns or unanticipated expenses in work programs, the risk of environmental contamination or damage resulting from the exploration operations, the need to comply with environmental and governmental regulations and the lack of availability of necessary capital, which may not be available to Fortune Bay, acceptable to it or at all. Fortune Bay is subject to the specific risks inherent in the mining business as well as general economic and business conditions. Accordingly, actual, and future events, conditions and results may differ materially from the estimates, beliefs, intentions, and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Fortune Bay undertakes no obligation to publicly update or revise forward-looking information. Fortune Bay does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities legislation. For more information on Fortune Bay, readers should refer to Fortune Bay's website at www.fortunebaycorp.com .

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Fortune Bay Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/June2022/16/c8083.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/June2022/16/c8083.html